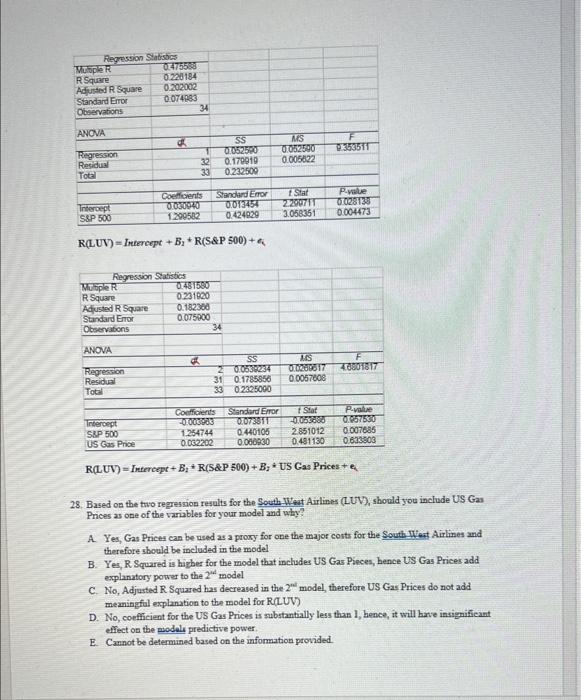

Regression Statistics Murple R 03475550 R Square 0.220 184 Adjusted R Square 0.202002 Standard Error 0.074983 Observations 34 ANOVA 1 MS 052500 0.005022 0358511 SS 07052580 0.179019 0.232500 Regression Residual Total 33 Corrents 0030040 1299582 Intercept S&P 500 Standard Error 0.013454 0.424029 ISA 2007IT 3.058351 P-value 01028130 0.004473 R(LUV) - Intercept+B; *R(S&P 500)+ Regression Statistics Multiple R 0481580 R Square 0.231820 Adiusted R Square 0.182300 Standard Error 0.075000 Observations 34 ANOVA Regression Residual Total 20301817 SS 20053234 31 Q.1785858 33 02325090 MS ODC00817 0.0057808 Intercept S&P 500 US Gas Price Coefficients 0003983 1.254744 0.002202 Standard Error 07073871 0.440105 0.000930 Star --0053888 2851012 0.481130 P-value 0.057530 0.007685 0.633803 RLUV) Intercept+B* R(S&P 500) + B, * US Gas Prices 28. Based on the two regression results for the South West Airlines (LUV) should you include US Gas Prices as one of the variables for your model and why? A Yes, Gas Prices can be used as a proxy for one the major costs for the South West Airlines and therefore should be included in the model B. Yes, Squared is higher for the model that includes US Gas Pieces, hence US Gas Prices add explanatory power to the 2 model C No, Adjusted R Squared has decreased in the 20 model, therefore US Gas Prices do not add meaningful explanation to the model for R/LUV) D. No, coefficient for the US Gas Prices is substantially less than 1, hence, it will have insignificant effect on the models predictive power E Cannot be determined based on the information provided 29. Based on the 1" Regression result for the South West Airlines: R(LUV) = Intercept+B. *R(S&P 500) + B4 what is Beta for the South West Airlines? A. 0.03094 B. 1.299582 C. 0.004473 D. 0.424929 30. Based on the 1" Regression result for the South West Airlines: R(LUV) = Intercept +B*R(S&P 500) + 8 if St. Dev. of the Residuals is equal to 5.62% and Variance of S&P 500 equals to 4.27%, what must be the amount total risk for the South West Airlines? A. 0.004175 B. 0.006238 C. 0.008742 D. 0.009013 E. 0.007046 Regression Statistics Murple R 03475550 R Square 0.220 184 Adjusted R Square 0.202002 Standard Error 0.074983 Observations 34 ANOVA 1 MS 052500 0.005022 0358511 SS 07052580 0.179019 0.232500 Regression Residual Total 33 Corrents 0030040 1299582 Intercept S&P 500 Standard Error 0.013454 0.424029 ISA 2007IT 3.058351 P-value 01028130 0.004473 R(LUV) - Intercept+B; *R(S&P 500)+ Regression Statistics Multiple R 0481580 R Square 0.231820 Adiusted R Square 0.182300 Standard Error 0.075000 Observations 34 ANOVA Regression Residual Total 20301817 SS 20053234 31 Q.1785858 33 02325090 MS ODC00817 0.0057808 Intercept S&P 500 US Gas Price Coefficients 0003983 1.254744 0.002202 Standard Error 07073871 0.440105 0.000930 Star --0053888 2851012 0.481130 P-value 0.057530 0.007685 0.633803 RLUV) Intercept+B* R(S&P 500) + B, * US Gas Prices 28. Based on the two regression results for the South West Airlines (LUV) should you include US Gas Prices as one of the variables for your model and why? A Yes, Gas Prices can be used as a proxy for one the major costs for the South West Airlines and therefore should be included in the model B. Yes, Squared is higher for the model that includes US Gas Pieces, hence US Gas Prices add explanatory power to the 2 model C No, Adjusted R Squared has decreased in the 20 model, therefore US Gas Prices do not add meaningful explanation to the model for R/LUV) D. No, coefficient for the US Gas Prices is substantially less than 1, hence, it will have insignificant effect on the models predictive power E Cannot be determined based on the information provided 29. Based on the 1" Regression result for the South West Airlines: R(LUV) = Intercept+B. *R(S&P 500) + B4 what is Beta for the South West Airlines? A. 0.03094 B. 1.299582 C. 0.004473 D. 0.424929 30. Based on the 1" Regression result for the South West Airlines: R(LUV) = Intercept +B*R(S&P 500) + 8 if St. Dev. of the Residuals is equal to 5.62% and Variance of S&P 500 equals to 4.27%, what must be the amount total risk for the South West Airlines? A. 0.004175 B. 0.006238 C. 0.008742 D. 0.009013 E. 0.007046