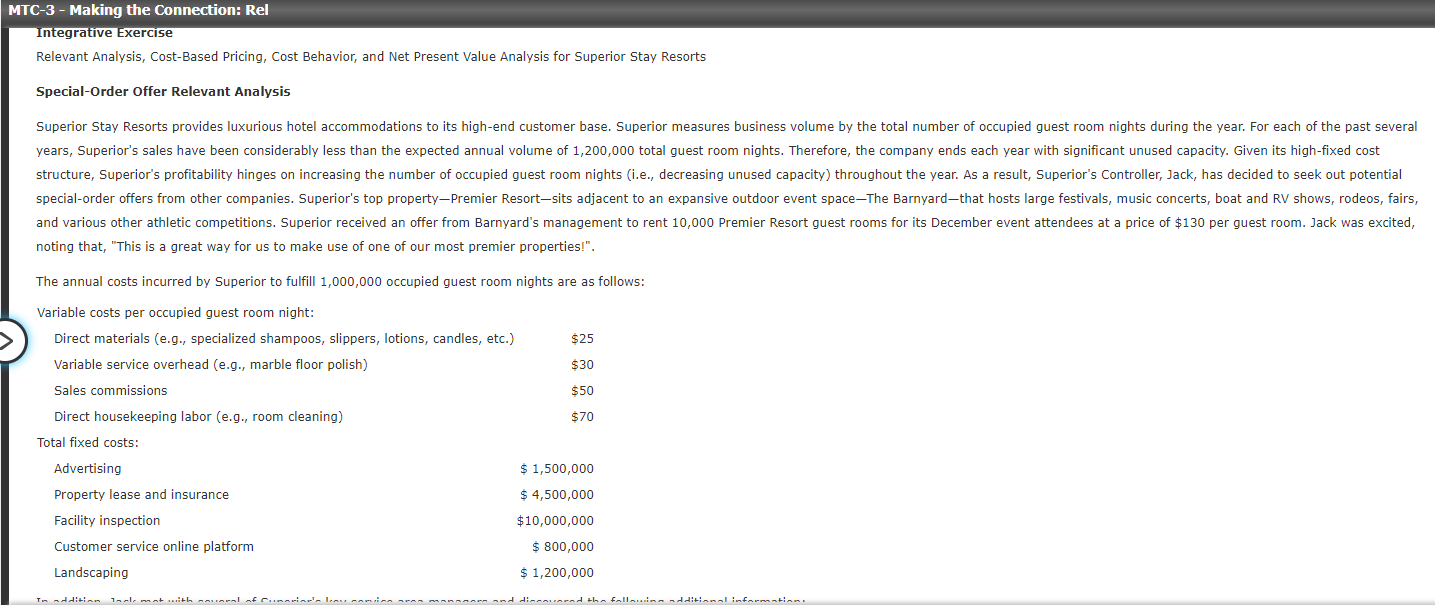

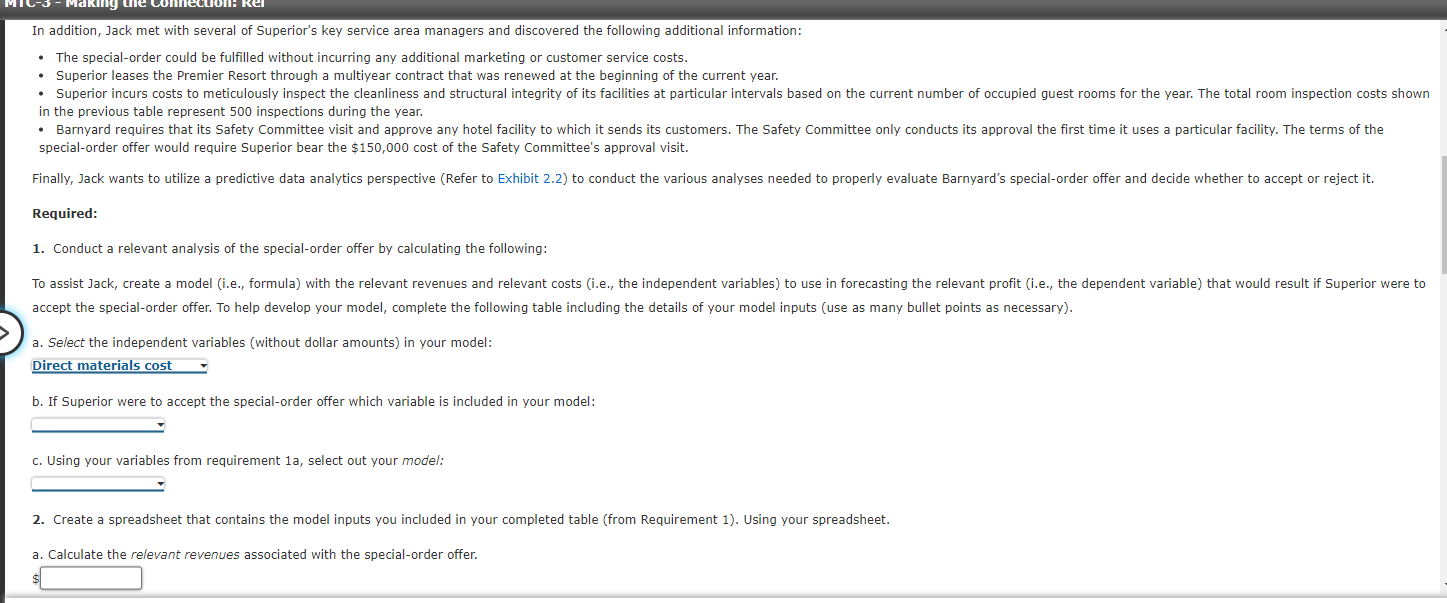

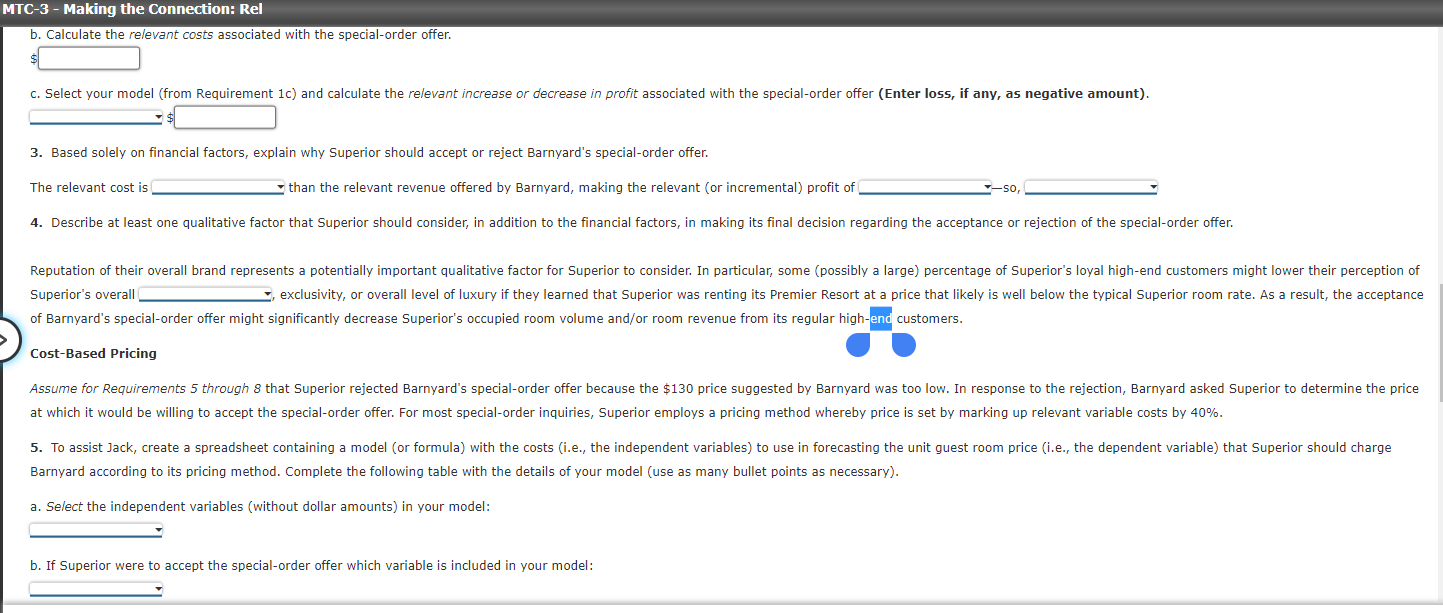

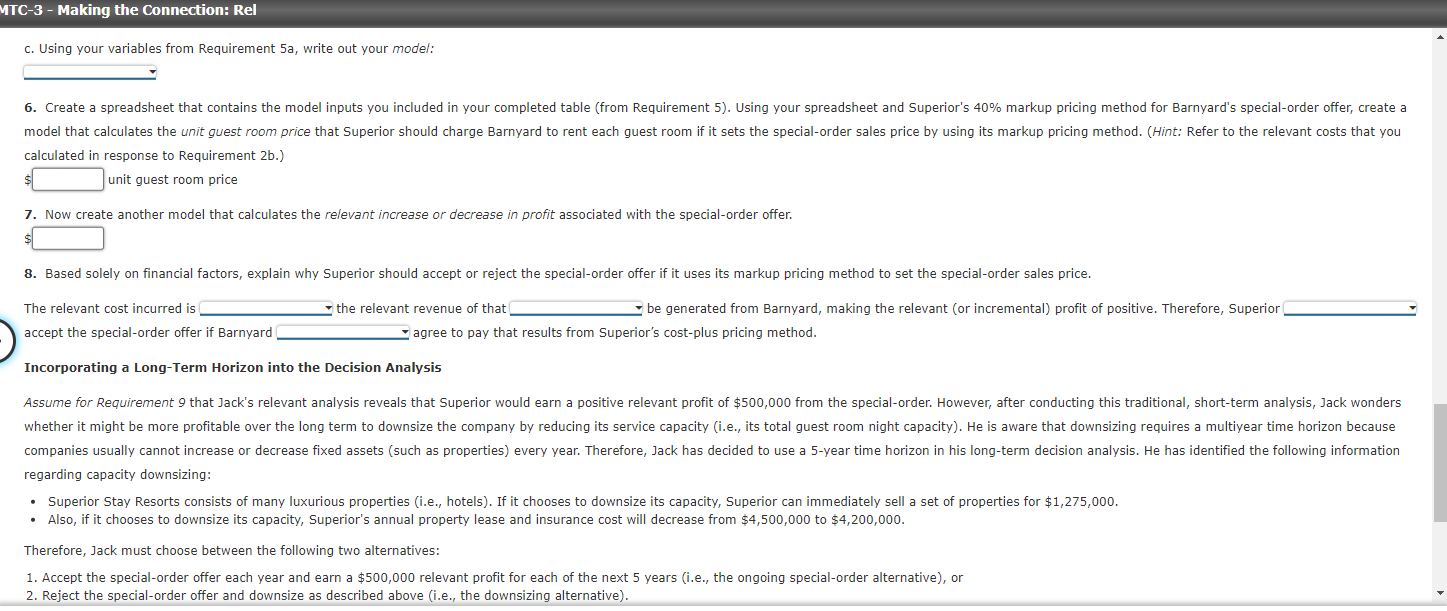

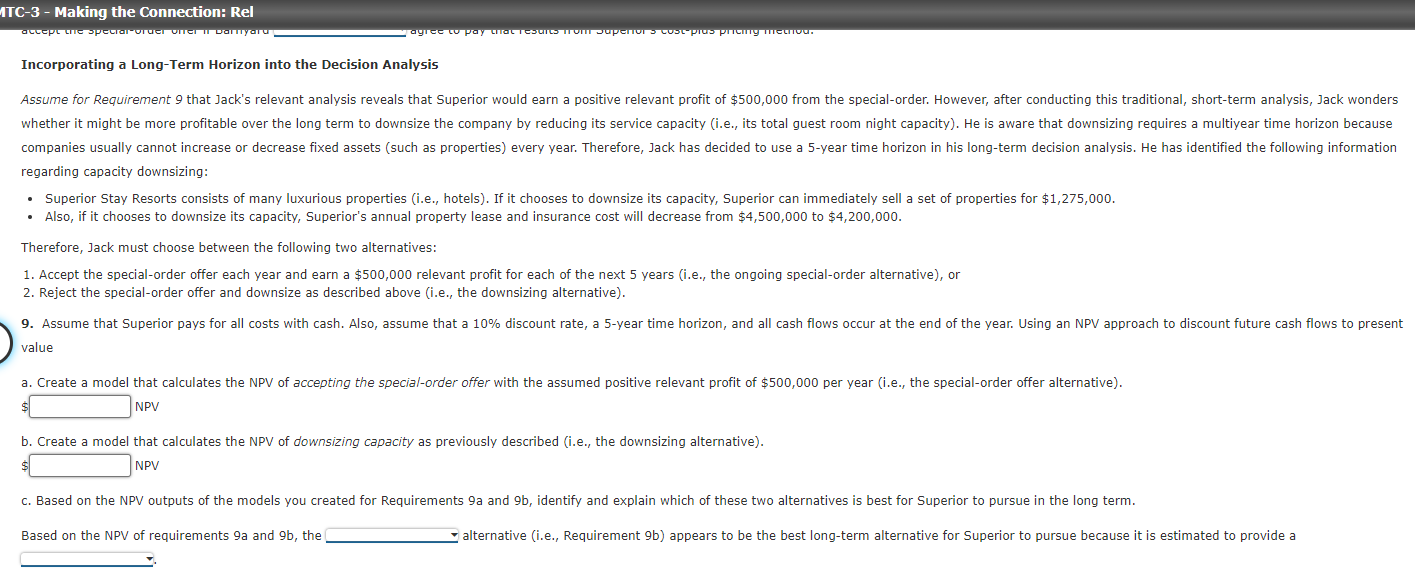

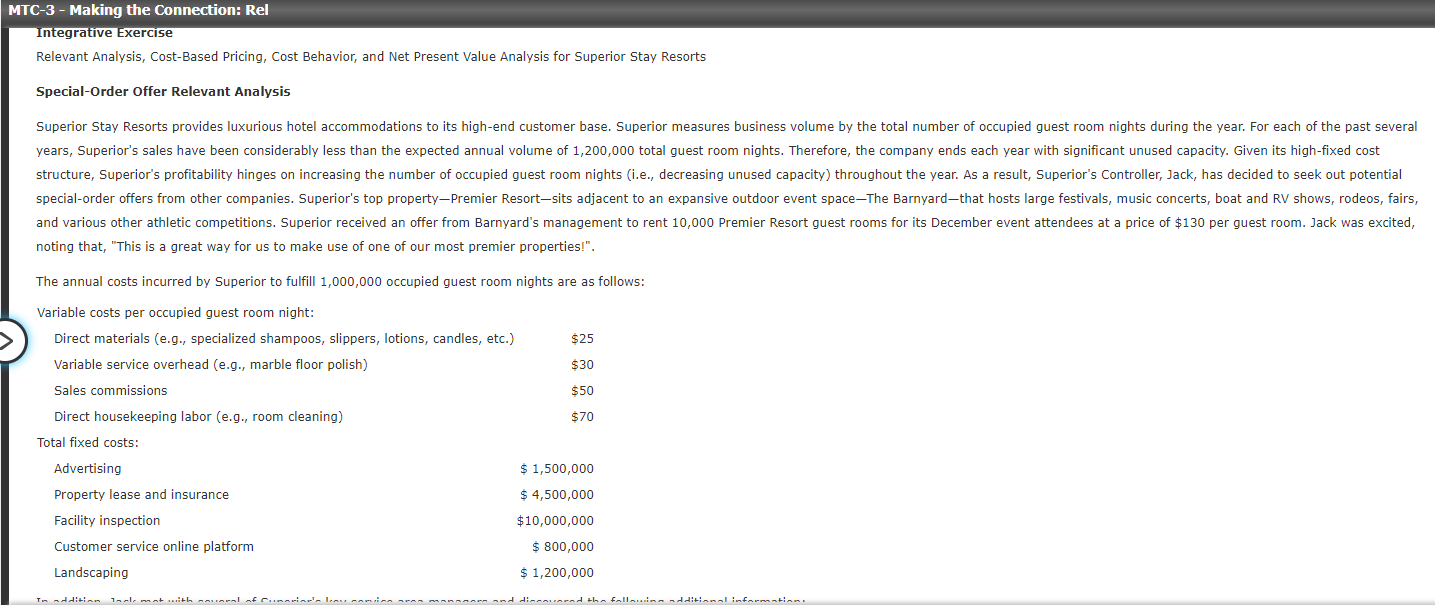

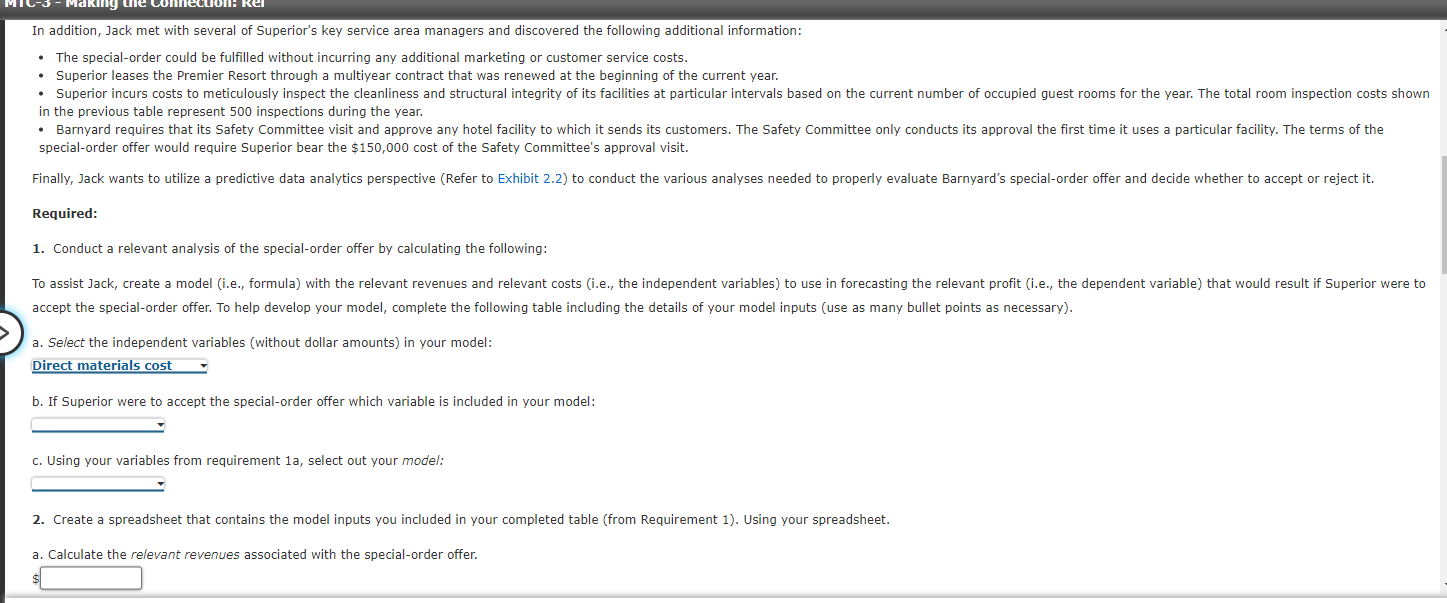

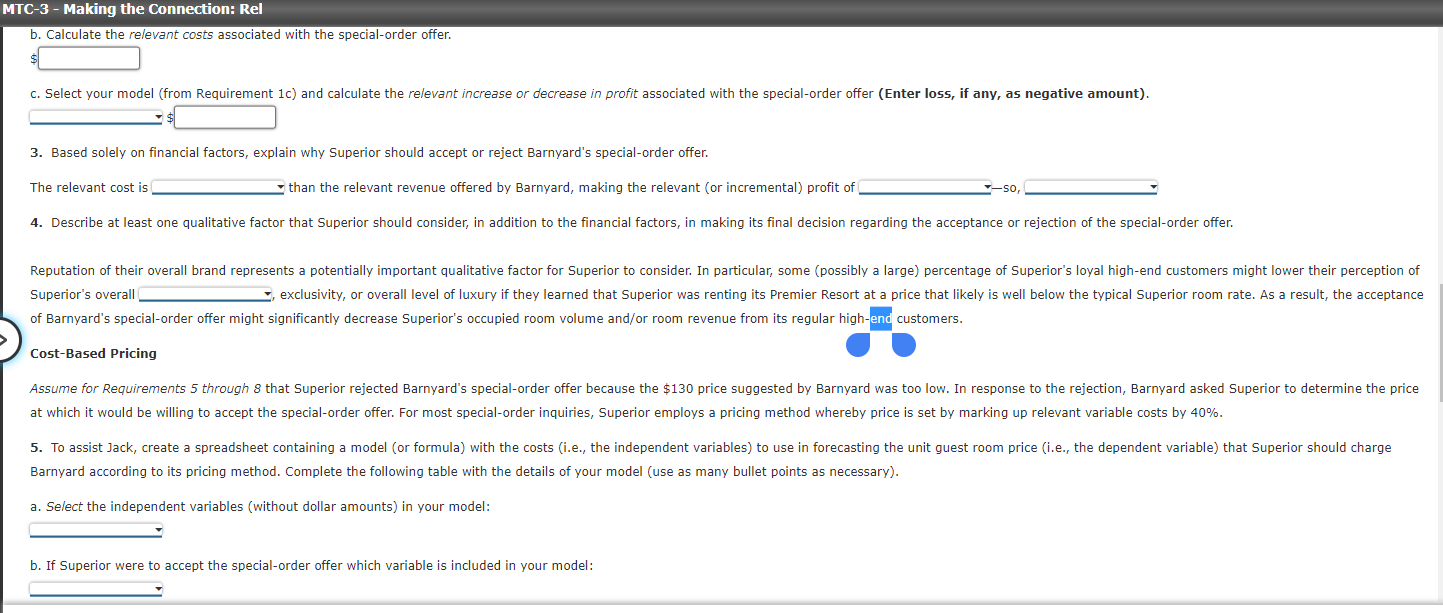

Relevant Analysis, Cost-Based Pricing, Cost Behavior, and Net Present Value Analysis for Superior Stay Resorts Special-Order Offer Relevant Analysis noting that, "This is a great way for us to make use of one of our most premier properties!". In addition, Jack met with several of Superior's key service area managers and discovered the following additional information: - The special-order could be fulfilled without incurring any additional marketing or customer service costs. - Superior leases the Premier Resort through a multiyear contract that was renewed at the beginning of the current year. in the previous