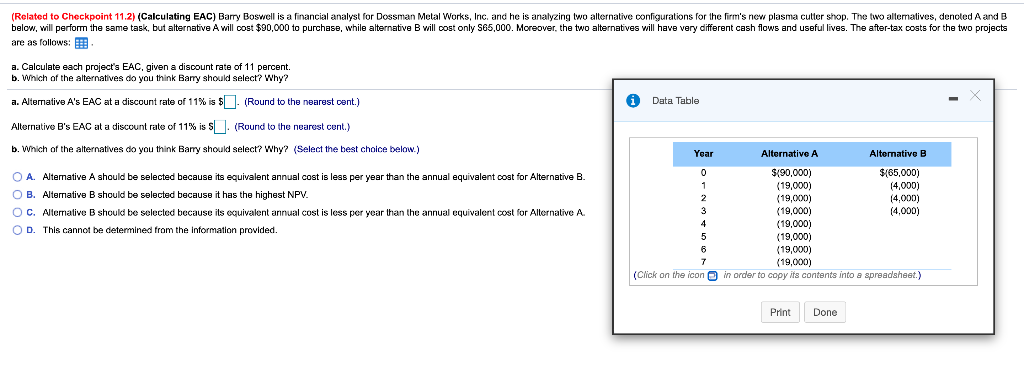

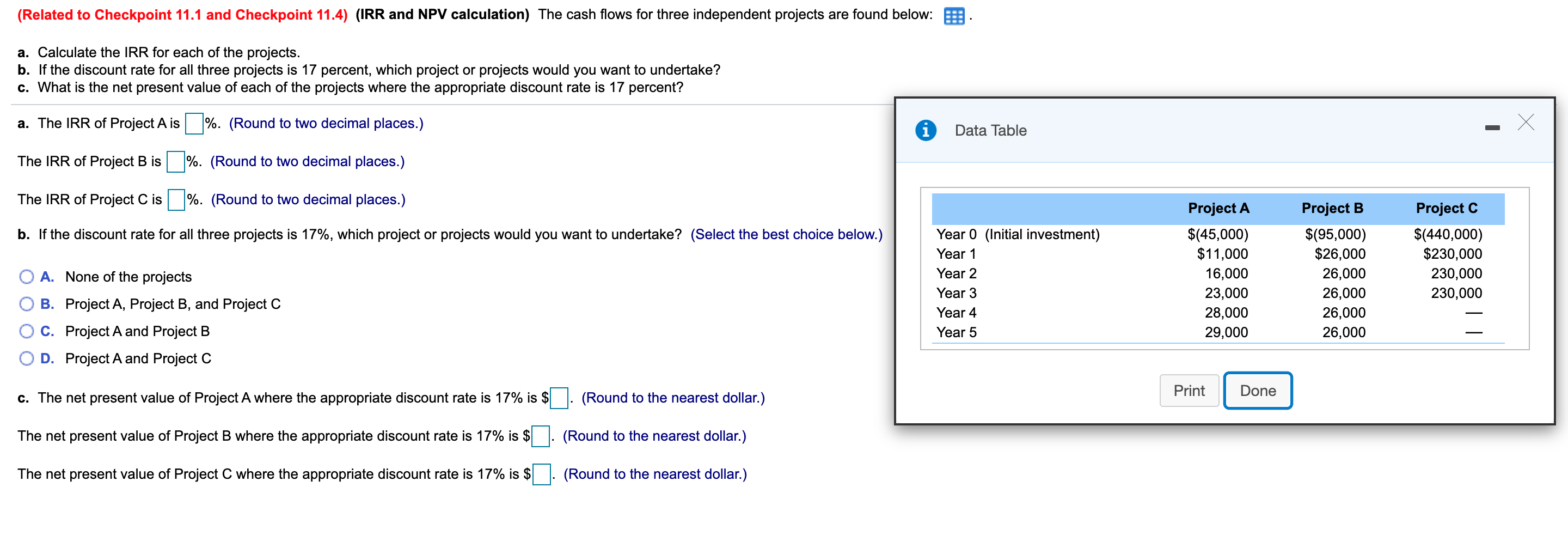

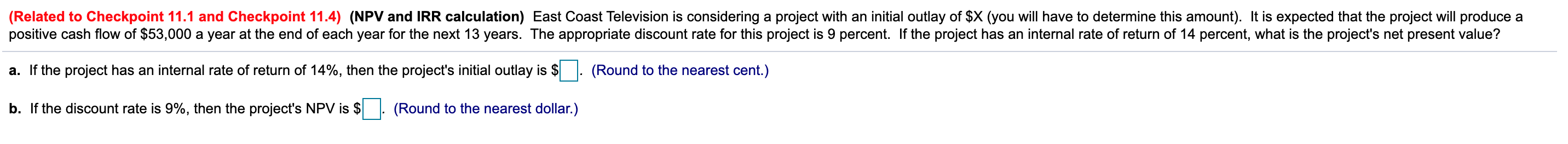

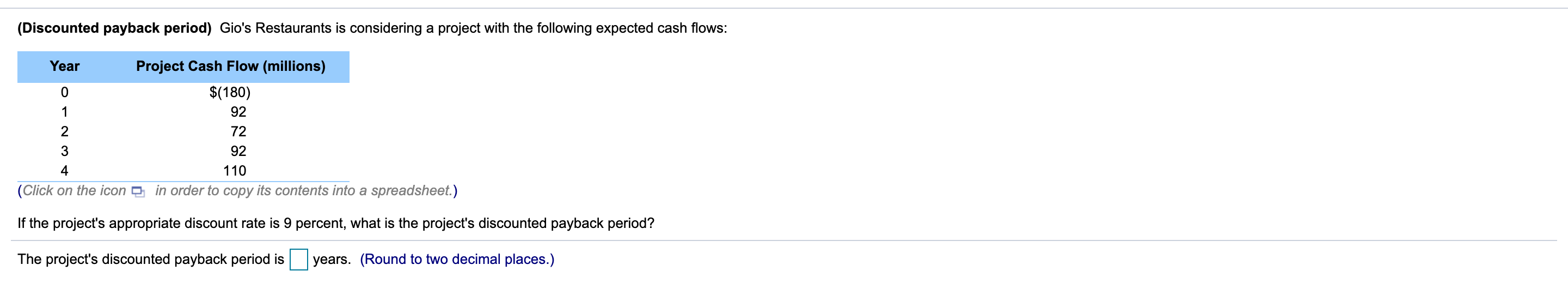

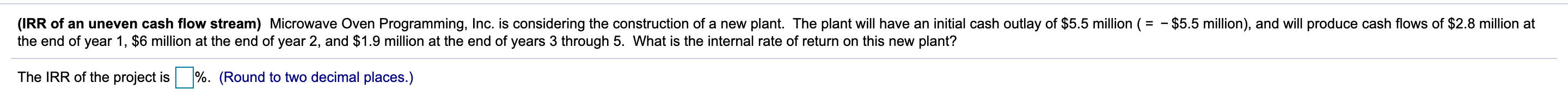

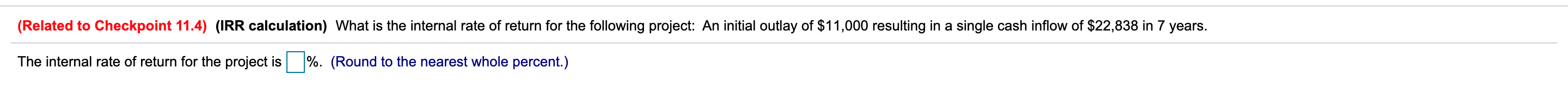

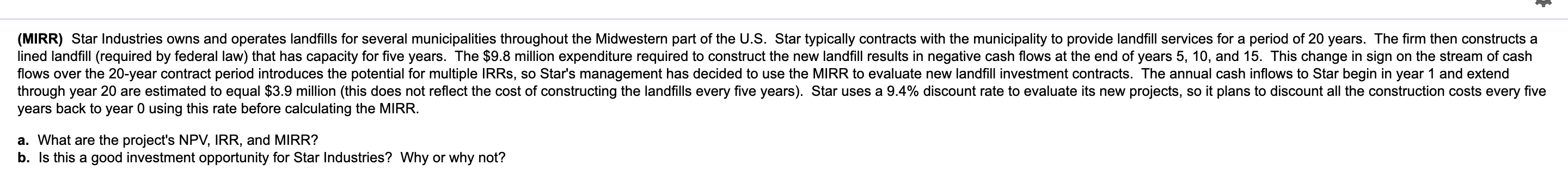

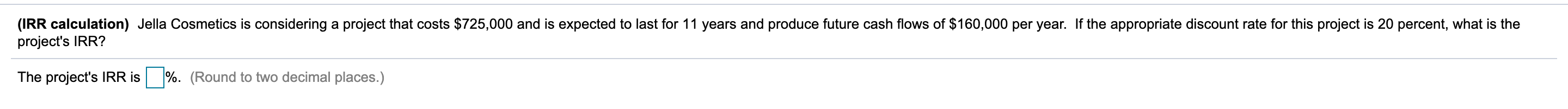

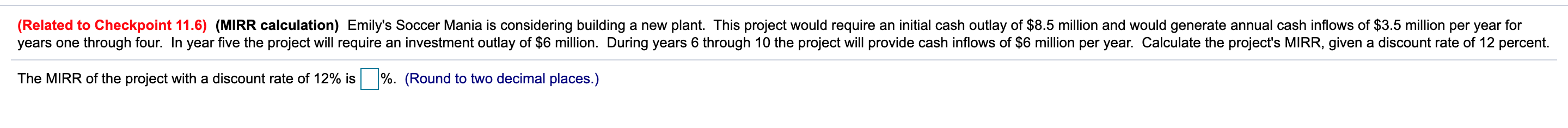

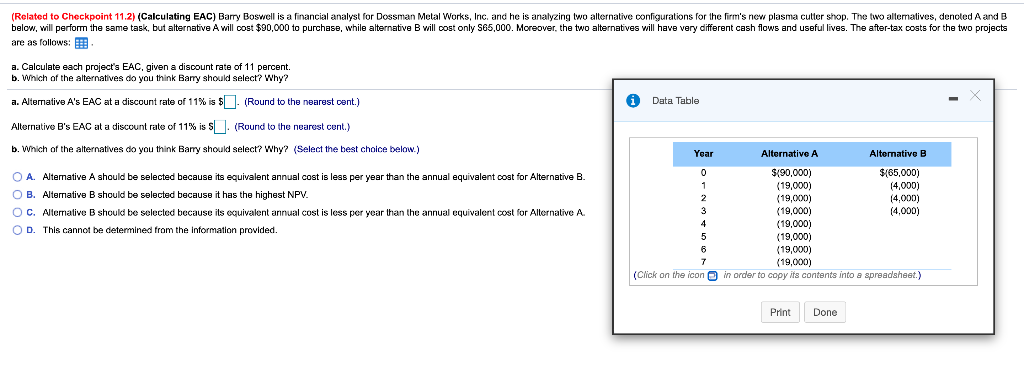

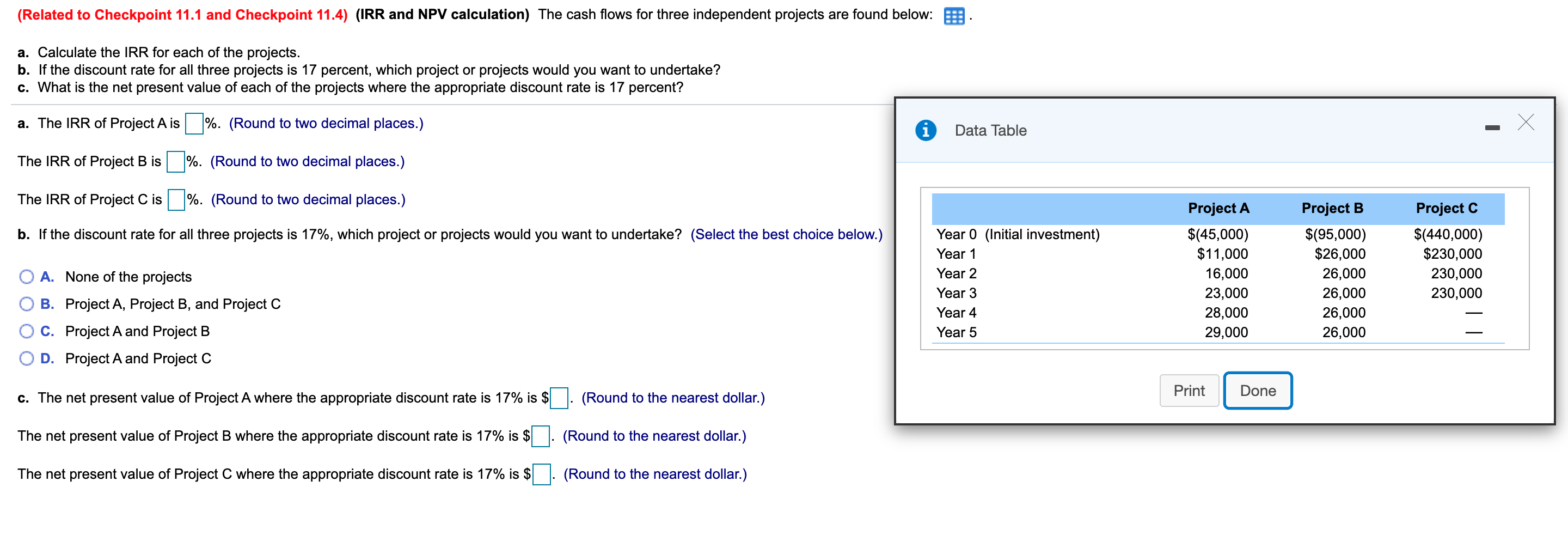

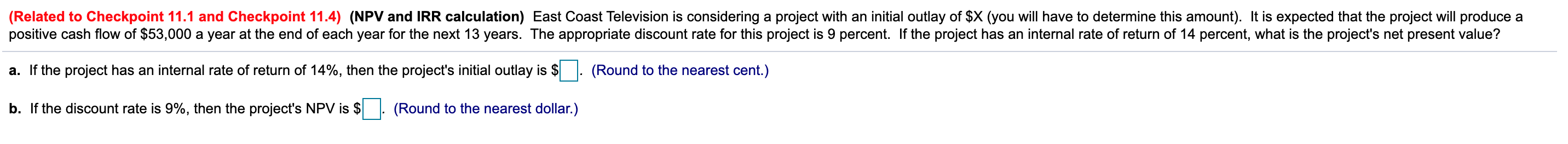

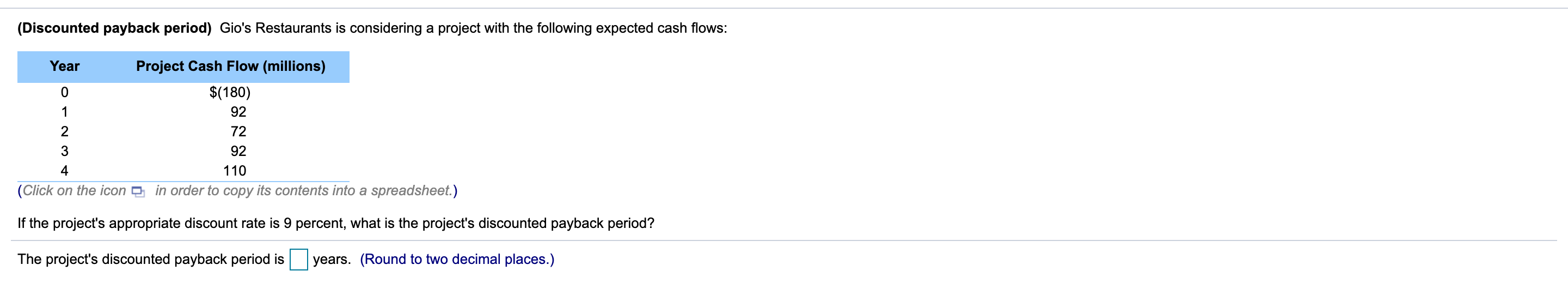

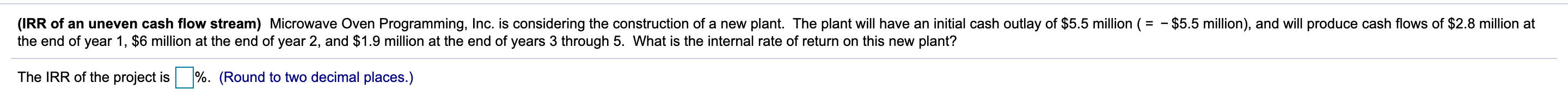

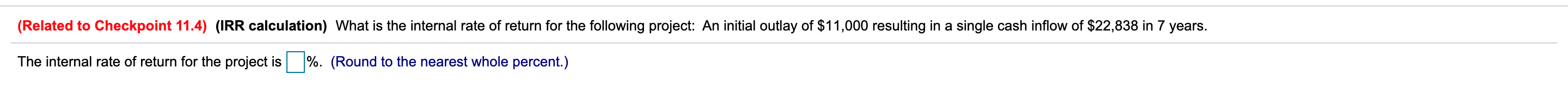

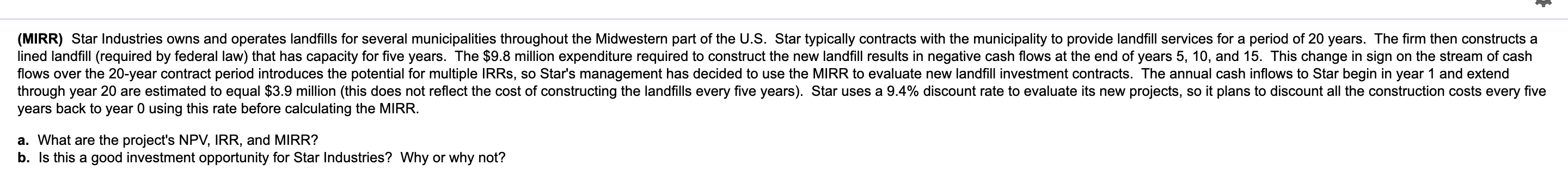

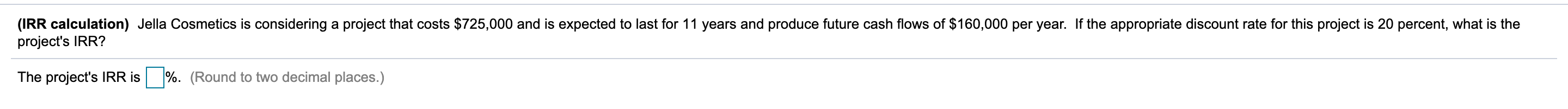

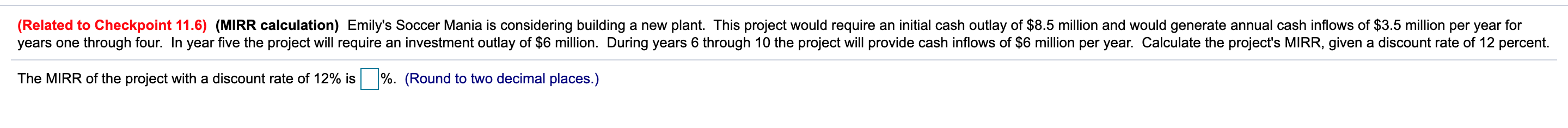

(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $90,000 to purchase, while alternative B will cost only 565,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 11 percent. b. Which of the alternatives do you think Barry should select? Why? a. Alternative A's EAC at a discount rate of 11% is $(Round to the nearest cent.) A Data Table Alternative B's EAC at a discount rate of 11% is S. (Round to the nearest cent.) b. Which of the alternatives do you think Barry should select? Why? (Select the best choice below.) 