Answered step by step

Verified Expert Solution

Question

1 Approved Answer

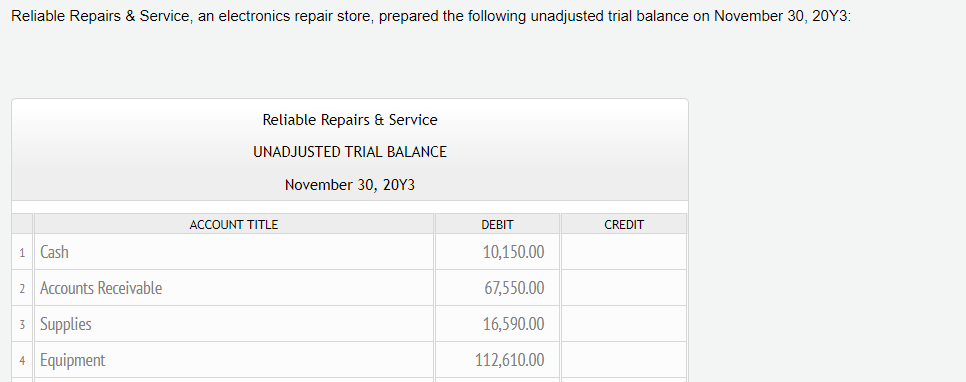

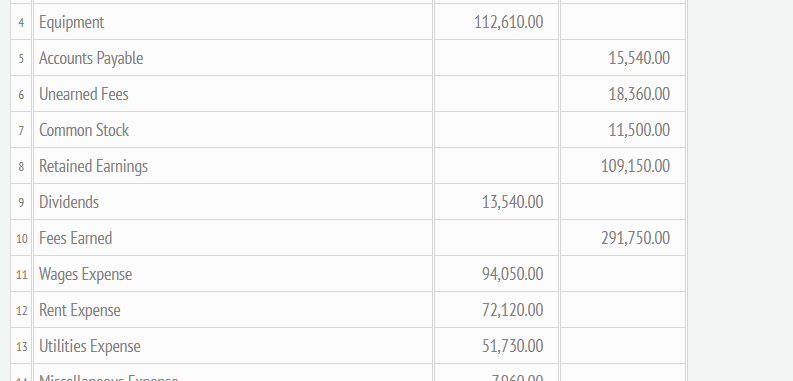

Reliable Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance on November 30 , 20 Y3: begin{tabular}{|r|l|r|r|} hline 4 & Equipment

