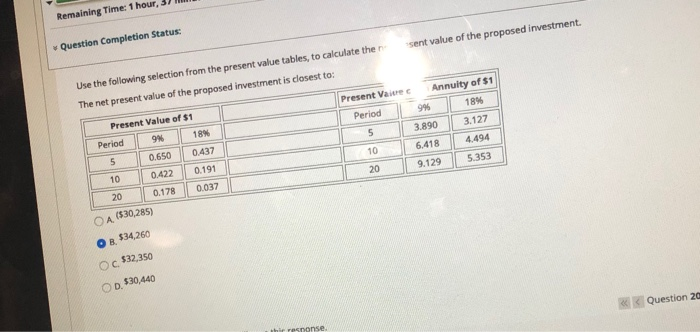

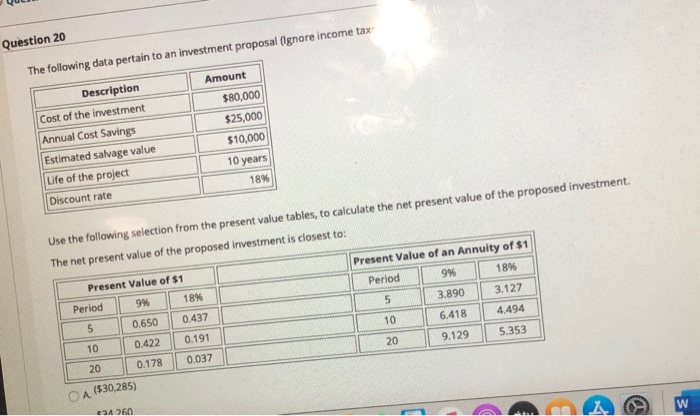

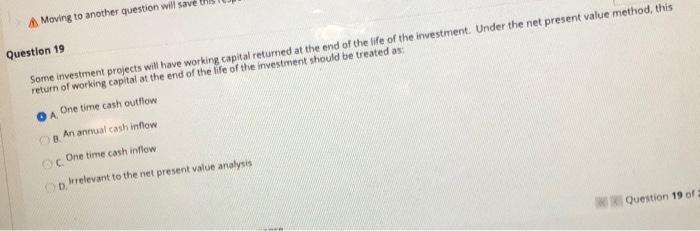

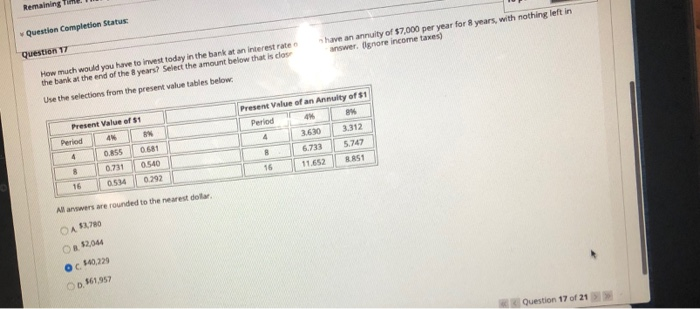

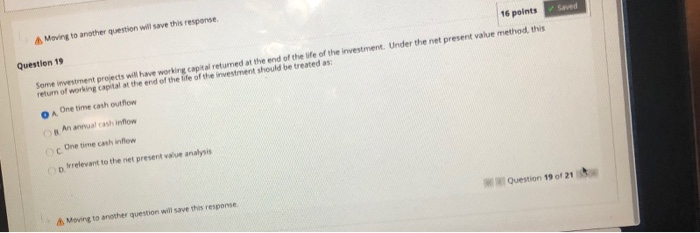

Remaining Time: 1 hour, Question Completion Status: sent value of the proposed investment. Use the following selection from the present value tables, to calculate the The net present value of the proposed investment is closest to: Present Value Period Annuity of $1 18% 995 3.127 3.890 5 4.494 10 6.418 9.129 5.353 20 Present Value of $1 Period 9N 18W 5 0.650 0.437 10 0.422 0.191 20 0.178 0.037 OA ($30,285) O $34.260 OC $32,350 OD $30.440 Question 20 the response Question 20 The following data pertain to an investment proposal (Ignore income tax Description Amount Cost of the investment $80,000 Annual Cost Savings $25,000 Estimated salvage value $10,000 Life of the project Discount rate 18% 10 years Use the following selection from the present value tables, to calculate the net present value of the proposed investment. The net present value of the proposed investment is closest to: Present Value of $1 Present Value of an Annuity of $1 Period 9% 18% 5 3.890 3.127 10 6.418 4.494 9% Period 0.650 18% 0.437 0.191 5 5.353 9.129 20 0.422 10 20 0.178 0.037 OA (530,285) W 24 260 A Moving to another question will save Question 19 Some investment projects will have working capital returned at the end of the life of the investment. Under the net present value method, this return of working capital at the end of the life of the investment should be treated as: OA One time cash outflow An annual cash inflow One time cash inflow Dirrelevant to the net present value analysis Question 19 or Remaining Question Completion Status: have an annuity of $7,000 per year for 8 years, with nothing left in answer. Ognore income taxes) Question 17 How much would you have to invest today in the bank at an interest rate the bank at the end of the years? Select the amount below that is clos Use the selections from the present value tables below Present Value of 1 Period 4 0.855 0.581 8 0731 0.540 16 054 0.292 Present Value of an Annuity of $1 Period 4 3.630 3312 8 6.733 5,747 15 11 652 BASI All answers are rounded to the nearest doar A $2780 52.044 Oc540229 561957 Question 17 of 21 A Moving to another question will save this response A Question 19 16 points Saved Some investment projects will have working capital returned at the end of the wife of the investment. Under the net present value method, this return of working capital at the end of the life of the investment should be treated as One time cash outflow An annual cash flow c One time cash inflow relevant to the net present value analysis Question 19 of 21 Moving to another question will save this response