2 O A. Alternative A should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative B. OB. Alternative B should be selected because it has the highest NPV. OC. Alternative B should be selected because ils equivalent annual cost is less per year than the annual equivalent cost for Alternative A OD. This cannot be determined from the information provided. 3 Year Alternative A Alternative B 0 $190,000) ${65,000) 1 (19,000) (4,000) (19,000) (4,000) (19,000) (4,000) 4 (19,000) 5 (19,000) 6 (19,000) 7 (19,000) (Click on the icon in order to copy its contents into a spreadshest.) Print Done (Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below: a. Calculate the IRR for each of the projects. b. If the discount rate for all three projects is 17 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 17 percent? a. The IRR of Project A is %. (Round to two decimal places.) X Data Table - The IRR of Project B is %. (Round to two decimal places.) The IRR of Project C is %. (Round to two decimal places.) b. If the discount rate for all three projects is 17%, which project or projects would you want to undertake? (Select the best choice below.) Year 0 (Initial investment) Year 1 Year 2 Year 3 Year 4 Year 5 A. None of the projects Project A $(45,000) $11,000 16,000 23,000 28,000 29,000 Project B $(95,000) $26,000 26,000 26,000 26,000 26,000 Project C $(440,000) $230,000 230,000 230,000 B. Project A, Project B, and Project C C. Project A and Project B D. Project A and Project C Print Done c. The net present value of Project A where the appropriate discount rate is 17% is $ (Round to the nearest dollar.) The net present value of Project B where the appropriate discount rate is 17% is $ (Round to the nearest dollar.) The net present value of Project C where the appropriate discount rate is 17% is $. (Round to the nearest dollar.) (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is considering a project with an initial outlay of $X (you will have to determine this amount). It is expected that the project will produce a positive cash flow of $53,000 a year at the end of each year for the next 13 years. The appropriate discount rate for this project