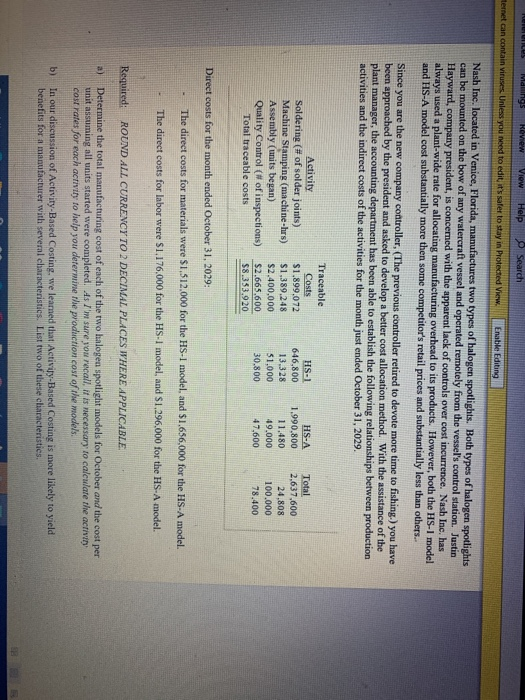

REILI LULUS Mallings ROVw View Help Search ternet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing Nash Inc. located in Venice, Florida, manufactures two types of halogen spotlights. Both types of halogen spotlights can be mounted on the bow of any watercraft vessel and operated remotely from the vessel's control station. Justin Hayward, company president is concerned with the apparent lack of controls over cost incurrence. Nash Inc. has always used a plant-wide rate for allocating manufacturing overhead to its products. However, both the HS-I model and HS-A model cost substantially more then some competitor's retail prices and substantially less than others.. Since you are the new company controller, (The previous controller retired to devote more time to fishing.) you have been approached by the president and asked to develop a better cost allocation method. With the assistance of the plant manager, the accounting department has been able to establish the following relationships between production activities and the indirect costs of the activities for the month just ended October 31, 2029. Activity Soldering (# of solder joints) Machine Stamping (machine-hrs) Assembly (units began) Quality Control (# of inspections) Total traceable costs Traceable Costs $1.899.072 $1.389.248 $2.400,000 $2.665.600 $8.353.920 HS-1 646,800 13.328 $1.000 30.800 HS-A 1.990.800 11.480 49.000 47,600 Total 2.637,600 24.808 100.000 78.400 Direct costs for the month ended October 31, 2029: The direct costs for materials were $1.512,000 for the HS-I model, and $1.656,000 for the HS-A model The direct costs for labor were $1.176,000 for the HS-1 model, and $1.296,000 for the HS-A model. Required: ROUND ALL CURRENCY TO DECIMAL PLACES WHERE APPLICABLE a) Determine the total manufacturing cost of each of the two halogen spotlight models for October and the cost per unit assuming all units started were completed. As I'm sure you recall is necessary to calculate the activity cost rates for each activity to help you determine the production cost of the models b) In our discussion of Activity-Based Costing, we learned that Activity-Based Costing is more likely to yield benefits for a manufacturer with several characteristics. List two of these characteristics