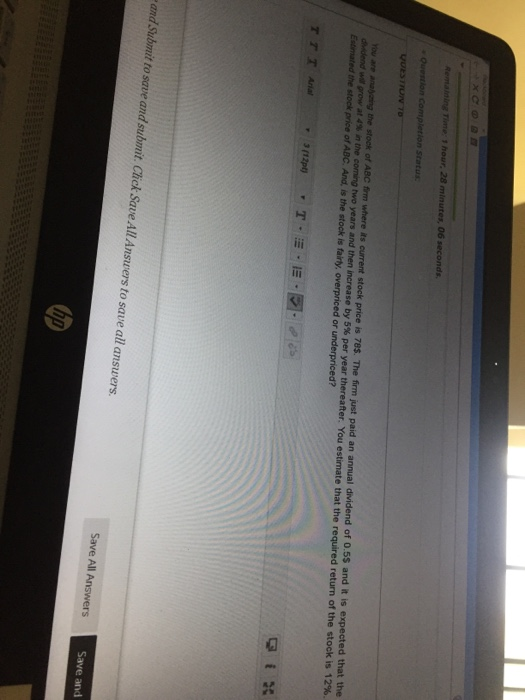

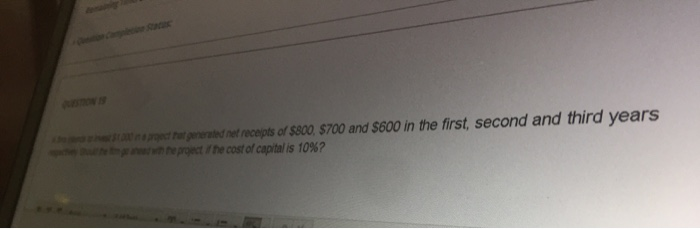

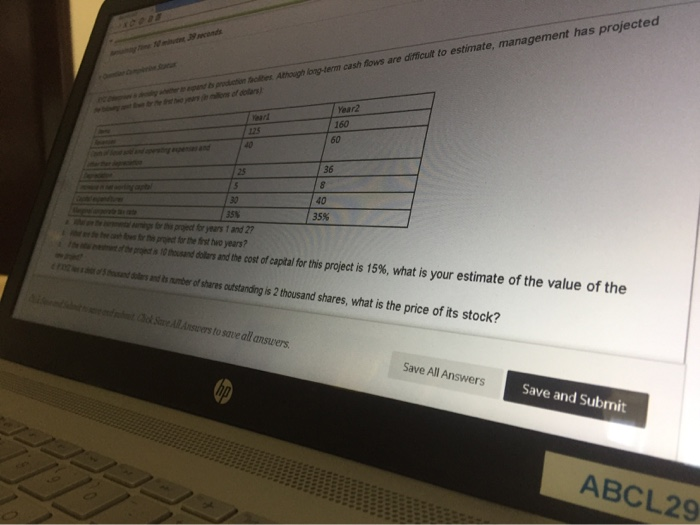

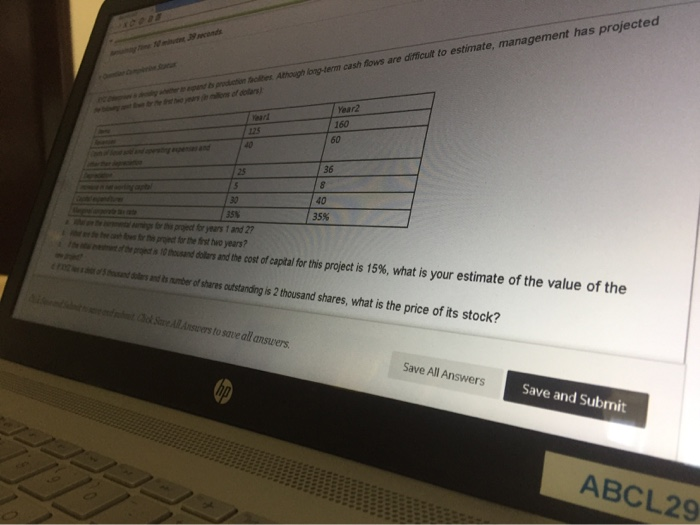

Rema Time 1 hour, 28 minutes, 06 seconds Owento completion Status VUESTION TO ou are about the stock of ABC form where is current stock price is 78$. The firm just paid an annual dividend of 0.55 and it is expected that the prowat e the coming two years and then increase by 5% per year thereafter. You estimate that the required return of the stock is 12% Estimated the stock price of ABC. And, is the stock is fairly, overpriced or underpriced? TTT 112TE 22 and Submit to save and submit. Chick Save All Answers to save all answers Save All Answers Save and de recepts of $800. $700 and 5600 in the first second and third years e proiect the cost of capital is 10%? les A b em cash flows are difficult to estimate, management has projected Year2 Heart 15 /30 36 /8 /40 the pros 10 howard dollars and the cost of capital for this project is 15%, what is your estimate of the value of the sa m ber of shares outstanding is a thousand shares, what is the price of its stock? di e Al Answers to see all answers. Save All Answers Save and Submit ABCL29 Rema Time 1 hour, 28 minutes, 06 seconds Owento completion Status VUESTION TO ou are about the stock of ABC form where is current stock price is 78$. The firm just paid an annual dividend of 0.55 and it is expected that the prowat e the coming two years and then increase by 5% per year thereafter. You estimate that the required return of the stock is 12% Estimated the stock price of ABC. And, is the stock is fairly, overpriced or underpriced? TTT 112TE 22 and Submit to save and submit. Chick Save All Answers to save all answers Save All Answers Save and de recepts of $800. $700 and 5600 in the first second and third years e proiect the cost of capital is 10%? les A b em cash flows are difficult to estimate, management has projected Year2 Heart 15 /30 36 /8 /40 the pros 10 howard dollars and the cost of capital for this project is 15%, what is your estimate of the value of the sa m ber of shares outstanding is a thousand shares, what is the price of its stock? di e Al Answers to see all answers. Save All Answers Save and Submit ABCL29