Answered step by step

Verified Expert Solution

Question

1 Approved Answer

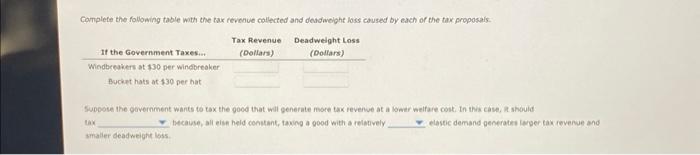

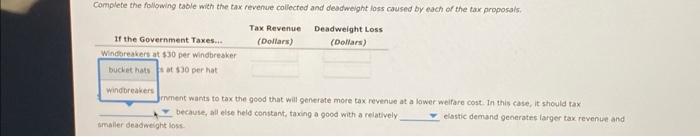

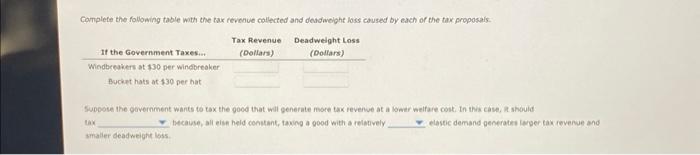

Relationship between tax revenues, deadweight loss, and elasticity Complete the following table with the tax revenve collected and dendweight loss caused by each of the

