Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Remaining Time: 1 hour, 28 minutes, 50 seconds. * Question Completion Status: > Moving to another question will save this response. Question 34 of 52

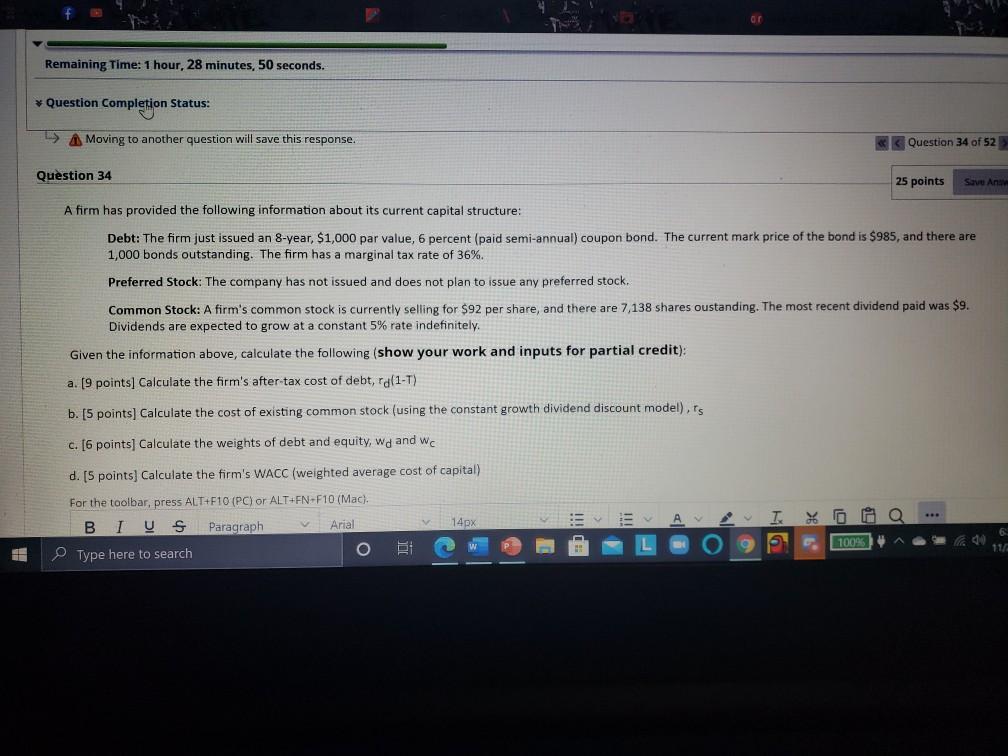

Remaining Time: 1 hour, 28 minutes, 50 seconds. * Question Completion Status: > Moving to another question will save this response. Question 34 of 52 Question 34 25 points Save Ana A firm has provided the following information about its current capital structure: Debt: The firm just issued an 8-year, $1,000 par value, 6 percent (paid semi-annual) coupon bond. The current mark price of the bond is $985, and there are 1,000 bonds outstanding. The firm has a marginal tax rate of 36%. Preferred Stock: The company has not issued and does not plan to issue any preferred stock. Common Stock: A firm's common stock is currently selling for $92 per share, and there are 7,138 shares oustanding. The most recent dividend paid was $9. Dividends are expected to grow at a constant 5% rate indefinitely. Given the information above, calculate the following (show your work and inputs for partial credit): a. [9 points] Calculate the firm's after tax cost of debt, rd(1-T) b. [5 points) Calculate the cost of existing common stock (using the constant growth dividend discount model).rs c. [6 points] Calculate the weights of debt and equity, wd and wc d. [5 points) Calculate the firm's WACC (weighted average cost of capital) For the toolbar, press ALT+F10 (PC) or ALT-EN-F10 (Mac). B I U S Paragraph V Arial 14px Type here to search O TE 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started