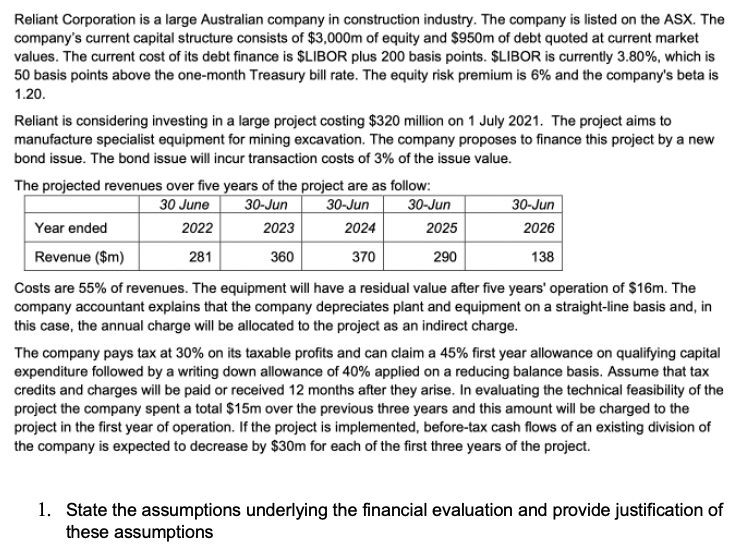

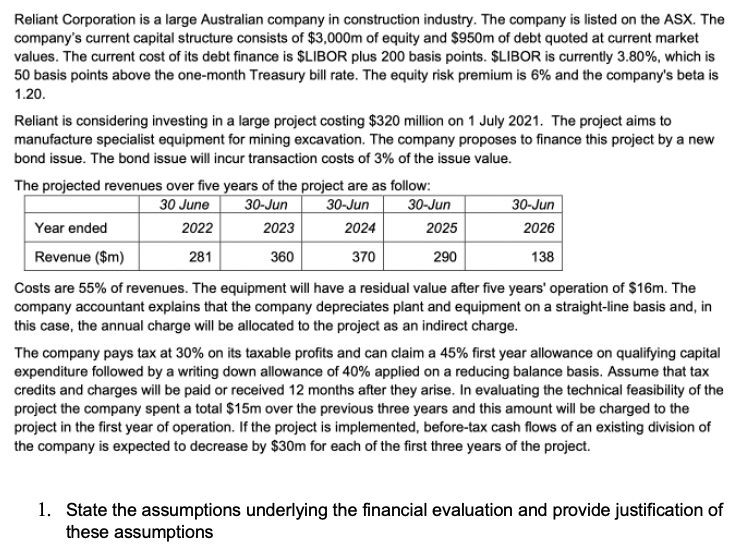

Reliant Corporation is a large Australian company in construction industry. The company is listed on the ASX. The company's current capital structure consists of $3,000m of equity and $950m of debt quoted at current market values. The current cost of its debt finance is $LIBOR plus 200 basis points. $LIBOR is currently 3.80%, which is 50 basis points above the one-month Treasury bill rate. The equity risk premium is 6% and the company's beta is 1.20. Reliant is considering investing in a large project costing $320 million on 1 July 2021. The project aims to manufacture specialist equipment for mining excavation. The company proposes to finance this project by a new bond issue. The bond issue will incur transaction costs of 3% of the issue value. The projected revenues over five years of the project are as follow: 30 June 30-Jun 30-Jun 30-Jun 30-Jun Year ended 2022 2023 2024 2025 2026 Revenue ($m) 281 360 370 290 138 Costs are 55% of revenues. The equipment will have a residual value after five years' operation of $16m. The company accountant explains that the company depreciates plant and equipment on a straight-line basis and, in this case, the annual charge will be allocated to the project as an indirect charge. The company pays tax at 30% on its taxable profits and can claim a 45% first year allowance on qualifying capital expenditure followed by a writing down allowance of 40% applied on a reducing balance basis. Assume that tax credits and charges will be paid or received 12 months after they arise. In evaluating the technical feasibility of the project the company spent a total $15m over the previous three years and this amount will be charged to the project in the first year of operation. If the project is implemented, before-tax cash flows of an existing division of the company is expected to decrease by $30m for each of the first three years of the project. 1. State the assumptions underlying the financial evaluation and provide justification of these assumptions Reliant Corporation is a large Australian company in construction industry. The company is listed on the ASX. The company's current capital structure consists of $3,000m of equity and $950m of debt quoted at current market values. The current cost of its debt finance is $LIBOR plus 200 basis points. $LIBOR is currently 3.80%, which is 50 basis points above the one-month Treasury bill rate. The equity risk premium is 6% and the company's beta is 1.20. Reliant is considering investing in a large project costing $320 million on 1 July 2021. The project aims to manufacture specialist equipment for mining excavation. The company proposes to finance this project by a new bond issue. The bond issue will incur transaction costs of 3% of the issue value. The projected revenues over five years of the project are as follow: 30 June 30-Jun 30-Jun 30-Jun 30-Jun Year ended 2022 2023 2024 2025 2026 Revenue ($m) 281 360 370 290 138 Costs are 55% of revenues. The equipment will have a residual value after five years' operation of $16m. The company accountant explains that the company depreciates plant and equipment on a straight-line basis and, in this case, the annual charge will be allocated to the project as an indirect charge. The company pays tax at 30% on its taxable profits and can claim a 45% first year allowance on qualifying capital expenditure followed by a writing down allowance of 40% applied on a reducing balance basis. Assume that tax credits and charges will be paid or received 12 months after they arise. In evaluating the technical feasibility of the project the company spent a total $15m over the previous three years and this amount will be charged to the project in the first year of operation. If the project is implemented, before-tax cash flows of an existing division of the company is expected to decrease by $30m for each of the first three years of the project. 1. State the assumptions underlying the financial evaluation and provide justification of these assumptions