Relationship between tax revenues, deadweight loss, and elasticity

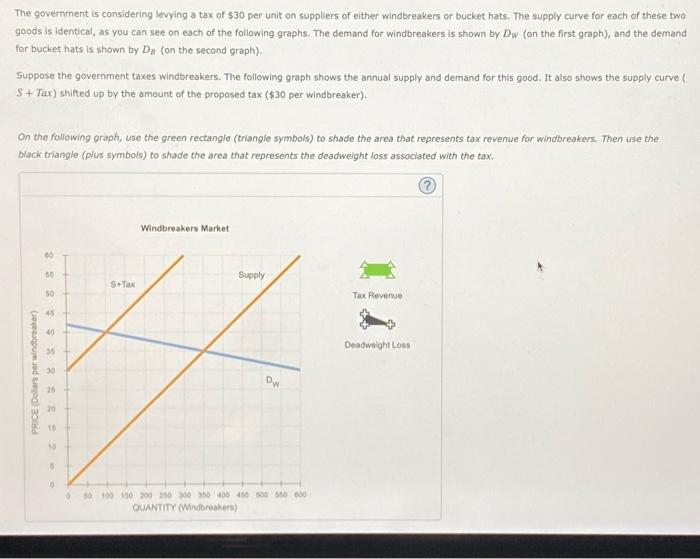

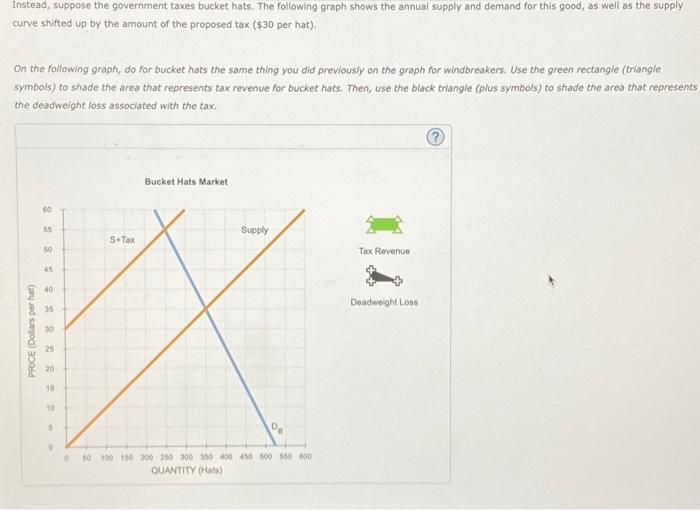

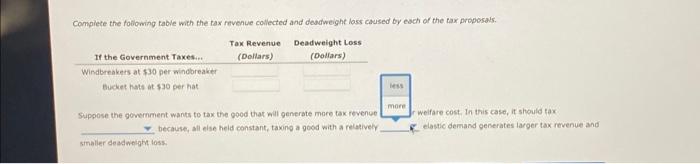

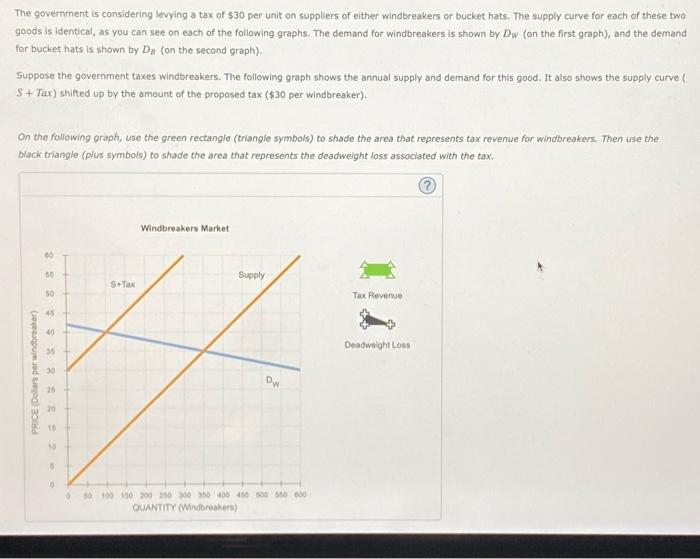

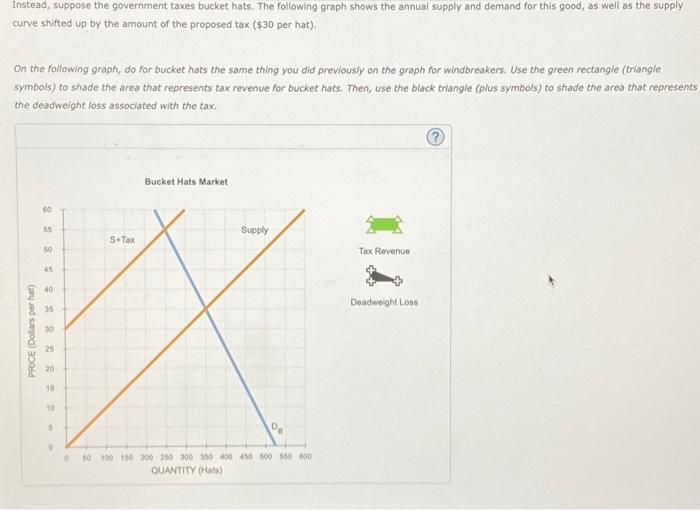

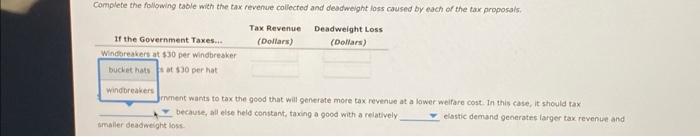

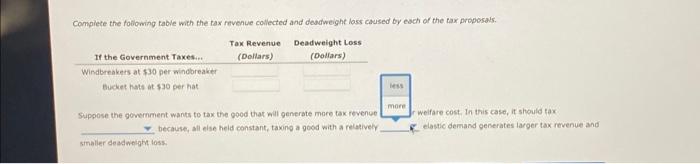

Complete the following table with the tax revenve collected and dendweight loss caused by each of the tax proposals. Supose the government wants to tax the good that wal generate more tax revenwe at a lower weifare cost. In this case, at should tax because, all eish held constant, taxing a good with a relatively elastic demand generates ievoer tav revenue and smalier deadweloht loss. Complete the following table with the tax revenue collected and deadweight loss caused by esch of the tax proposals. Suppose the gowemment wants to tax the good that will generate more tax revence because, all else held constant, taxing a good with a relatively weifare cost, in this case, it should tax. elastic demand generates larger tax revenue and sinaller dead weight loss. Innent wants to tax the good that will generate more tox revence at a lower weifare cost. In this case, it shoula tax because, all else held constant, taxing a good with a relatively imaller deadwelght ioss. elostic demand generntre farger tax revehue and The government is considering levying a tax of $30 per unit on suppliers of either windbreakers or bucket hats. The supply curve for each of these two goods is identical, as you can see on each of the following graphs. The demand for windbreakers is shown by DW (on the first graph), and the demand for bucket hats is shown by DB (on the second graph). Suppose the government taxes windbreakers. The following graph shows the annual supply and demand for this good. It also shows the supply curve \& S+Tax) shifted up by the amount of the proposed tax ( $30 per windbreaker). On the following graph, use the green rectangle (triangle symbols) to shade the area that represents tax revenue for windbreakers. Then use the black triangle (plus symbols) to shade the area that represents the deadweight loss associated with the tax. Instead, suppose the government taxes bucket hats. The following graph shows the annual supply and demand for this good, as well as the supply curve shifted up by the amount of the proposed tax ( $30 per hat). On the following graph, do for bucket hats the same thing you did previously on the graph for windbreakers. Use the green rectangle (triangle symbols) to shade the area that represents tax revenue for bucket hats. Then, use the black triangle (plus symbols) to shade the area that represent the deadweight loss associated with the tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started