Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working

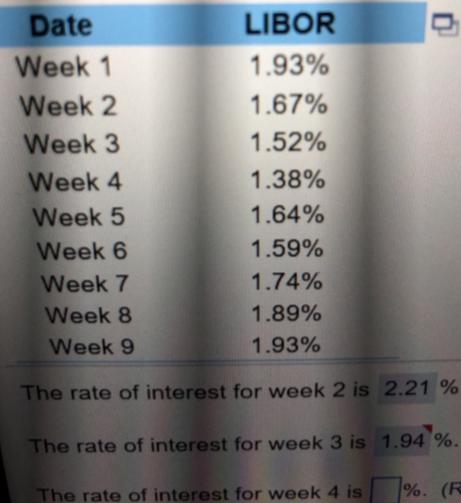

(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 29 basis points (0.29 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.17 percent and a minimum of 1.78 percent. Calculate the rate of interest for weeks 2 through 10. Date LIBOR Week 1 1.92% Week 2 1.64% Week 3 Week 4 1.54% 1.37% Week 5 1.56% 1.63% Week 6 Week 7 1.68% The rate of interest for week 2 is%. (Round to two decimal places.) Date Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 LIBOR 1.93% 1.67% 1.52% 1.38% 1.64% 1.59% 1.74% 1.89% 1.93% The rate of interest for week 2 is 2.21 % The rate of interest for week 3 is 1.94 %. The rate of interest for week 4 is %. (R

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Answer Solution stepby Step eAp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started