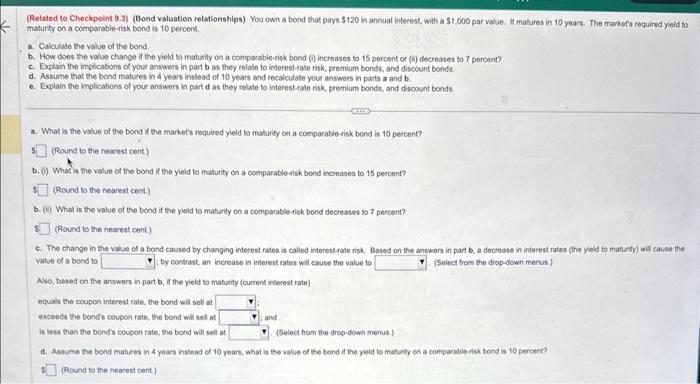

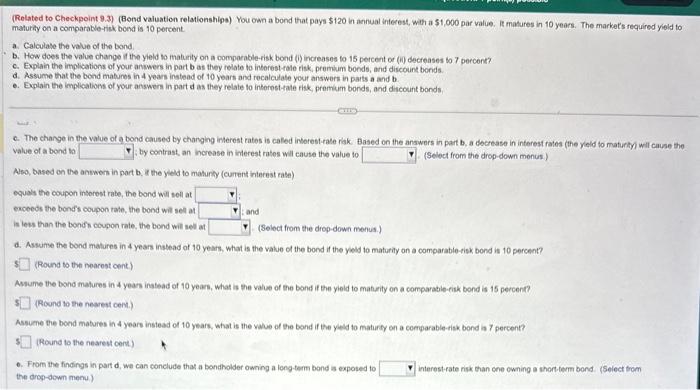

(Related to Checkpoint 0.J) (Bond valuation relationships) You own a bond that pays $120 in annual intevest, with a $1,000 par value. it matures in 10 years. The markefi required yield to mahurity on a comparable-risk bond is 10 percont. a. Calculate the value of the bond. b. How does the value change if the yield to maturity on a comporablo-risk bond (0) increases to 15 porcent or (i) decreases to 7 percent? c. Explain the impications of your answers in part b as they relate to interest-rale risk, premium bonds, and discount bonds. a. Assume that the bond matures in 4 years insleod of 10 years and recalculate your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to interost-rale tisk, premium bonds, and discount bonds. a. What is the value of the bond it the market's required yield to makurity on a comparable-isk bend is 10 percent? (Round to the nearest cent) b. (1) What is the value of the bond if the yield to malurity on a comparable-isk bond incroases to 15 percont? (Round to the nearest cent.) b. (i) What is the value of the bond it the yield to maturity on a comparable-isk bond decresies to 7 percent? (Round to the nearest cent) c. The change in the value of a bond canaed by changing interost rates it called interestrate nisk. Based on fhe answers in part b, a decrease in interest rates (the yeid to matarty) wilf cause the value of a bond to ; by contrast, an increase in interest rates wil cavise the value to (Select from the drop-down menus.) Aso, bused on the anwers in part b, it the yield to maturity (current ineeest rate) oquals the coupon interest rale. the bond wal sell at exceeds the bonds coupon rate, the bond will sell at ; and is less than the bonfs coupon rate, the bond will sell at (Select from the drop-down menus) d. Assume the bond matures in 4 year instead of 10 years, what is the value of the bond it the yeld to matyeity on a comparable risk bond is to percent? (Round to the nearest cent) (Rolated to Checkpoint 9.3) (Bond valuation relationshlpa) You can a bond that pays $120 in arnual interest, with a $1,000 par value. If matures in 10 years. The market's required yield to maturify on a comparablerisk bond is 10 percent. a. Calculase the value of the bond b. How does the value change if the yield to maturily on a comporable-risk bond (i) increases to 15 percent or (ii) decreases to 7 percent? c. Explain the implications of your anmwers in part b as they relate to intorest-ale risk, premium bonds, and discount bonds. d. Assume that the bond maturos in 4 yeas instead of 10 yoars and rocalculate your answers in parts a and b. e. Explain the implicatioms of your answers in part a as they relate to interost-tale filk, premium bonds, and diccount bonds. c. The change in the value of a bond caused by changing interest rates is caled indorestrale riak. Based on the anawers in part b, a docrease in interest rates (the yeld to maturly) will cause the. value of a bend th iby contrast, an increase in interest ratos will cause the value to (Select from the drop-down menus) Also, based on the answens in port b. is the yled to maturfy (curtent interest rate) equals the coupon insorest rate, the bond wit sell at excoeds the bond's coupon rabe, the bond will sel at i and is les than the bondin coupon rate, the bond wil sel at (Select from the drop-down menus.) d. Aswume the bond matures in 4 years inslead of 10 years. What is the value of the bond if the yeld to maturity on a comparable-isk bond is 10 percent? (Round to the nearest cent) Assume the bond matures in 4 years inatead of 10 yeare, what is the value of the bond if the yoid to matyrity on a comparable-eisk bond is 15 percent? (Round to the nesrest cent.) Assume the bond matures in 4 years instead of 10 years, what is the value of the bond if the yleld to maturcy on a comparable-tisk bond is 7 percent? (Round to the nearent cert) 6. From the findings in part d, we can conelude that a bandholder owning a long-tem bond as exposed to the drog-down meny)