Question

RELOCATION Falkirk meets with the head of corporate facilities to discuss the availability of space in the N.J. service center and the possibility of subleasing

RELOCATION

Falkirk meets with the head of corporate facilities to discuss the availability of space in the N.J. service center and the possibility of subleasing any excess space created in the New York office. The head of facilities states that the company currently has over 4,000 square feet of excess space in N.J. and there is up to an additional 28,500 square feet of space available in the building that could be leased for approximately $25 per square foot. But space must be leased in blocks of 9,500 square feet, which is equivalent to one floor in the building.

Also, the head of facilities states that the company currently has approximately 3,500 square feet of excess space in the New York office and could sublease the space in blocks of 10,000 square feet (equivalent to one floor). But if a block or blocks of 10,000 square feet of space cannot be created, the available space could not be subleased. Given current real estate prices, he estimated the sublease rent would be $65 per square foot. Based on past moves, he estimates the costs to move employees and set up new workstations average $1,000 per position in the new space plus $50,000 per floor to build out and wire the new space.

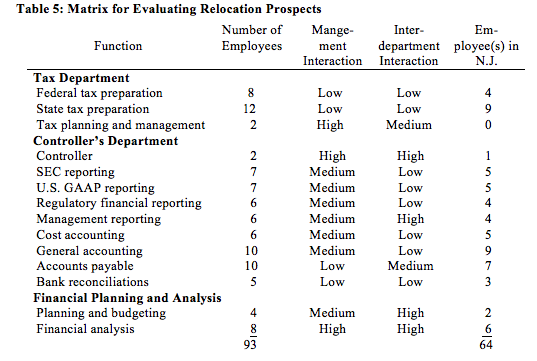

Falkirk prepares a grid (see Table 5) highlighting the level of management and interdepartment interaction as well as the number of N.J. resident employees in each function. He believes that those functions with the lowest level of interdepartment and management interaction would be best for possible relocation and selects the departments with low to medium interdepartment rankings. Additionally, Falkirk prepares a summary list of employees by function and their residence (see Table 6) to estimate the likely number of employees that would be retained and the potential severance costs if a portion of the accounting functions are relocated to N.J.

He assumes that department heads and their assistants would have offices in both the corporate headquarters and the N.J. location. He estimates that 250 square feet of office space per position will be needed for each employee relocated from the New York office and a comparable[A1] [A2] amount would be available for subleasing. He assumes 100% of all employees who are N.J. residents would be retained. Of the residents not in N.J., he assumes all department heads and their assistants would remain while all other employees not from N.J. would terminate and severance would be paid to any employee not relocating. I have provided information regarding the companys severance policy in Table 7, section F, and summary employee information by department in Table 6.

Table[A1] [A2] 6: Summary Employee Information for Severance Calculations

|

|

|

|

|

|

|

| |||||||||||

| Weeks of | Total | Actual Costs | |||||||||||||||

| Number of | Eligible | Annual | Benefits | Payroll | |||||||||||||

| Tax Department: | Employees | Severance | Salaries | Load | Health | 401 (k) | Taxes | ||||||||||

| Department head and assistant[A3] [A4] | 2 | 32 | $250,000 | $62,500 | $17,200 | $12,500 | $19,125 |

| |||||||||

|

| |||||||||||||||||

| Federal Tax |

| ||||||||||||||||

| N.J. residents | 4 | 76 | 445,000 | 111,250 | 32,200 | 22,250 | 34,043 |

| |||||||||

| NonN.J. residents | 4 | 66 | 357,000 | 89,250 | 27,200 | 17,850 | 27,311 |

| |||||||||

| Total | 8 | 142 | 802,000 | 200,500 | 59,400 | 40,100 | 61,354 |

| |||||||||

| State Taxes |

| ||||||||||||||||

| N.J. residents | 9 | 140 | 627,000 | 156,750 | 76,600 | 31,350 | 47,966 |

| |||||||||

| NonN.J. residents | 3 | 52 | 185,000 | 46,250 | 20,000 | 9,250 | 14,153 |

| |||||||||

| Total | 12 | 192 | 812,000 | 203,000 | 96,600 | 40,600 | 62,119 |

| |||||||||

|

| |||||||||||||||||

| Controllers Department: |

| ||||||||||||||||

| Department head and assistant | 2 | 28 | 285,000 | 71,250 | 15,000 | 14,250 | 21,803 |

| |||||||||

| SEC Reporting |

| ||||||||||||||||

| N.J. residents | 5 | 96 | 379,000 | 94,750 | 34,400 | 18,950 | 28,994 |

| |||||||||

| NonN.J. residents | 2 | 36 | 146,000 | 36,500 | 17,200 | 7,300 | 11,169 |

| |||||||||

| Total | 7 | 132 | 525,000 | 131,250 | 51,600 | 26,250 | 40,163 |

| |||||||||

| U.S. GAAP Reporting |

| ||||||||||||||||

| N.J. residents | 5 | 74 | 413,500 | 103,375 | 37,200 | 20,675 | 31,633 |

| |||||||||

| NonN.J. residents | 2 | 30 | 161,500 | 40,375 | 12,200 | 8,075 | 12,355 |

| |||||||||

| Total | 7 | 104 | 575,000 | 143,750 | 49,400 | 28,750 | 43,988 |

| |||||||||

| Regulatory Reporting | |||||||||||||||||

| N.J. residents | 4 | 52 | 351,000 | 87,750 | 27,200 | 17,550 | 26,852 | ||||||||||

| NonN.J. residents | 2 | 30 | 174,000 | 43,500 | 17,200 | 8,700 | 13,311 | ||||||||||