table represent 500 inspections during the year. special-order offer would require Superior bear the $150,000 cost of the Safety Committee's approval visit. Required: 1. Conduct a relevant analysis of the special-order offer by calculating the following: a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from requirement 1 , select out your model: 2. Create a spreadsheet that contains the model inputs you included in your completed table (from Requirement 1 ). Using your spreadsheet. a. Calculate the relevant revenues associated with the special-order offer. $ 3. Based solely on financial factors, explain why Superior should accept or reject Barnyard's special-order offer. The relevant cost is than the relevant revenue offered by Barnyard, making the relevant (or incremental) profit of SO2 of Barnyard's special-order offer might significantly decrease Superior's occupied room volume and/or room revenue from its regular high-end customers. Cost-Based Pricing Barnyard according to its pricing method. Complete the following table with the details of your model (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from Requirement 5 a, write out your model: calculated in response to Requirement 2b.) unit guest room price 7. Now create another model that calculates the relevant increase or decrease in profit associated with the special-order offer. 8. Based solely on financial factors, explain why Superior should accept or reject the special-order offer if it uses its markup pricing method to set the special-order sales price. The relevant cost incurred is the relevant revenue of that be generated from Barnyard, making the relevant (or incremental) profit of positive. Therefore, Superior accept the special-order offer if Barnyard agree to pay that results from Superior's cost-plus pricing method. Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). value a. Create a model that calculates the NPV of accepting the special-order offer with the assumed positive relevant profit of $500,000 per year (i.e., the special-order offer alternative). \$ NPV b. Create a model that calculates the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). $ NPV c. Based on the NPV outputs of the models you created for Requirements 9 a and 9b, identify and explain which of these two alternatives is best for Superior to pursue in the long term. Based on the NPV of requirements 9a and 9b, the alternative (i.e., Requirement 9b) appears to be the best long-term alternative for Superior to pursue because it is estimated to provide a Relevant Analysis, Cost-Based Pricing, Cost Behavior, and Net Present Value Analysis for Superior Stay Resorts Special-Order Offer Relevant Analysis noting that, "This is a great way for us to make use of one of our most premier properties!". In addition, Jack met with several of Superior's key service area managers and discovered the following additional information: - The special-order could be fulfilled without incurring any additional marketing or customer service costs. - Superior leases the Premier Resort through a multiyear contract that was renewed at the beginning of the current year. in the previous table represent 500 inspections during the year. special-order offer would require Superior bear the $150,000 cost of the Safety Committee's approval visit. Required: 1. Conduct a relevant analysis of the special-order offer by calculating the following: a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from requirement 1 , select out your model: 2. Create a spreadsheet that contains the model inputs you included in your completed table (from Requirement 1 ). Using your spreadsheet. a. Calculate the relevant revenues associated with the special-order offer. $ 3. Based solely on financial factors, explain why Superior should accept or