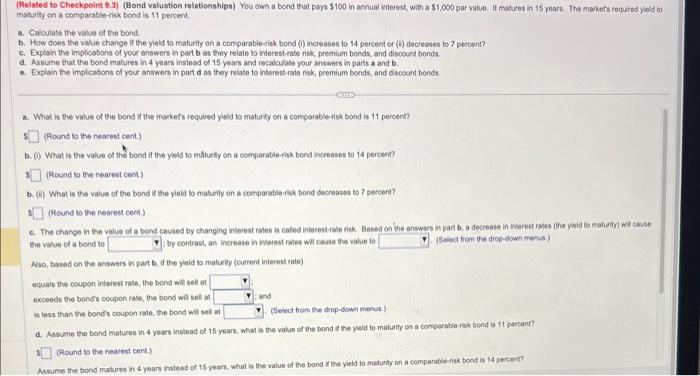

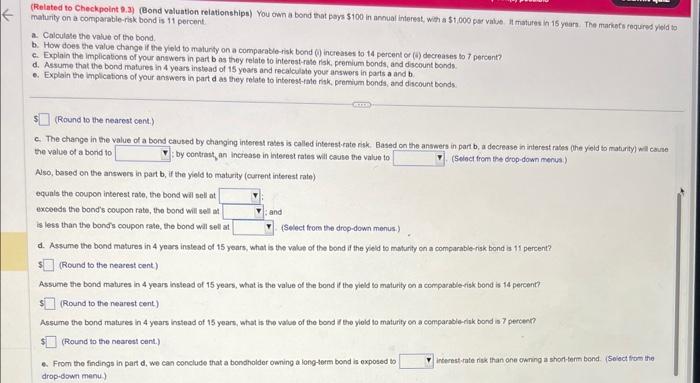

(Related to Checkpoint 9.3 ) (Bond valustion relationships) You own a bond that pays $100 in arnual interest, with a $1,000 par value. It matures in 15 yoars. The manefs roquired yoid to makirity on a comparable-risk bond is 11 peroent. A. Calculate the value of the bond. b. How does the value change if the yield to maturity on a comparable-tisk bond (i) increases to 14 percent or (6) decreases to 7 percent? c. Explain the implicetions of your answers in part b as they relate to interest-rabe risk premium bonds, and discount bonds. d. Assurne that the bond matures in 4 years instead of 15 years and recakulae your answers in parts a and b. e. Explain the implicatons of your answers in part d as thoy relate to interest-rate riak, premium bonds, and cscount bonds. a. What is the value of the bond it the markets required yied to maturity on a cormerable-isk band is 11 percent? (Round to the nearest cent) b. (i) What is the value of th bond if the yield to mhiturity on a comparabie-risk bond increases to 14 percent? 1. (Round lo the nearest cent.) b. (ii) What is the value of the bond it the yleld to maturity on a comparable-isk bond decreases to 7 percent? 1. (Round to the nearest cem.) c. The change in the value of a bend cassed by changing interest reles is caled interestale ritk. Baced on the answers in part b. a decrease in interest raiss (the yeld to maturity will cesse the value of a bond to I by contrast, an increase in heiest rames wil taxse the value to (Select fiom the dropdown menut) Aso, based on the answers in pact b. If the yeid to maturfy (curtent interest rute) equale the coupon interest rate, the bond wal sot at d. Actume the bond matures in 4 years instead of 15 yoars. What is the value of the bond it the yeld to maturity on a comparacle -rek bend is 11 isercint? (Round to the nearest cent) Assume the bond makures in 4 years inatead of 15 years. what is the value of the band t the yield to maturty on a comparable risk bond is 14 pereen?? malurity on a comparable-risk bond is 11 porcent. a. Calculate the vatue of the bond. b. How does the value change if the yield to maturity on a compacable-isk bond (0) increases to 14 percent or (0) decreases to 7 percent? c. Explain the implications of your answers in part b as they relate to interest-rete riak, premium bonds, and discount bonds. d. Assume that the bond matures in 4 years instead of 15 years and recalculste your answers in parts a and b e. Explain the implications of your answers in part d as they relate to interest-tale risk, peemiun bonds, and discount bonds (Round to the nearest cent.) c. The change in the value of a bond caused by changing interest rases is called interesterate risk. Based on the answers in part b, a decrease in interest rases (the yiold to matinty) will casse the value of a bond to : by contrast, an increase in interest rates will cause the value to (Selaci from the drop-down menis.) Aso, based on the answors in part b, if the yeld to maturity (current interest rate) equals the coupon interest rate, the bond wil sell at exceeds the bond's coupon rate, the bond will sell at ; ; and is less than the bond's coupon rate, the bond will sell at (Select trom the drop-down menus;) d. Assume the bond matures in 4 years instead of 15 years, what is the value of the bond it the yeld to maturity on a comparable isk bond is 11 percent? 3. (Round to the nearest cent) Assume the bond matures in 4 years instead of 15 years, what is the value of the bond if the yleld to maturity on a comparable-tisk bond is 14 percent? 1. (Round to the nearest cent) Assume the bond matures in 4 years instead of 15 years, what is the value of the bond to the yioid to maturity on a comparable-riak bond is 7 percent? (Round to the nearest cent.) 4. From the findings in part d, wo can conclude that a bondholder owning a long-torm bond is oxposed to interest rate risk than one owning a shattetem bond. (Seect from the drop-down menu)