Answered step by step

Verified Expert Solution

Question

1 Approved Answer

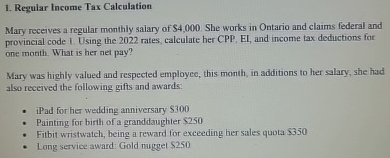

Regular Income Tax Calculation Mary receives a regular monthly salary of $ 4 , 0 0 0 . She works in Ontario and claims federal

Regular Income Tax Calculation

Mary receives a regular monthly salary of $ She works in Ontario and claims federal and

provincial code Using the rates, calculate her CPP EI and income tax deductions for

one month. What is her net pay?

Mary was highly valued and respected employee, this month, in additions to her salary, she had

also recerved the following gifts and awards:

iPad for her wedding anniversary $

Painting for birth of a granddaughter $

Fitbit wristwatch, heing a reward for exceeding her sales quota $

Long service award Gold nuggel $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started