Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Relevant change rates Ce exchange REQUIRED 1. O t abell 2010 2 Celcom 2016 lanconote 2016 B 14-5 Remeasurement worksheet Paroquired the proced ury. Bol

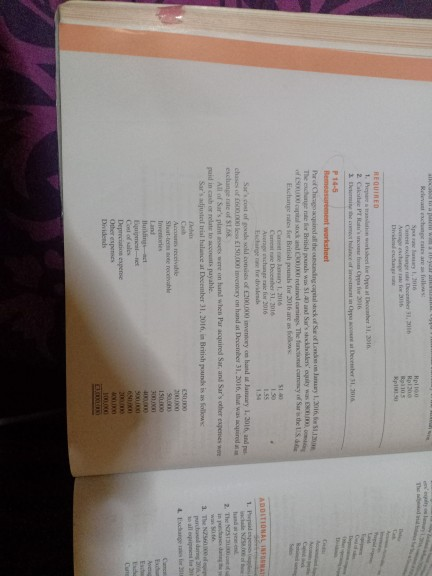

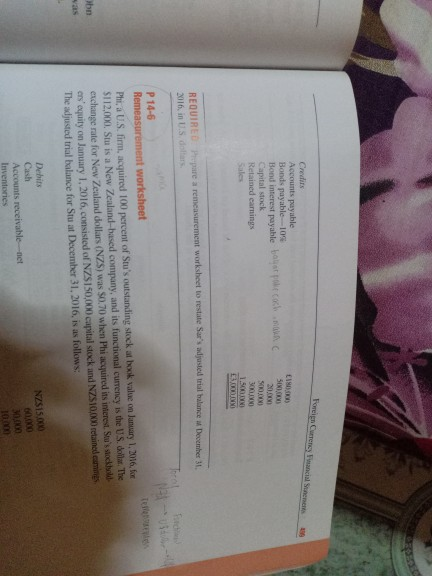

Relevant change rates Ce exchange REQUIRED 1. O t abell 2010 2 Celcom 2016 lanconote 2016 B 14-5 Remeasurement worksheet Paroquired the proced ury. Bol The H W SL40 and Sar's sadden W . S tand i ng the functionaristhed Exchange for British for 2016 are as follows Cemete ry 1.2016 Come Decher 11 2016 Anchor 2016 E dwide Sacosto del conoci m y hand may l. 2016. and put chases of 6 0 150,000 inventory on and December 31, 2016, that was cred exchange of SDS. All of Sar's plant e n und when Par acquired Saran Sarther expenses were paid in cachorrelate to accounts payahle. Sar's adjusterial e at December Jl. 2016. British pound is as follows ADDITIONAL INFO 2. The 3. The all o ut Cost of als Deprecatepec XLIIN for Curren c ial Credits Accounts payable Bonds payable 10% Bond interest payable bas pot cock Capital stock Relained earnings SINO STRAN) 1.500.000 LUDO REQUIRED Prepare a measurement worksheet to restate Saadusted trial balance December 31 2016, in de P 14-6 Remeasurement worksheet Ph a US firm, acquired 100 percent of Stu's outstanding stock at book value on January 1, 2016, $112.000. Stu is a New Zealand-based company, and its functional currency is the US. Com The exchange rate for New Zealand dollar (NZS) was 50.70 when Phi acquired its interest. S o m'equity on January 1, 2016. consisted of NZS150,000 capital stock and NZS1o retained cars The adjusted trial balance for Stu at December 31, 2016, is as follows: Ibn NZS15.000 Debits Cash Accounts receivable net Inventories 60,000 30,000 10000 Relevant change rates Ce exchange REQUIRED 1. O t abell 2010 2 Celcom 2016 lanconote 2016 B 14-5 Remeasurement worksheet Paroquired the proced ury. Bol The H W SL40 and Sar's sadden W . S tand i ng the functionaristhed Exchange for British for 2016 are as follows Cemete ry 1.2016 Come Decher 11 2016 Anchor 2016 E dwide Sacosto del conoci m y hand may l. 2016. and put chases of 6 0 150,000 inventory on and December 31, 2016, that was cred exchange of SDS. All of Sar's plant e n und when Par acquired Saran Sarther expenses were paid in cachorrelate to accounts payahle. Sar's adjusterial e at December Jl. 2016. British pound is as follows ADDITIONAL INFO 2. The 3. The all o ut Cost of als Deprecatepec XLIIN for Curren c ial Credits Accounts payable Bonds payable 10% Bond interest payable bas pot cock Capital stock Relained earnings SINO STRAN) 1.500.000 LUDO REQUIRED Prepare a measurement worksheet to restate Saadusted trial balance December 31 2016, in de P 14-6 Remeasurement worksheet Ph a US firm, acquired 100 percent of Stu's outstanding stock at book value on January 1, 2016, $112.000. Stu is a New Zealand-based company, and its functional currency is the US. Com The exchange rate for New Zealand dollar (NZS) was 50.70 when Phi acquired its interest. S o m'equity on January 1, 2016. consisted of NZS150,000 capital stock and NZS1o retained cars The adjusted trial balance for Stu at December 31, 2016, is as follows: Ibn NZS15.000 Debits Cash Accounts receivable net Inventories 60,000 30,000 10000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started