is 9 percent. If the project has an internal rate of return of 14 percent, what is the project's net present value? a. If the project has an internal rate of return of 14%, then the project's initial outlay is $ (Round to the nearest cent.) b. If the discount rate is 9%, then the project's NPV is $| (Round to the nearest dollar.) (Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year Project Cash Flow (millions) 0 $(180) 1 92 2 72 3 92 4 110 (Click on the icon in order to copy its contents into a spreadsheet.) If the project's appropriate discount rate is 9 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.) (IRR of an uneven cash flow stream) Microwave Oven Programming, Inc. is considering the construction of a new plant. The plant will have an initial cash outlay of $5.5 million ( = - $5.5 million), and will produce cash flows of $2.8 million at the end of year 1, $6 million at the end of year 2, and $1.9 million at the end of years 3 through 5. What is the internal rate of return on this new plant? The IRR of the project is %. (Round to two decimal places.) (Related to Checkpoint 11.4) (IRR calculation) What is the internal rate of return for the following project: An initial outlay of $11,000 resulting in a single cash inflow of $22,838 in 7 years. The internal rate of return for the project is %. (Round to the nearest whole percent.) (MIRR) Star Industries owns and operates landfills for several municipalities throughout the Midwestern part of the U.S. Star typically contracts with the municipality to provide landfill services for a period of 20 years. The firm then constructs a lined landfill (required by federal law) that has capacity for five years. The $9.8 million expenditure required to construct the new landfill results in negative cash flows at the end of years 5, 10, and 15. This change in sign on the stream of cash flows over the 20-year contract period introduces the potential for multiple IRRs, so Star's management has decided to use the MIRR to evaluate new landfill investment contracts. The annual cash inflows to Star begin in year 1 and extend through year 20 are estimated to equal $3.9 million (this does not reflect the cost of constructing the landfills every five years). Star uses a 9.4% discount rate to evaluate its new projects, so it plans to discount all the construction costs every five years back to year 0 using this rate before calculating the MIRR. a. What are the project's NPV, IRR, and MIRR? b. Is this a good investment opportunity for Star Industries? Why or why not? (IRR calculation) Jella Cosmetics is considering a project that costs $725,000 and is expected to last for 11 years and produce future cash flows of $160,000 per year. If the appropriate discount rate for this project is 20 percent, what is the project's IRR? The project's IRR is %. (Round to two decimal places.) (Related to Checkpoint 11.6) (MIRR calculation) Emily's Soccer Mania is considering building a new plant. This project would require an initial cash outlay of $8.5 million and would generate annual cash inflows of $3.5 million per year for years one through four. In year five the project will require an investment outlay of $6 million. During years 6 through 10 the project will provide cash inflows of $6 million per year. Calculate the project's MIRR, given a discount rate of 12 percent. The MIRR of the project with a discount rate of 12% is %. (Round to two decimal places.)