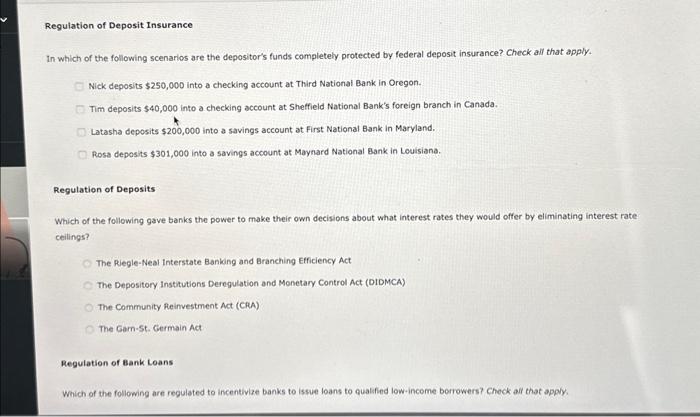

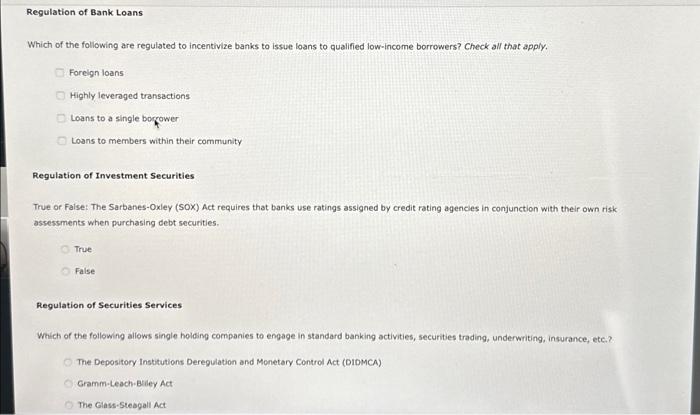

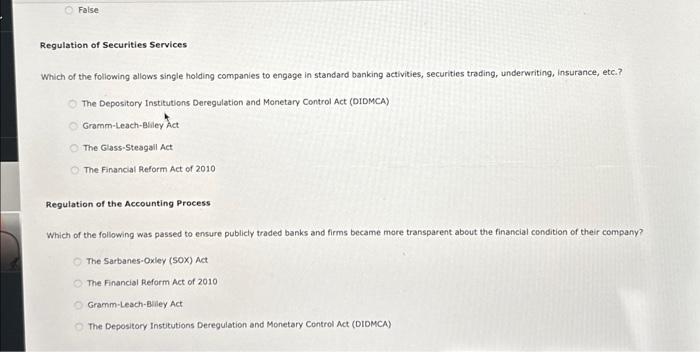

Regulation of Deposit Insurance In which of the following scenarios are the depositor's funds completely protected by federal deposit insurance? Check all that apply. Nick deposits $250,000 into a checking account at Third National Bank in Oregon. Tim deposits $40,000 into a checking account at Sheffield National Bank's foreign branch in Canada. Latasha deposits $200,000 into a savings account at First National Bank in Maryland. Rosa deposits $301,000 into a savings account at Maynard National Bank in Louisiana. Regulation of Deposits Which of the following gave banks the power to make their own decisions about what interest rates they would offer by eliminating interest rate ceilings? The Riegle-Neal Interstate Banking and Branching Efficiency Act The Depository Institutions Deregulation and Monetary Control Act (DIDMCA) The Community Reinvestment ACt (CRA) The Garn-St. Cermain Act Regulation of Bank Loans Which of the following are regulated to incentivize banks to issue loans to qualfind low-income borrowers? Cheok ail that apply. Which of the following are regulated to incentivize banks to issue loans to qualified low-income borrowers? Check an that apply. Forelgn loans Highly leveraged transactions Loans to a single bocrower Loans to members within their community Regulation of Investment Securities True or False: The Sarbanes-Oxley (SOX) Act requires that banks use ratings assigned by credit rating agencies in conjunction with their own risk assessments when purchasing debt securities. True False Regulation of Securities Services Which of the following allows single holding companies to engage in standard banking activities, securities trading, underwriting, insurance, ete;? The Depository Institutions Deregulation and Monetary Control Act (DIDMCA) Gramm-Leach-Buley Act The Giass-Stebgall Act False Regulation of Securities Services Which of the following allows single holding companies to engage in standard banking activities, securities trading, underwriting, insurance, etc. The Depository Institutions Deregulation and Monetary Control Act (DIDMCA) Gramm-Leach-Bsiley Act The Glass-Steagail Act The Financial Reform Act of 2010 Regulation of the Accounting Process Which of the following was passed to ensure publicly traded banks and firms became more transparent about the financial condition of their company? The Sarbanes-Oxley (SOX) Act The Financial Reform Act of 2010 Gramm-Leach-Biley Act The Depository Institutions Deregulation and Monetary Control Act (DIDMCA)