regarding trade credit costs! please help ASAP!

UPDATED:

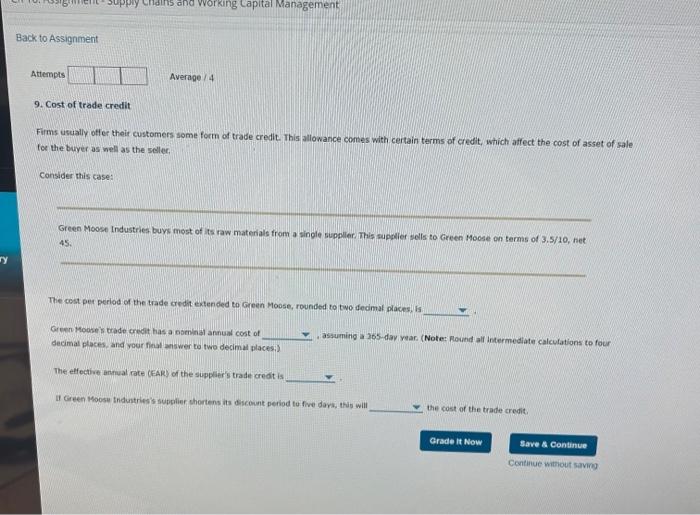

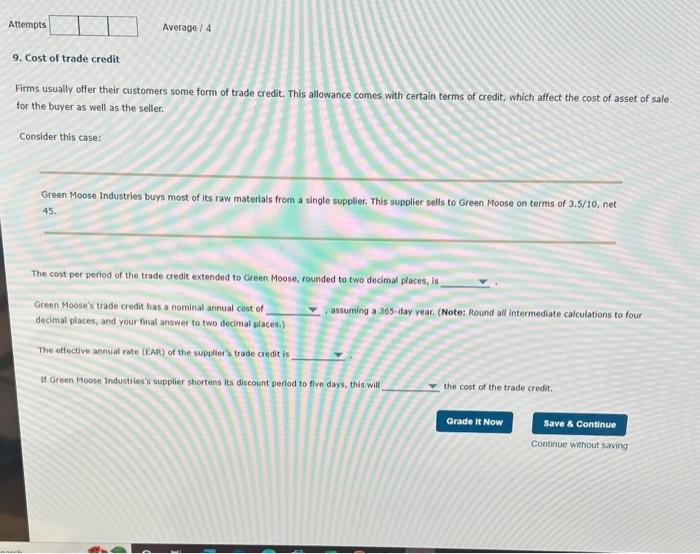

9. Cost of trade credit Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as vell as the seller. Consider this case: Green Moose Industries buys most of its raw materials from a single suppliter This suppller sells to Green Moose on terms of 3.5/10, het 45 . The cost per period of the trade credit extended to Green Moose, rounded to two dedmat placesi is decimat places, and vour finct answer to two decimal places:) . assuming a 3os-day vear, (Note: Roind alf intermediate calculations to four The effective annual rate (EAR) of the suppleer's trade credt is It Green Poosu thduntries's subphiler chortens its deccount period to five dars, this will the cost of the trade credit. Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Green Moose Industries buys most of its raw materials from a single supplier. This supplier sells to Green Moose on terms of 3.5/10, net 45. The cost per period of the trade credit extended to Green Moose, rounded to two decimal places, in Green Moose's trade credit has a nominal annual cost of decimal places, and your final answer to two decimal places.) The effective annual rate (EAR) of the suppliers trade credit is It Green Moose industries's supplier shortens its discount period to five days, this will the cost of the trade credit. 9. Cost of trade credit Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as vell as the seller. Consider this case: Green Moose Industries buys most of its raw materials from a single suppliter This suppller sells to Green Moose on terms of 3.5/10, het 45 . The cost per period of the trade credit extended to Green Moose, rounded to two dedmat placesi is decimat places, and vour finct answer to two decimal places:) . assuming a 3os-day vear, (Note: Roind alf intermediate calculations to four The effective annual rate (EAR) of the suppleer's trade credt is It Green Poosu thduntries's subphiler chortens its deccount period to five dars, this will the cost of the trade credit. Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Green Moose Industries buys most of its raw materials from a single supplier. This supplier sells to Green Moose on terms of 3.5/10, net 45. The cost per period of the trade credit extended to Green Moose, rounded to two decimal places, in Green Moose's trade credit has a nominal annual cost of decimal places, and your final answer to two decimal places.) The effective annual rate (EAR) of the suppliers trade credit is It Green Moose industries's supplier shortens its discount period to five days, this will the cost of the trade credit