Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Remaining Time: 1 hour, 51 minutes, 56 seconds. Question Completion Status: Please use the following information for Q1-Q6. The Ginsberg Co. Issued 10-year bonds on

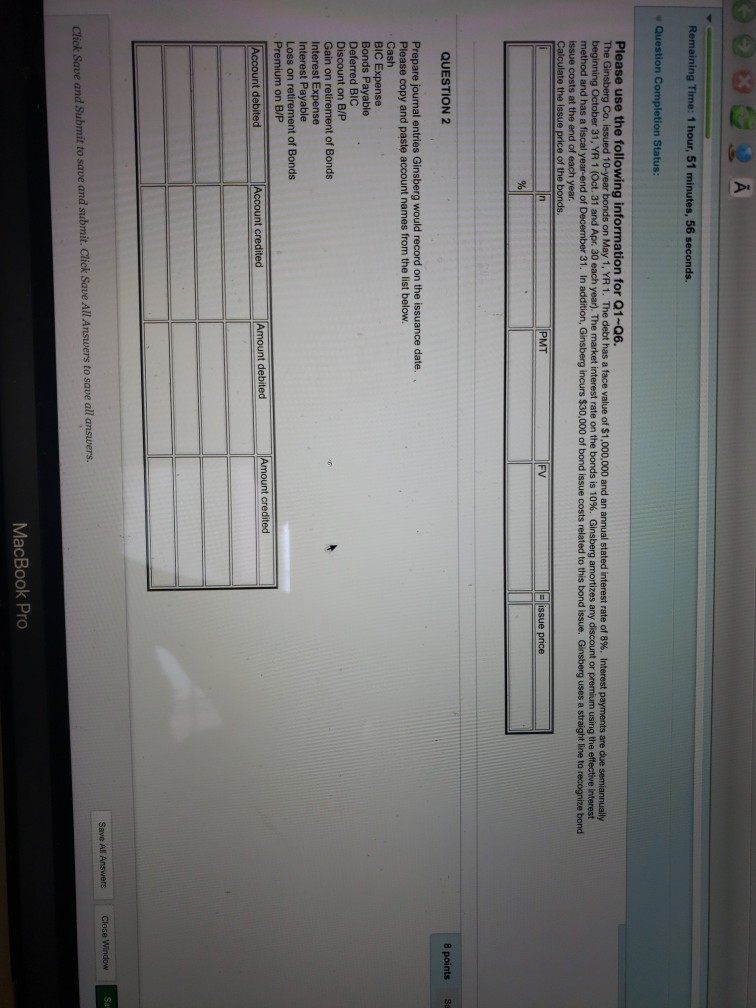

Remaining Time: 1 hour, 51 minutes, 56 seconds. Question Completion Status: Please use the following information for Q1-Q6. The Ginsberg Co. Issued 10-year bonds on May 1, YR 1. The debt has a face value of $1,000,000 and an annual stated interest rate of 8%. Interest payments are due semiannually beginning October 31, YR 1 (Oct. 31 and Apr. 30 each year). The market interest rate on the bonds is 10%. Ginsberg amortizes any discount or premium using the effective interest method and has a fiscal year-end of December 31. In addition, Ginsberg incurs $30,000 of bond issue costs related to this bond issue. Ginsberg uses a straight line to recognize bond issue costs at the end of each year. Calculate the issue price of the bonds PMT FV = issue price % QUESTION 2 8 points Prepare journal entries Ginsberg would record on the issuance date. Please copy and paste account names from the list below. Cash BIC Expense Bonds Payable Deferred BIC Discount on B/P Gain on retirement of Bonds Interest Expense Interest Payable Loss on retirement of Bonds Premium on B/P Account debited Account credited Amount debited Amount credited Save All Answers Close Window Click Save and Submit to save and submit. Click Save All Answers to save all answers MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started