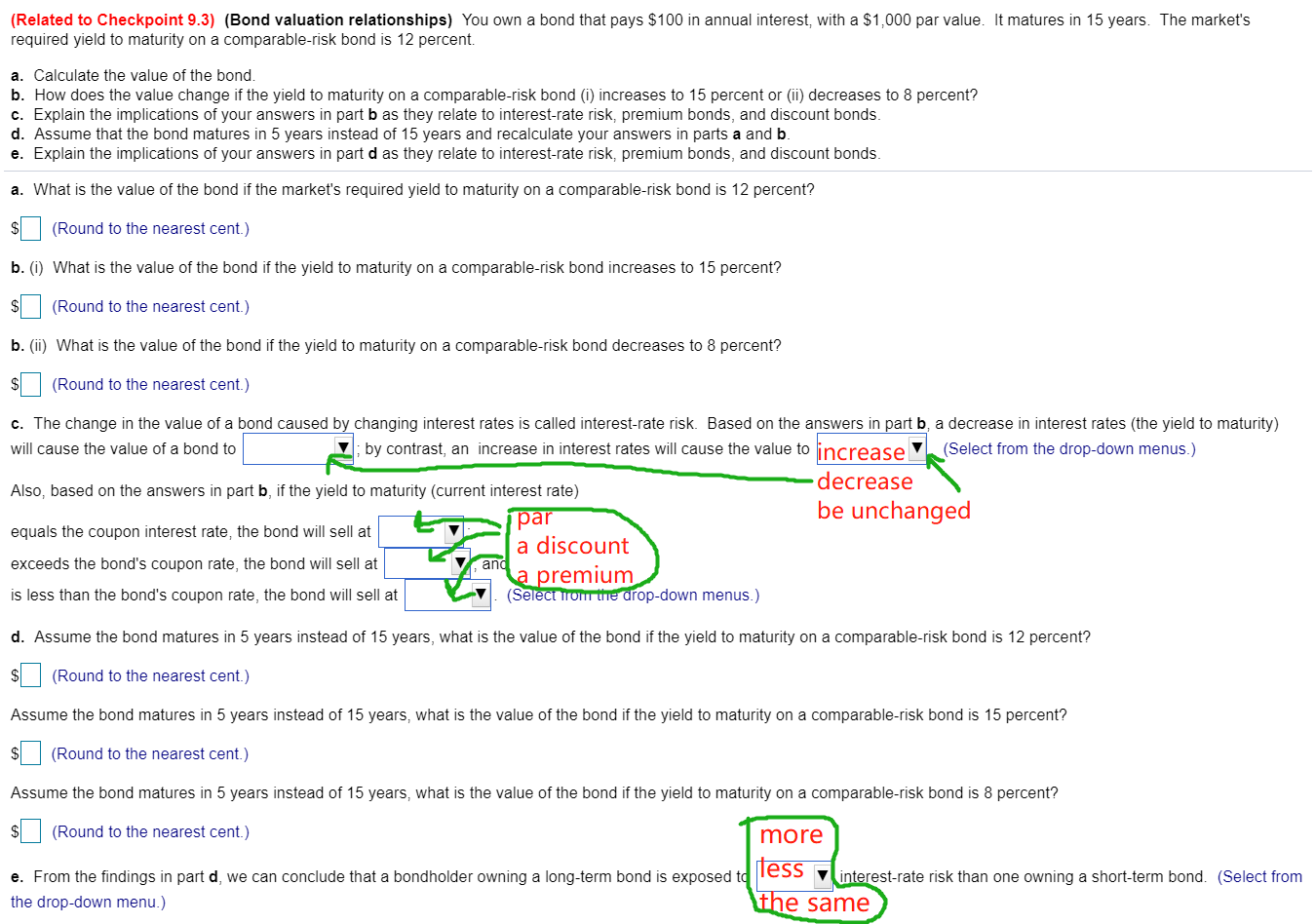

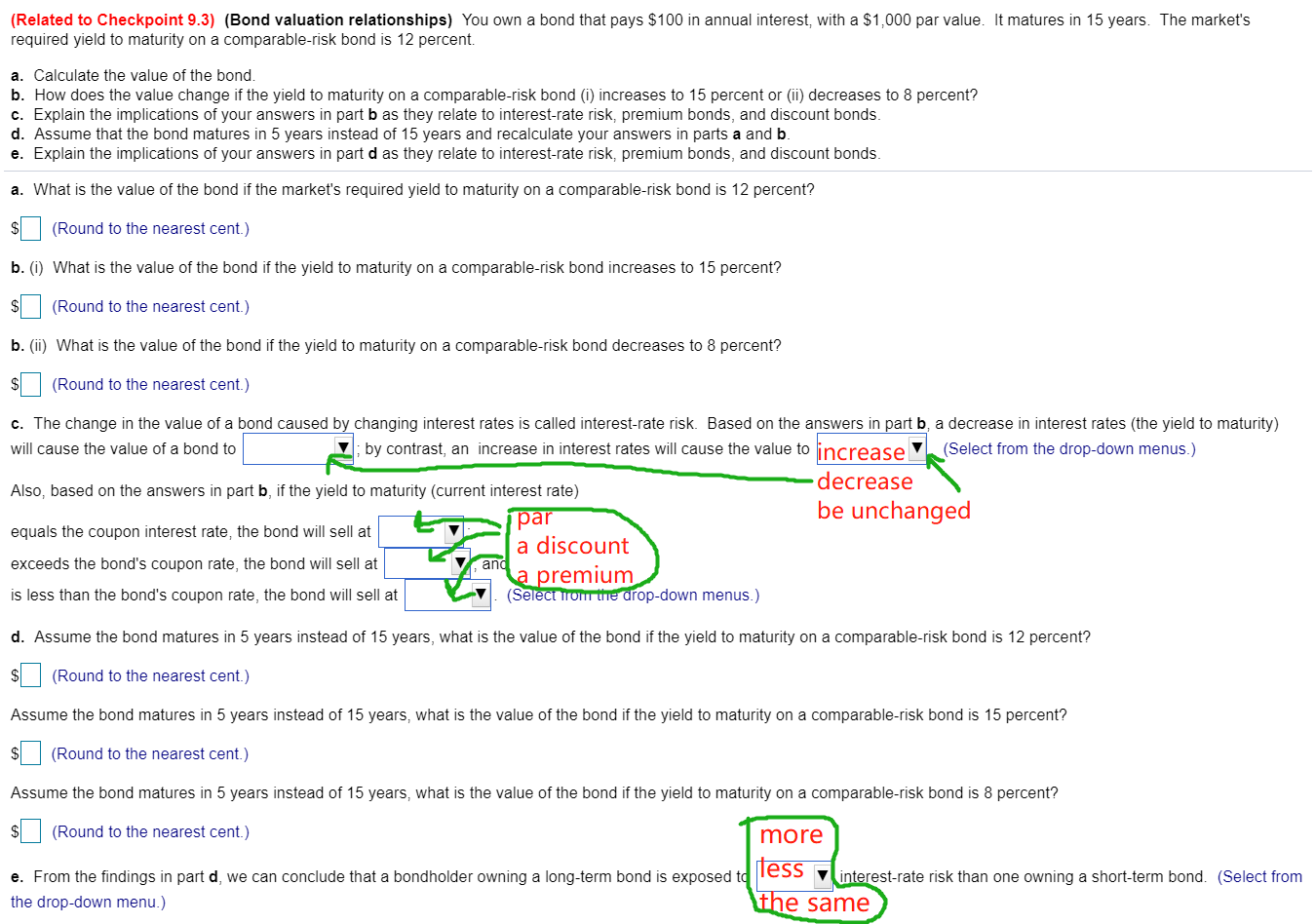

(Related to Checkpoint 9.3) (Bond valuation relationships) You own a bond that pays $100 in annual interest, with a $1,000 par value. It matures in 15 years. The market's required yield to maturity on a comparable-risk bond is 12 percent. a. Calculate the value of the bond. b. How does the value change if the yield to maturity on a comparable-risk bond (l) increases to 15 percent or (ii) decreases to 8 percent? c. Explain the implications of your answers in part b as they relate to interest-rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 5 years instead of 15 years and recalculate your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to interest-rate risk, premium bonds, and discount bonds. a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 12 percent? (Round to the nearest cent.) b. (0) What is the value of the bond if the yield to maturity on a comparable-risk bond increases to 15 percent? (Round to the nearest cent.) b. (ii) What is the value of the bond if the yield to maturity on a comparable-risk bond decreases to 8 percent? (Round to the nearest cent.) y; by contrast, an increase in interest rates will cause the value to increasel c. The change in the value of a bond caused by changing interest rates is called interest-rate risk. Based on the answers in part b, a decrease in interest rates (the yield to maturity) will cause the value of a bond to (Select from the drop-down menus.) decrease Also, based on the answers in part b, if the yield to maturity (current interest rate) par be unchanged equals the coupon interest rate, the bond will sell at a discount exceeds the bond's coupon rate, the bond will sell at a premium is less than the bond's coupon rate, the bond will sell at (Select from the drop-down menus.) and d. Assume the bond matures in 5 years instead of 15 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 12 percent? $ (Round to the nearest cent.) Assume the bond matures in 5 years instead of 15 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 15 percent? (Round to the nearest cent) Assume the bond matures in 5 years instead of 15 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 8 percent? (Round to the nearest cent.) more e. From the findings in part d, we can conclude that a bondholder owning a long-term bond is exposed to less interest-rate risk than one owning a short-term bond. (Select from the same the drop-down menu.)