Answered step by step

Verified Expert Solution

Question

1 Approved Answer

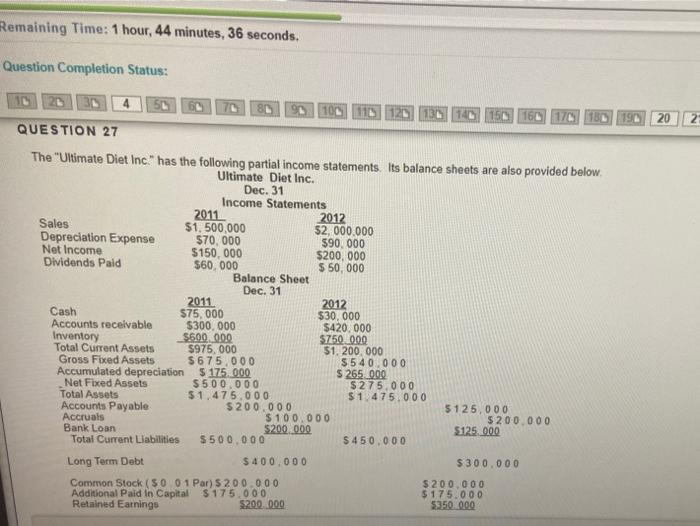

Remaining Time: 1 hour, 44 minutes, 36 seconds. Question Completion Status: 100 110 129 130 150 190 20 12 QUESTION 27 The Ultimate Diet Inc.