reject Barnyard's special-order offer. The relevant cost is than the relevant revenue offered by Barnyard, making the relevant (or incremental) profit of SO2 of Barnyard's special-order offer might significantly decrease Superior's occupied room volume and/or room revenue from its regular high-end customers. Cost-Based Pricing Barnyard according to its pricing method. Complete the following table with the details of your model (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from Requirement 5 a, write out your model: calculated in response to Requirement 2b.) unit guest room price 7. Now create another model that calculates the relevant increase or decrease in profit associated with the special-order offer. 8. Based solely on financial factors, explain why Superior should accept or reject the special-order offer if it uses its markup pricing method to set the special-order sales price. The relevant cost incurred is the relevant revenue of that be generated from Barnyard, making the relevant (or incremental) profit of positive. Therefore, Superior accept the special-order offer if Barnyard agree to pay that results from Superior's cost-plus pricing method. Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). value a. Create a model that calculates the NPV of accepting the special-order offer with the assumed positive relevant profit of $500,000 per year (i.e., the special-order offer alternative). \$ NPV b. Create a model that calculates the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). $ NPV c. Based on the NPV outputs of the models you created for Requirements 9 a and 9b, identify and explain which of these two alternatives is best for Superior to pursue in the long term. Based on the NPV of requirements 9a and 9b, the alternative (i.e., Requirement 9b) appears to be the best long-term alternative for Superior to pursue because it is estimated to provide a