Answered step by step

Verified Expert Solution

Question

1 Approved Answer

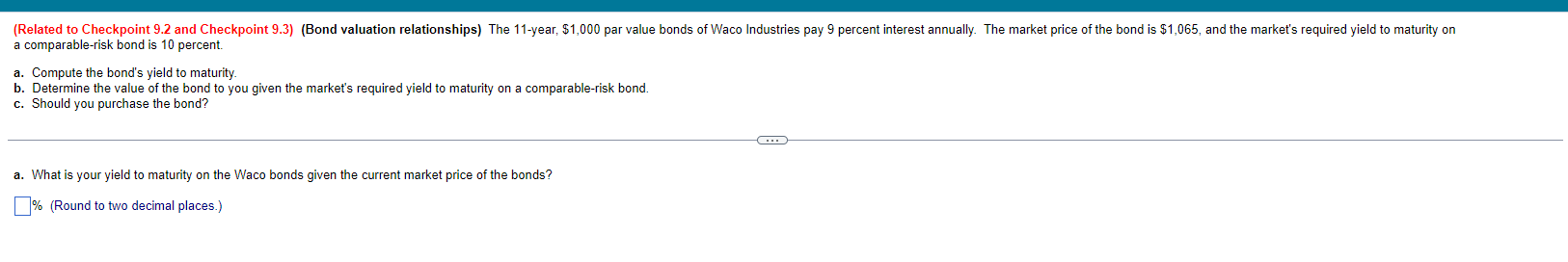

(Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 11-year, $1,000 par value bonds of Waco Industries pay 9 percent interest annually.