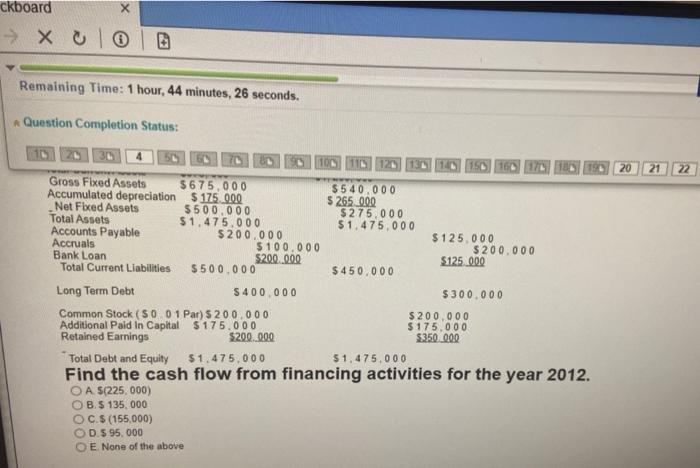

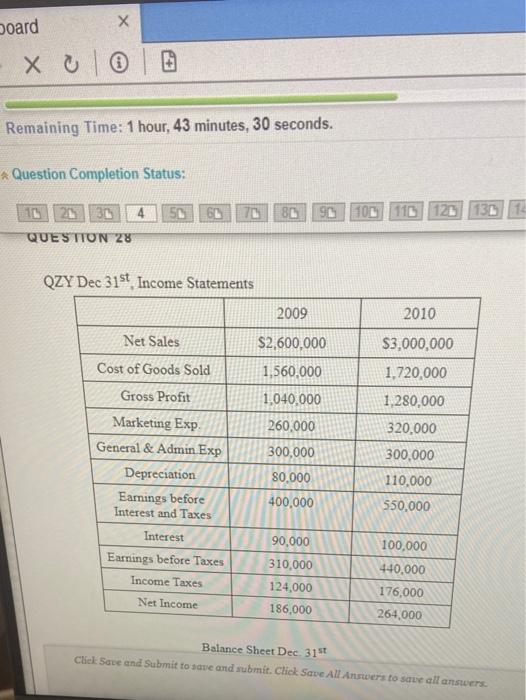

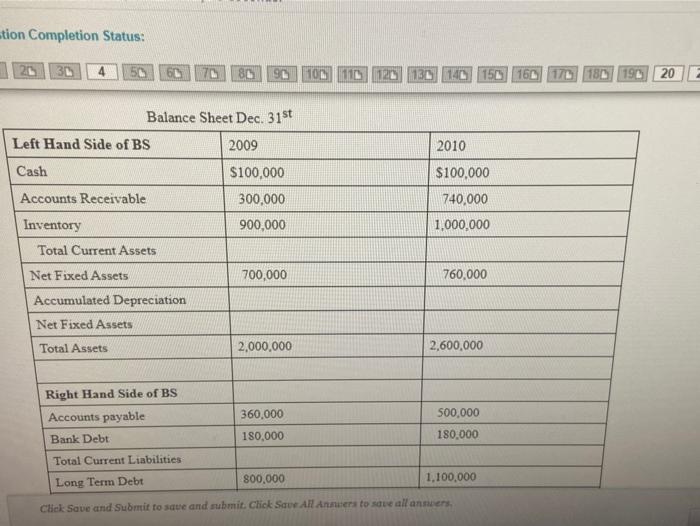

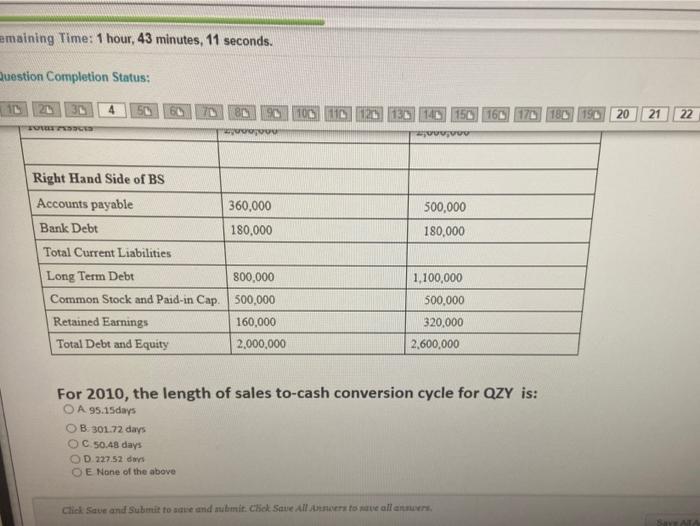

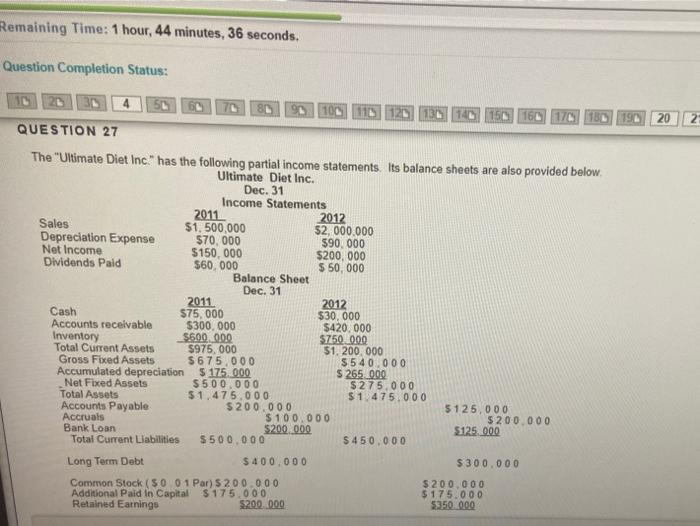

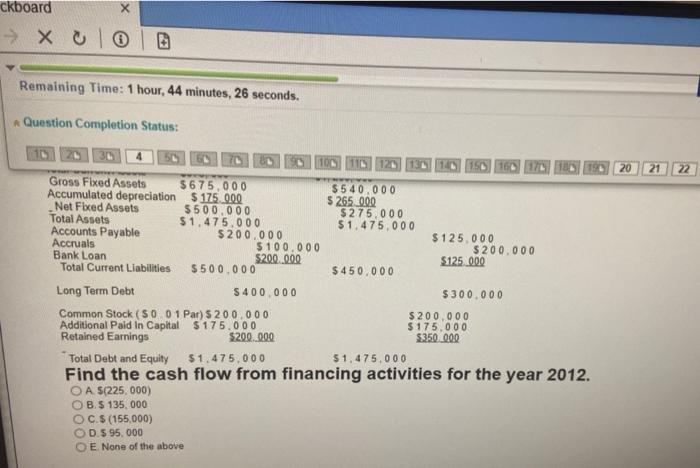

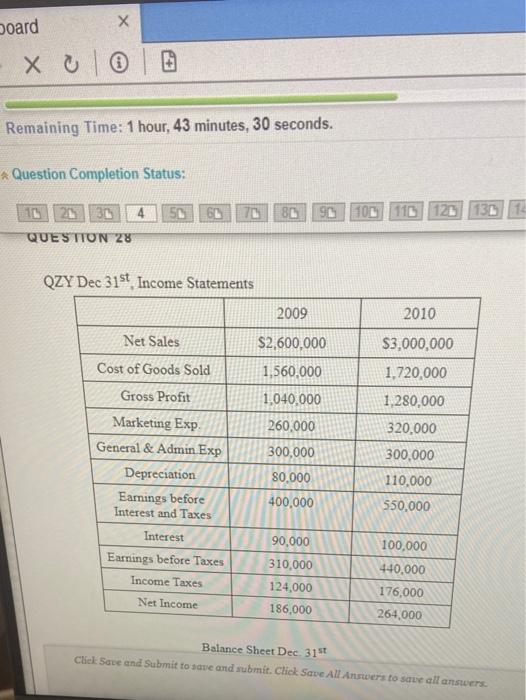

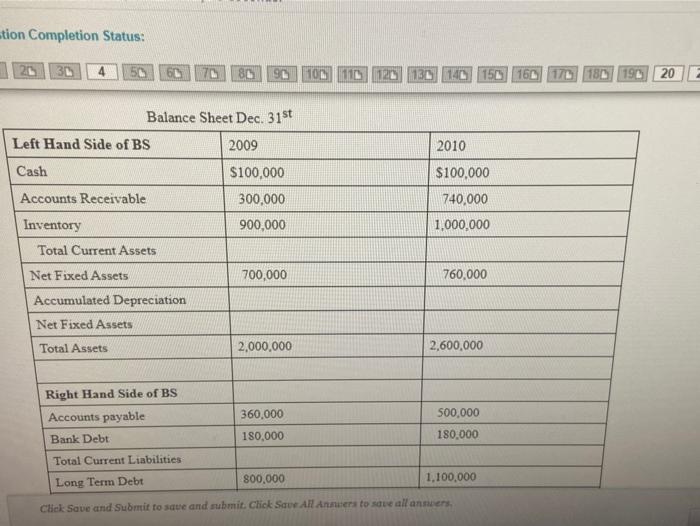

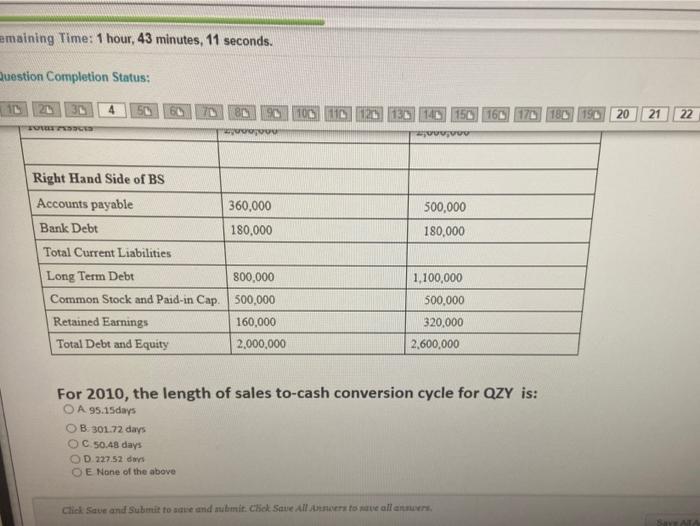

Remaining Time: 1 hour, 44 minutes, 36 seconds. Question Completion Status: 100 110 129 130 150 190 20 12 QUESTION 27 The Ultimate Diet Inc. has the following partial income statements. Its balance sheets are also provided below. Ultimate Diet Inc. Dec. 31 Income Statements 2011 2012 Sales $1,500,000 $2,000,000 Depreciation Expense $70,000 $90,000 Net Income $150.000 $200,000 Dividends Paid $60,000 $ 50,000 Balance Sheet Dec. 31 2011 2012 Cash $75,000 $30,000 Accounts receivable $300,000 $420,000 Inventory $600.000 $750,000 Total Current Assets $975,000 $1.200.000 Gross Fixed Assets 5 6 75.000 5540.000 Accumulated depreciation $175.000 $ 265 000 Net Fixed Assets $ 500.000 $275.000 Total Assets $1.475.000 $1.475.000 Accounts Payable $ 200.000 5125,000 Accruals $ 100.000 $200.000 Bank Loan $200.000 $125.000 Total Current Liabilities $ 500.000 $450,000 Long Term Debt $400.000 $ 300.000 Common Stock (S0 0 1 Par) $ 200.000 $200.000 