| Total | 6 | 82 | 525,000 | 131,250 | 44,400 | 26,250 | 40,163 | ||||||||||

| Management Reporting | |||||||||||||||||

| N.J. residents | 4 | 52 | 303,000 | 75,750 | 27,200 | 15,150 | 23,180 | ||||||||||

| NonN.J. residents | 2 | 30 | 152,000 | 38,000 | 17,200 | 7,600 | 11,628 | ||||||||||

| Total | 6 | 82 | 455,000 | 113,750 | 44,400 | 22,750 | 34,808 | ||||||||||

| Cost Accounting | |||||||||||||||||

| N.J. residents | 5 | 70 | 322,000 | 80,500 | 34,400 | 16,100 | 24,633 | ||||||||||

| NonN.J. residents | 1 | 12 | 63,000 | 15,750 | 10,000 | 3,150 | 4,820 | ||||||||||

| Total | 6 | 82 | 385,000 | 96,250 | 44,400 | 19,250 | 29,453 | ||||||||||

| General Accounting | |||||||||||||||||

| N.J. residents | 9 | 128 | 559,000 | 139,750 | 69,400 | 27,950 | 42,764 | ||||||||||

| NonN.J. residents | 1 | 18 | 69,000 | 17,250 | 7,200 | 3,450 | 5,279 | ||||||||||

| Total | 10 | 146 | 628,000 | 157,000 | 76,600 | 31,400 | 48,042 | ||||||||||

| Table 6: Summary Employee Data (continued)[A5] | |||||||||||||||||

|

|

|

|

|

| |||||||||||||

|

|

| Weeks of | Total | Actual Costs | |||||||||||||

|

| Number of | Eligible | Annual | Benefits |

|

| Payroll | ||||||||||

|

| Employees | Severance | Salaries | Load | Health | 401 (k) | Taxes | ||||||||||

| Accounts Payable | |||||||||||||||||

| N.J. residents | 7 | 106 | 333,000 | 83,250 | 46,600 | 16,650 | 25,475 | ||||||||||

| NonN.J. residents | 3 | 60 | 137,000 | 34,250 | 25,000 | 6,850 | 10,481 | ||||||||||

| Total (a) | 10 | 166 | 470,000 | 117,500 | 71,600 | 23,500 | 35,956 | ||||||||||

| Bank Reconciliation | |||||||||||||||||

| N.J. residents | 3 | 42 | 137,000 | 34,250 | 30,000 | 6,850 | 10,481 | ||||||||||

| NonN.J. residents | 2 | 24 | 78,000 | 19,500 | 12,200 | 3,900 | 5,967 | ||||||||||

| Total a | 5 | 66 | 215,000 | 53,750 | 42,200 | 10,750 | 16,448 | ||||||||||

| Financial Reporting & Analysis Department | |||||||||||||||||

| Budgeting | |||||||||||||||||

| N.J. residents | 2 | 28 | 177,000 | 44,250 | 12,200 | 8,850 | 13,541 | ||||||||||

| NonN.J. residents | 2 | 26 | 148,000 | 37,000 | 15,000 | 7,400 | 11,322 | ||||||||||

| Total | 4 | 54 | 325,000 | 81,250 | 27,200 | 16,250 | 24,863 | ||||||||||

| Financial Analysis | |||||||||||||||||

| N.J. residents | 6 | 72 | 526,000 | 131,500 | 39,400 | 26,300 | 40,239 | ||||||||||

| NonN.J. residents | 2 | 30 | 159,000 | 39,750 | 17,200 | 7,950 | 12,164 | ||||||||||

| Total | 8 | 102 | 685,000 | 171,250 | 56,600 | 34,250 | 52,403 | ||||||||||

a The severance and continuing benefits for the accounts payable manager total $29,073 and the severance and continuing benefits for the most experienced staff member in bank reconciliations is $19,714.

Note: When calculating severance using the total salaries, you must first find the average weekly salary (salariesumber of employees/52 weeks) [A6] [A7] and multiply by the number of weeks of severance. Follow a similar process for health benefits. For 401(k) and payroll taxes, you may either follow the same process or apply the rate.

Section 7F: The company severance policy calls for two weeks of salary for each year of service with minimum payment of 12 weeks. Health benefits and retirement plan

QUESTIONS

A) Using the information that Falkirk gathered on potential real estate savings through relocation, estimate the annual cost savings available through relocating some or all of the accounting functions to N.J.

B) What are the impacts on AC-USs costs over the next three years, including the one-time costs? (Be sure to include severance costs, using information from Table 6, in the one-time costs).

Table 5: Matrix for Evaluating Relocation Prospects Number of Mange- Employees men department ployee(s) in Inter- Function Interaction Interaction N.J Tax Department Federal tax preparation State tax preparation Tax planning and management Controller's Department Controller SEC reporting U.S. GAAP reporting Regulatory financial reporting Management reporting Cost accounting General accounting Accounts payable Bank reconciliations Financial Planning and Analysis Planning and budgeting Financial analysis Low Low Low Low Medium 12 Hi High Medium Mediumm Medium Mediumm Mediumm Mediumm Low Low High 10 10 Mediumm Low High High Mediumm Hi 93 Table 5: Matrix for Evaluating Relocation Prospects Number of Mange- Employees men department ployee(s) in Inter- Function Interaction Interaction N.J Tax Department Federal tax preparation State tax preparation Tax planning and management Controller's Department Controller SEC reporting U.S. GAAP reporting Regulatory financial reporting Management reporting Cost accounting General accounting Accounts payable Bank reconciliations Financial Planning and Analysis Planning and budgeting Financial analysis Low Low Low Low Medium 12 Hi High Medium Mediumm Medium Mediumm Mediumm Mediumm Low Low High 10 10 Mediumm Low High High Mediumm Hi 93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started