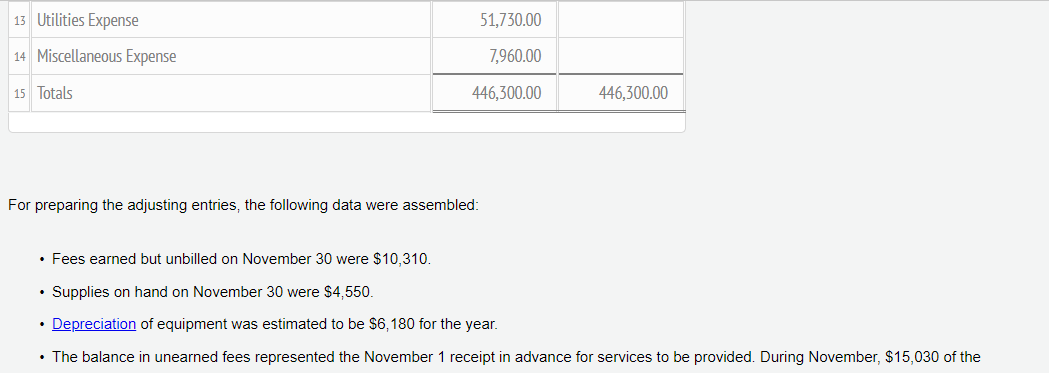

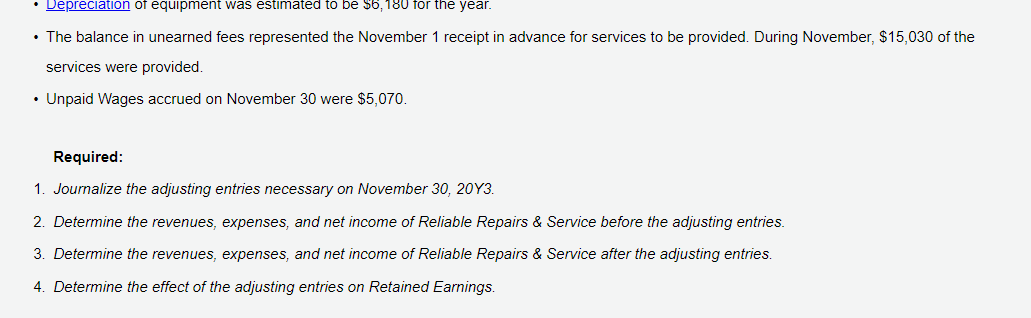

Reliable Repairs \& Service, an electronics repair store, prepared the following unadjusted trial balance on November 30 , 20 Y3: \begin{tabular}{|r|l|r|r|} \hline 4 & Equipment & 112,610.00 & \\ \hline 5 & Accounts Payable & & 15,540.00 \\ \hline 6 & Unearned Fees & & 18,360.00 \\ \hline 7 & Common Stock & & 11,500.00 \\ \hline 8 & Retained Earnings & & 109,150.00 \\ \hline 9 & Dividends & & \\ \hline 10 & Fees Earned & 13,540.00 & \\ \hline 11 & Wages Expense & & 291,750.00 \\ \hline 12 & Rent Expense & & \\ \hline 13 & Utilities Expense & 94,050.00 & \\ \hline & Mirollymer| & & \\ \hline \end{tabular} For preparing the adjusting entries, the following data were assembled: - Fees earned but unbilled on November 30 were $10,310. - Supplies on hand on November 30 were $4,550. - Depreciation of equipment was estimated to be $6,180 for the year. - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the services were provided. - Unpaid Wages accrued on November 30 were $5,070. Required: 1. Journalize the adjusting entries necessary on November 30,20Y3. 2. Determine the revenues, expenses, and net income of Reliable Repairs \& Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Reliable Repairs \& Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings. Reliable Repairs \& Service, an electronics repair store, prepared the following unadjusted trial balance on November 30 , 20 Y3: \begin{tabular}{|r|l|r|r|} \hline 4 & Equipment & 112,610.00 & \\ \hline 5 & Accounts Payable & & 15,540.00 \\ \hline 6 & Unearned Fees & & 18,360.00 \\ \hline 7 & Common Stock & & 11,500.00 \\ \hline 8 & Retained Earnings & & 109,150.00 \\ \hline 9 & Dividends & & \\ \hline 10 & Fees Earned & 13,540.00 & \\ \hline 11 & Wages Expense & & 291,750.00 \\ \hline 12 & Rent Expense & & \\ \hline 13 & Utilities Expense & 94,050.00 & \\ \hline & Mirollymer| & & \\ \hline \end{tabular} For preparing the adjusting entries, the following data were assembled: - Fees earned but unbilled on November 30 were $10,310. - Supplies on hand on November 30 were $4,550. - Depreciation of equipment was estimated to be $6,180 for the year. - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the services were provided. - Unpaid Wages accrued on November 30 were $5,070. Required: 1. Journalize the adjusting entries necessary on November 30,20Y3. 2. Determine the revenues, expenses, and net income of Reliable Repairs \& Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Reliable Repairs \& Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings

Reliable Repairs \& Service, an electronics repair store, prepared the following unadjusted trial balance on November 30 , 20 Y3: \begin{tabular}{|r|l|r|r|} \hline 4 & Equipment & 112,610.00 & \\ \hline 5 & Accounts Payable & & 15,540.00 \\ \hline 6 & Unearned Fees & & 18,360.00 \\ \hline 7 & Common Stock & & 11,500.00 \\ \hline 8 & Retained Earnings & & 109,150.00 \\ \hline 9 & Dividends & & \\ \hline 10 & Fees Earned & 13,540.00 & \\ \hline 11 & Wages Expense & & 291,750.00 \\ \hline 12 & Rent Expense & & \\ \hline 13 & Utilities Expense & 94,050.00 & \\ \hline & Mirollymer| & & \\ \hline \end{tabular} For preparing the adjusting entries, the following data were assembled: - Fees earned but unbilled on November 30 were $10,310. - Supplies on hand on November 30 were $4,550. - Depreciation of equipment was estimated to be $6,180 for the year. - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the services were provided. - Unpaid Wages accrued on November 30 were $5,070. Required: 1. Journalize the adjusting entries necessary on November 30,20Y3. 2. Determine the revenues, expenses, and net income of Reliable Repairs \& Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Reliable Repairs \& Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings. Reliable Repairs \& Service, an electronics repair store, prepared the following unadjusted trial balance on November 30 , 20 Y3: \begin{tabular}{|r|l|r|r|} \hline 4 & Equipment & 112,610.00 & \\ \hline 5 & Accounts Payable & & 15,540.00 \\ \hline 6 & Unearned Fees & & 18,360.00 \\ \hline 7 & Common Stock & & 11,500.00 \\ \hline 8 & Retained Earnings & & 109,150.00 \\ \hline 9 & Dividends & & \\ \hline 10 & Fees Earned & 13,540.00 & \\ \hline 11 & Wages Expense & & 291,750.00 \\ \hline 12 & Rent Expense & & \\ \hline 13 & Utilities Expense & 94,050.00 & \\ \hline & Mirollymer| & & \\ \hline \end{tabular} For preparing the adjusting entries, the following data were assembled: - Fees earned but unbilled on November 30 were $10,310. - Supplies on hand on November 30 were $4,550. - Depreciation of equipment was estimated to be $6,180 for the year. - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the - The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, $15,030 of the services were provided. - Unpaid Wages accrued on November 30 were $5,070. Required: 1. Journalize the adjusting entries necessary on November 30,20Y3. 2. Determine the revenues, expenses, and net income of Reliable Repairs \& Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Reliable Repairs \& Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started