Additional Paid In Capital $175.000 $175.000 Retained Earnings $200 000 $350.000 ckboard X o Remaining Time: 1 hour, 44 minutes, 26 seconds. Question Completion Status: 20 21 22 10 150 160 Gross Fixed Assets $675.000 $540.000 Accumulated depreciation $175.000 $265.000 Net Fixed Assets $500.000 $275.000 Total Assets $1.475.000 $1.475.000 Accounts Payable $200.000 $125.000 Accruals $100.000 $200.000 Bank Loan $200.000 $125.000 Total Current Liabilities $500.000 $ 450.000 Long Term Debt $ 400.000 $300.000 Common Stock ( 5 0 0 1 Par) $ 200.000 $ 200.000 Additional Paid in Capital $175.000 $175.000 Retained Earnings $200.000 $350.000 Total Debt and Equity 51.475.000 51.475.000 Find the cash flow from financing activities for the year 2012. O A 5(225.000) OBS 135,000 O C.(155,000) D.5 95.000 OE None of the above board X 0 | 0 Remaining Time: 1 hour, 43 minutes, 30 seconds. Question Completion Status: 50 100 1110 120 130 1 1 20 30 QUESTION 28 QZY Dec 31st Income Statements 2009 2010 Net Sales $2,600,000 Cost of Goods Sold 1,560,000 Gross Profit 1,040,000 $3,000,000 1,720,000 1,280,000 320,000 300,000 260,000 300,000 80,000 Marketing Exp General & Admin Exp Depreciation Earings before Interest and Taxes Interest Earnings before Taxes Income Taxes Net Income 110,000 550.000 400,000 90,000 310,000 124.000 186,000 