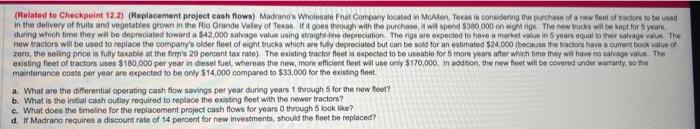

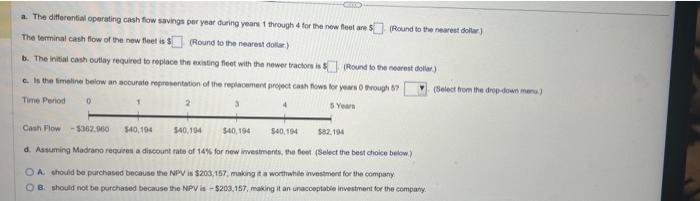

(Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Frut Conpany located in MeAlen, fexas is cansidering the purchase of a renw flont of taciors is Ee used in the delivery of fruits and vegetabies grown in the foo Grande Valey of Texas. If it goes through with the purchase, il wil spend 5300.000 on eqgh rigs. The new rucke will te kapt for 5 yeare during which time they wil be depreciated toward a $42,000 salvage value uaing atraighutine degreciation. The ngs are expected to have a maket value in 6 years equal to ther satrage uave. the now tractors will be used to replace the company's older flet of eight tricka which are fully depreciated but can be sold for an estimated 524 ooo (because the tradors hare a currert bock value of zero, the selling price is fully taxable at the firmis 29 percent tax rato). The exiating tractor floet is expectod to be useable for 5 more years after which tme they wal have no aakuge value. The existing fleet of tractors uses $180,000 per year in diesel fuel, whereas the new, more efficient fleet wil use only $170,000, in addscn, the new feet wili be cevered under wartanty, so the maintenance costs per year are expected to be only $14,000 compared to $33,000 for the existing fleet a. What are the diflerential operating cash flow savings per year during years 1 through 5 for the new fleet? b. What is the inital cash outlay required to replace the existing teet with the newer tractors? c. What does the timeline for the replacement project casti flows tor yoars o through 5 look tive? d. It Madrano requires a discount rate of 14 percent for new investments, should the fleet be replaced? a. The differential operating cash fow savings per year during years 1 through 4 for the new feet ane: (Found to the nearest bolac) The terminal cash flow of the new fleet is $ (Round to the nearest dollse) b. The initiai cash cotlay required to replace the exating fleet with the newer traciors is : (Round to the neorest deltar) c. Is the fmeline below an aocurale mepresentaion of the reslacemen propect cash fows bor years of mrough s? (Belect fogm the dro-down d. Assuming Madrano requires a discount fate of 14% for new investments, the feet (Belect the best choice below) ) A. chould be purchased bocause the NPY is $203,457, making it a worthahile investment for the company. B. should not be purchabed because the NPV is $203,157, making it an inacceptable investment for the compary