Answered step by step

Verified Expert Solution

Question

1 Approved Answer

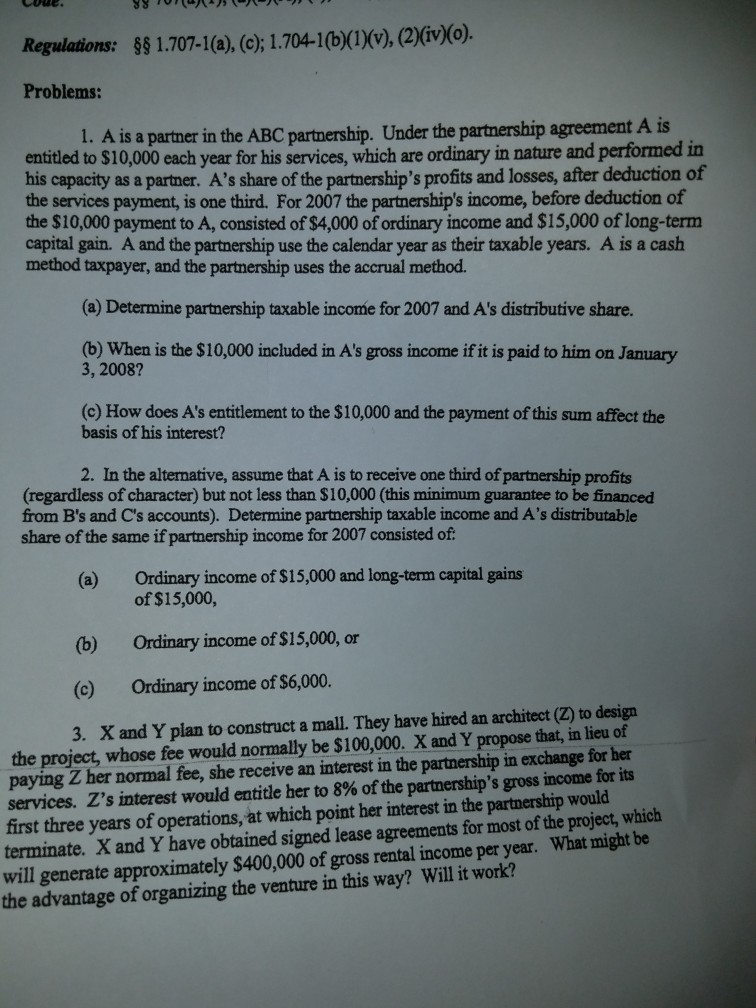

Regulations: 1707-1(a), (c);1.704-1(b)(1)(v), (2)(iv)(0) Problems: 1. A is a partner in the ABC partnership. Under the partnership agreement A is entitled to $10,000 each year

Regulations: 1707-1(a), (c);1.704-1(b)(1)(v), (2)(iv)(0) Problems: 1. A is a partner in the ABC partnership. Under the partnership agreement A is entitled to $10,000 each year for his services, which are ordinary in nature and performed in his capacity as a partner. A's share of the partnership's profits and losses, after deduction of the services payment, is one third. For 2007 the partnership's income, before deduction of the $10,000 payment to A, consisted of $4,000 of ordinary income and $15,000 of long-term capital gain. A and the partnership use the calendar year as their taxable years. A is a cash method taxpayer, and the partnership uses the accrual method. (a) Determine partnership taxable income for 2007 and A's distributive share (b) When is the $10,000 included in A's gross income if it is paid to him on January 3, 2008? (c) How does A's entitlement to the $10,000 and the payment of this sum affect the basis of his interest? 2. In the alternative, assume that A is to receive one third of partnership profits (regardless of character) but not less than $10,000 (this minimum guarantee to be financed from B's and C's accounts). Determine partnership taxable income and A's distributable share of the same if partnership income for 2007 consisted of (a) Ordinary income of $15,000 and long-term capital gains (b) Ordinary income of S15,000, or (c) Ordinary income of $6,000. 3. X and Y plan to construct a mall. They have hired an architect (Z) to design of $15,000, the project, whose fee would normally be $100,000. X and Y propose that, in lieu of paying Z her normal fee, she receive an interest in the partnership in exchange for her services. Z's interest would entitle her to 8% of the partnership's gross income for its first three years of operations, at which point her interest in the partnership would terminate. X and Y have obtained signed lease agreements for most of the project, which will generate approximately $400,000 of gross rental income per year. What might be the advantage of organizing the venture in this way? Will it work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started