100,000 440,000 176,000 264.000 Balance Sheet Dec. 31st Click Save and Submit to save and submit. Click Save All Ansters to save all answers. ution Completion Status: 80 90 100 110 120 130 140 150 160 170 180 190 20E Balance Sheet Dec 31st Left Hand Side of BS 2009 2010 Cash $100,000 300,000 $100,000 740,000 1,000,000 900,000 Accounts Receivable Inventory Total Current Assets Net Fixed Assets Accumulated Depreciation Net Fixed Assets 700,000 760,000 Total Assets 2,000,000 2,600,000 Right Hand Side of BS Accounts payable Bank Debt Total Current Liabilities Long Term Debt 360,000 180,000 500,000 180.000 800.000 1,100,000 Click Save and Submit to sue and submit. Click Save Alanners to save all annen emaining Time: 1 hour, 43 minutes, 11 seconds. Question Completion Status: 31 4 5 110 1126 139 140 150 160 170 180 190 20 21 22 ovo 500,000 180,000 Right Hand Side of BS Accounts payable 360,000 Bank Debt 180,000 Total Current Liabilities Long Term Debt 800,000 Common Stock and Paid-in Cap. 500,000 Retained Earnings 160,000 Total Debt and Equity 2,000,000 1,100,000 500,000 320,000 2,600,000 For 2010, the length of sales to-cash conversion cycle for QZY is: O A 95.15days OB. 301.72 days OC.50.48 days OD 227.52 O E None of the above Click Save and submit to save and nutit. Click Save all verstomave all answers