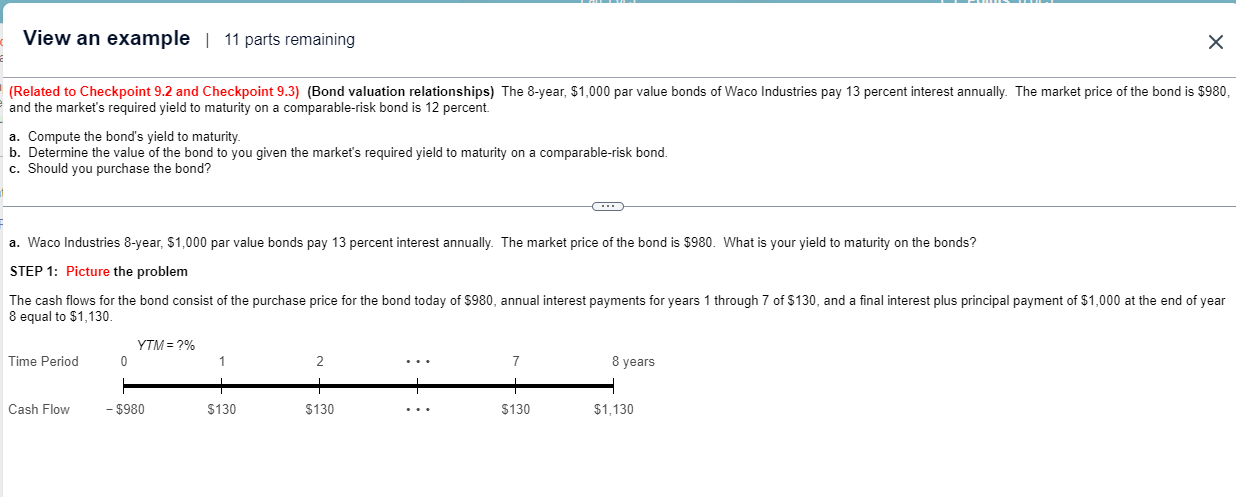

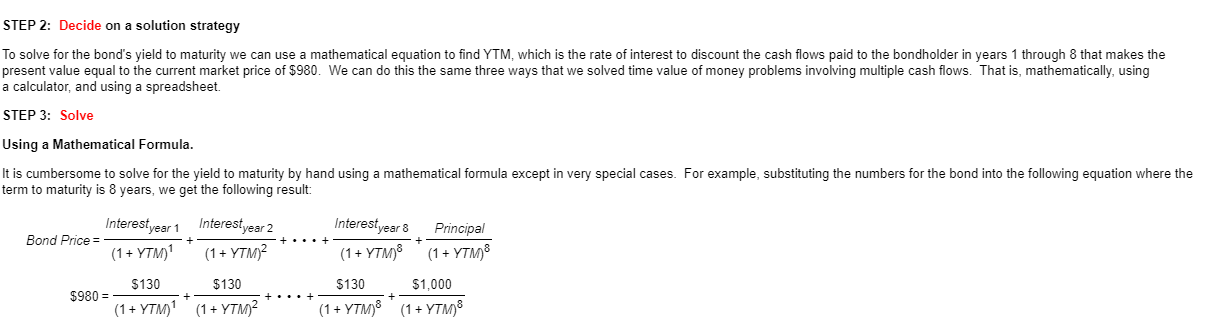

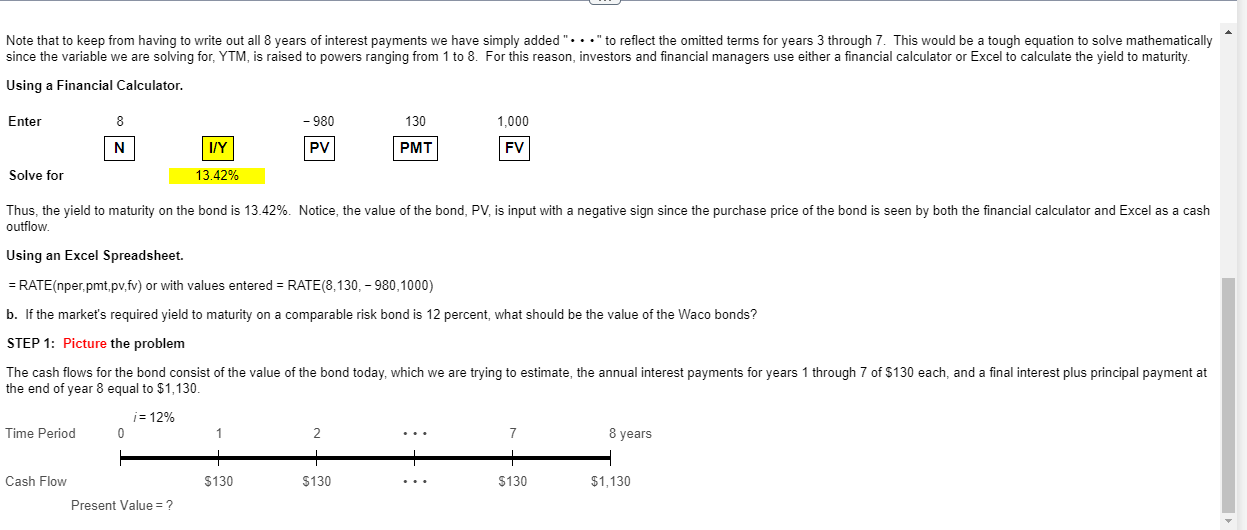

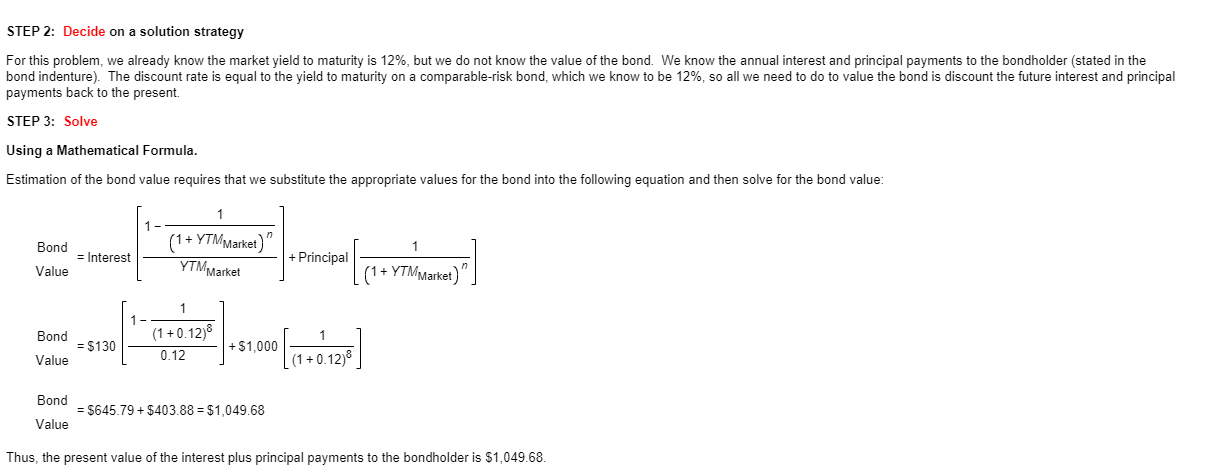

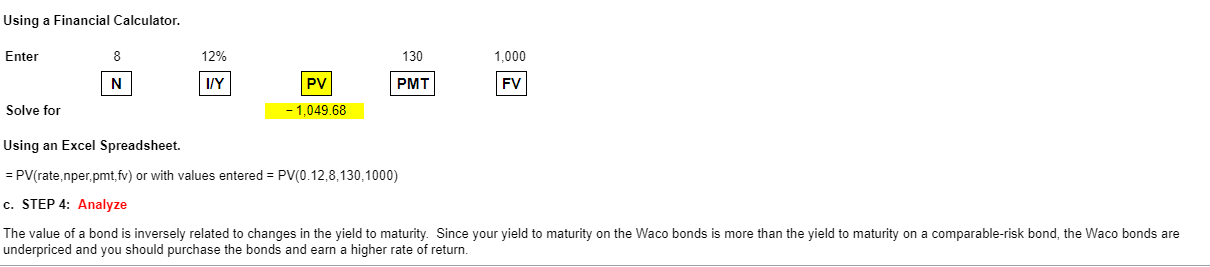

(Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 11-year, $1,000 par value bonds of Waco Industries pay 9 percent interest annually. The market price of the bond is $1,065, and the market's required yield to maturity on a comparable-risk bond is 10 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. What is your yield to maturity on the Waco bonds given the current market price of the bonds? % (Round to two decimal places.) View an example | 11 parts remaining (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 8-year, $1,000 par value bonds of Waco Industries pay 13 percent interest annually. The market price of the bond is $980, and the market's required yield to maturity on a comparable-risk bond is 12 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. Waco Industries 8-year, $1,000 par value bonds pay 13 percent interest annually. The market price of the bond is $980. What is your yield to maturity on the bonds? STEP 1: Picture the problem The cash flows for the bond consist of the purchase price for the bond today of $980, annual interest payments for years 1 through 7 of $130, and a final interest plus principal payment of $1,000 at the end of year 8 equal to $1,130. YTM=?% Time Period 0 1 2 8 years + + Cash Flow - $980 $130 $130 $130 $1,130 STEP 2: Decide on a solution strategy To solve for the bond's yield to maturity we can use a mathematical equation to find YTM, which is the rate of interest to discount the cash flows paid to the bondholder in years 1 through 8 that makes the present value equal to the current market price of $980. We can do this the same three ways that we solved time value of money problems involving multiple cash flows. That is, mathematically, using a calculator, and using a spreadsheet. STEP 3: Solve Using a Mathematical Formula. It is cumbersome to solve for the yield to maturity by hand using a mathematical formula except in very special cases. For example, substituting the numbers for the bond into the following equation where the term to maturity is 8 years, we get the following result: Bond Price= Interest year 1 (1+ YTM)' Interest year 2 (1+ YTM) $130 $130 $980 + (1+ YTM) (1+ YTM) Interest year 8 (1+ YTM) $130 Principal (1+ YTM) $1,000 + (1+ YTM) (1+Y7M)" Note that to keep from having to write out all 8 years of interest payments we have simply added " " to reflect the omitted terms for years 3 through 7. This would be a tough