Answered step by step

Verified Expert Solution

Question

1 Approved Answer

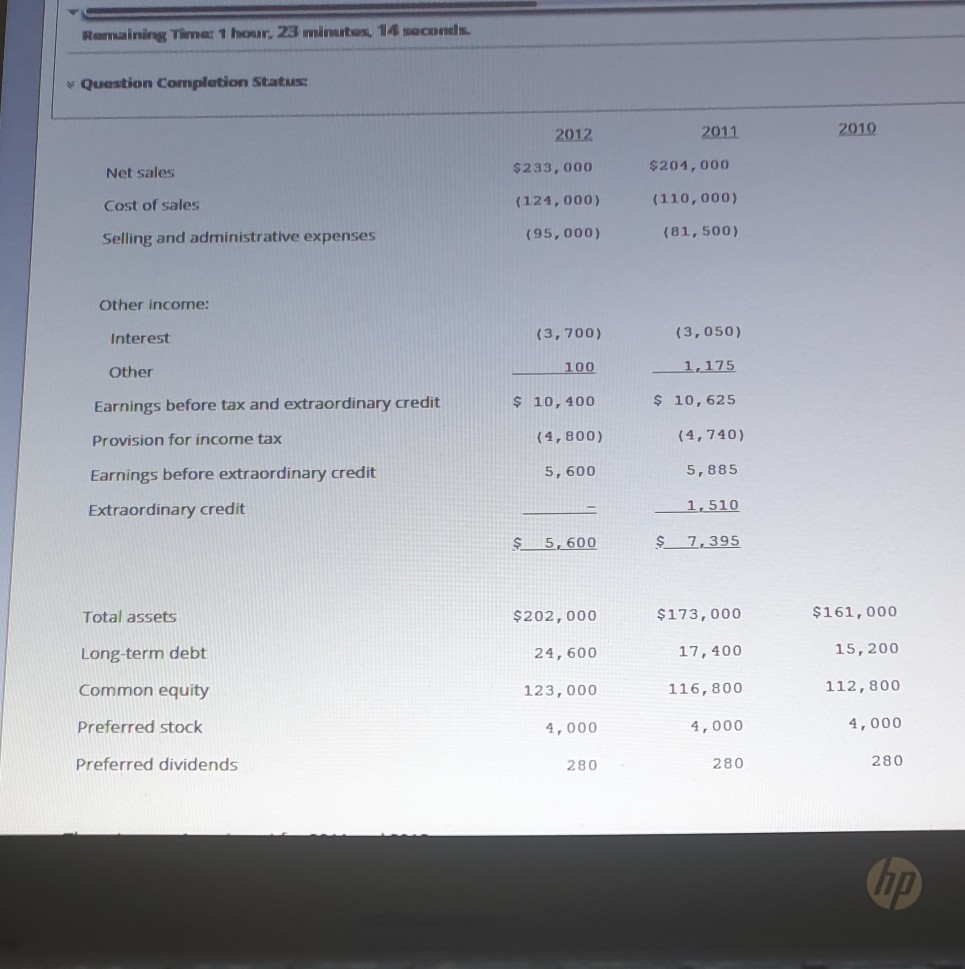

Remaining Time: 1 hour. 23 minutes, 14 seconds Question Completion Status 2012 2011 2010 Net sales $233,000 $ 201,000 Cost of sales (124, 000) (110,000)

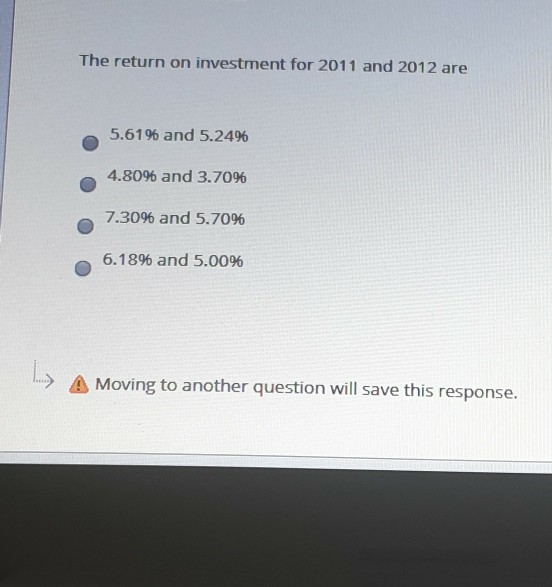

Remaining Time: 1 hour. 23 minutes, 14 seconds Question Completion Status 2012 2011 2010 Net sales $233,000 $ 201,000 Cost of sales (124, 000) (110,000) Selling and administrative expenses (95, 000) (81,500) Other income: Interest (3,700) (3,050) Other 100 1,175 Earnings before tax and extraordinary credit $ 10,400 $ 10, 625 Provision for income tax (4,800) (4,740) 5,600 5,885 Earnings before extraordinary credit Extraordinary credit 1,510 $ 5,600 $ 7,395 Total assets $202,000 $173,000 $161,000 Long-term debt 24,600 17,400 15, 200 Common equity 123,000 116,800 112,800 Preferred stock 4,000 4,000 4,000 Preferred dividends 280 280 280 (hp The return on investment for 2011 and 2012 are 5.6196 and 5.2496 4.8096 and 3.7096 7.3096 and 5.7096 6.1896 and 5.0096 A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started