Remaining Time: 1 hour, 44 minutes, 36 seconds. Question Completion Status: 100 110 129 130 150 190 20 12 QUESTION 27 The Ultimate Diet Inc. has the following partial income statements. Its balance sheets are also provided below. Ultimate Diet Inc. Dec. 31 Income Statements 2011 2012 Sales $1,500,000 $2,000,000 Depreciation Expense $70,000 $90,000 Net Income $150.000 $200,000 Dividends Paid $60,000 $ 50,000 Balance Sheet Dec. 31 2011 2012 Cash $75,000 $30,000 Accounts receivable $300,000 $420,000 Inventory $600.000 $750,000 Total Current Assets $975,000 $1.200.000 Gross Fixed Assets 5 6 75.000 5540.000 Accumulated depreciation $175.000 $ 265 000 Net Fixed Assets $ 500.000 $275.000 Total Assets $1.475.000 $1.475.000 Accounts Payable $ 200.000 5125,000 Accruals $ 100.000 $200.000 Bank Loan $200.000 $125.000 Total Current Liabilities $ 500.000 $450,000 Long Term Debt $400.000 $ 300.000 Common Stock (S0 0 1 Par) $ 200.000 $200.000 Additional Paid In Capital $175.000 $175.000 Retained Earnings $200 000 $350.000 ckboard X o Remaining Time: 1 hour, 44 minutes, 26 seconds. Question Completion Status: 20 21 22 10 150 160 Gross Fixed Assets $675.000 $540.000 Accumulated depreciation $175.000 $265.000 Net Fixed Assets $500.000 $275.000 Total Assets $1.475.000 $1.475.000 Accounts Payable $200.000 $125.000 Accruals $100.000 $200.000 Bank Loan $200.000 $125.000 Total Current Liabilities $500.000 $ 450.000 Long Term Debt $ 400.000 $300.000 Common Stock ( 5 0 0 1 Par) $ 200.000 $ 200.000 Additional Paid in Capital $175.000 $175.000 Retained Earnings $200.000 $350.000 Total Debt and Equity 51.475.000 51.475.000 Find the cash flow from financing activities for the year 2012. O A 5(225.000) OBS 135,000 O C.(155,000) D.5 95.000 OE None of the above board X 0 | 0 Remaining Time: 1 hour, 43 minutes, 30 seconds. Question Completion Status: 50 100 1110 120 130 1 1 20 30 QUESTION 28 QZY Dec 31st Income Statements 2009 2010 Net Sales $2,600,000 Cost of Goods Sold 1,560,000 Gross Profit 1,040,000 $3,000,000 1,720,000 1,280,000 320,000 300,000 260,000 300,000 80,000 Marketing Exp General & Admin Exp Depreciation Earings before Interest and Taxes Interest Earnings before Taxes Income Taxes Net Income 110,000 550.000 400,000 90,000 310,000 124.000 186,000 100,000 440,000 176,000 264.000 Balance Sheet Dec. 31st Click Save and Submit to save and submit. Click Save All Ansters to save all answers. ution Completion Status: 80 90 100 110 120 130 140 150 160 170 180 190 20E Balance Sheet Dec 31st Left Hand Side of BS 2009 2010 Cash $100,000 300,000 $100,000 740,000 1,000,000 900,000 Accounts Receivable Inventory Total Current Assets Net Fixed Assets Accumulated Depreciation Net Fixed Assets 700,000 760,000 Total Assets 2,000,000 2,600,000 Right Hand Side of BS Accounts payable Bank Debt Total Current Liabilities Long Term Debt 360,000 180,000 500,000 180.000 800.000 1,100,000 Click Save and Submit to sue and submit. Click Save Alanners to save all annen emaining Time: 1 hour, 43 minutes, 11 seconds. Question Completion Status: 31 4 5 110 1126 139 140 150 160 170 180 190 20 21 22 ovo 500,000 180,000 Right Hand Side of BS Accounts payable 360,000 Bank Debt 180,000 Total Current Liabilities Long Term Debt 800,000 Common Stock and Paid-in Cap. 500,000 Retained Earnings 160,000 Total Debt and Equity 2,000,000 1,100,000 500,000 320,000 2,600,000 For 2010, the length of sales to-cash conversion cycle for QZY is: O A 95.15days OB. 301.72 days OC.50.48 days OD 227.52 O E None of the above Click Save and submit to save and nutit. Click Save all verstomave all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started