equation to solve mathematically since the variable we are solving for, YTM, is raised to powers ranging from 1 to 8. For this reason, investors and financial managers use either a financial calculator or Excel to calculate the yield to maturity. Using a Financial Calculator. Enter 8 N -980 Solve for I/Y 13.42% PV 130 PMT 1,000 FV Thus, the yield to maturity on the bond is 13.42%. Notice, the value of the bond, PV, is input with a negative sign since the purchase price of the bond is seen by both the financial calculator and Excel as a cash outflow. Using an Excel Spreadsheet. = RATE (nper,pmt,pv.fv) or with values entered = RATE (8,130, -980, 1000) b. If the market's required yield to maturity on a comparable risk bond is 12 percent, what should be the value of the Waco bonds? STEP 1: Picture the problem The cash flows for the bond consist of the value of the bond today, which we are trying to estimate, the annual interest payments for years 1 through 7 of $130 each, and a final interest plus principal payment at the end of year 8 equal to $1,130. i= 12% Time Period 0 Cash Flow Present Value = ? 2 8 years + $130 $130 $130 $1,130 STEP 2: Decide on a solution strategy For this problem, we already know the market yield to maturity is 12%, but we do not know the value of the bond. We know the annual interest and principal payments to the bondholder (stated in the bond indenture). The discount rate is equal to the yield to maturity on a comparable-risk bond, which we know to be 12%, so all we need to do to value the bond is discount the future interest and principal payments back to the present. STEP 3: Solve Using a Mathematical Formula. Estimation of the bond value requires that we substitute the appropriate values for the bond into the following equation and then solve for the bond value: Bond Value (1+ YTM Market)" 1 = Interest + Principal YTM Market (1+ YTM Market)" 1 Bond Value = $130 (1+0.12) 0.12 +$1,000 +0.12)8 Bond = $645.79 + $403.88 = $1,049.68 Value Thus, the present value of the interest plus principal payments to the bondholder is $1,049.68. Using a Financial Calculator. Enter 8 12% 130 1,000 N I/Y PV PMT FV Solve for - 1,049.68 Using an Excel Spreadsheet. = PV(rate,nper,pmt,fv) or with values entered = PV(0.12,8,130,1000) c. STEP 4: Analyze The value of a bond is inversely related to changes in the yield to maturity. Since your yield to maturity on the Waco bonds is more than the yield to maturity on a comparable-risk bond, the Waco bonds are underpriced and you should purchase the bonds and earn a higher rate of return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started