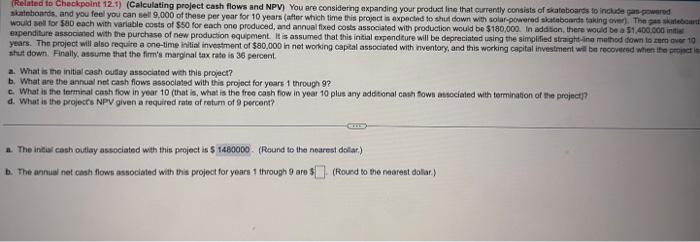

(Relafed to Checkpoint 12.1) (Caleulating project cash flows and NPV) You ere consifering axpanding your produat line that cartently consists of skataboarts fo incuse fas-powerva would sel for 590 each with variable costs of \$50 for each one produced, and annual fixed costs associated with production would be $180,000. in addion, there would be a 51,400 coch mitie expenditurt associated wath the purchase of new production equipment. It is assumed that this intial oxpendture will be depreciated ising the simplified straigte-ina mathod down to rurn over 10 years. The project will also requite a cne-time initial inveetment of $80,000 in net woiking cappal associated with niventory, and this working capital investment will be tecoveced when ife perivet is shtet down. Finally, assume that the firm's marginal tex rate is 36 percent. a. What is the initial cash oullay associated with this project? b. What are the annual not cash fiows associeted with this projoct for yoars 1 through 9 ? c. What is the terminal cash flow in year 10 (that is, what is the free cash fow in year 10 plus any additional cash fows asteciated weth termination of the project? a. What is the project's NPV given a required rate of return of 9 percens? a. The intial cash outlay associated with this peojoct is 5 (Reund to the nearest dollar) b. The annial net cash flows associated with this project for years 1 through 9 are 3 (Round to the nearest dollar.) (Relafed to Checkpoint 12.1) (Caleulating project cash flows and NPV) You ere consifering axpanding your produat line that cartently consists of skataboarts fo incuse fas-powerva would sel for 590 each with variable costs of \$50 for each one produced, and annual fixed costs associated with production would be $180,000. in addion, there would be a 51,400 coch mitie expenditurt associated wath the purchase of new production equipment. It is assumed that this intial oxpendture will be depreciated ising the simplified straigte-ina mathod down to rurn over 10 years. The project will also requite a cne-time initial inveetment of $80,000 in net woiking cappal associated with niventory, and this working capital investment will be tecoveced when ife perivet is shtet down. Finally, assume that the firm's marginal tex rate is 36 percent. a. What is the initial cash oullay associated with this project? b. What are the annual not cash fiows associeted with this projoct for yoars 1 through 9 ? c. What is the terminal cash flow in year 10 (that is, what is the free cash fow in year 10 plus any additional cash fows asteciated weth termination of the project? a. What is the project's NPV given a required rate of return of 9 percens? a. The intial cash outlay associated with this peojoct is 5 (Reund to the nearest dollar) b. The annial net cash flows associated with this project for years 1 through 9 are 3 (Round to the nearest dollar.)