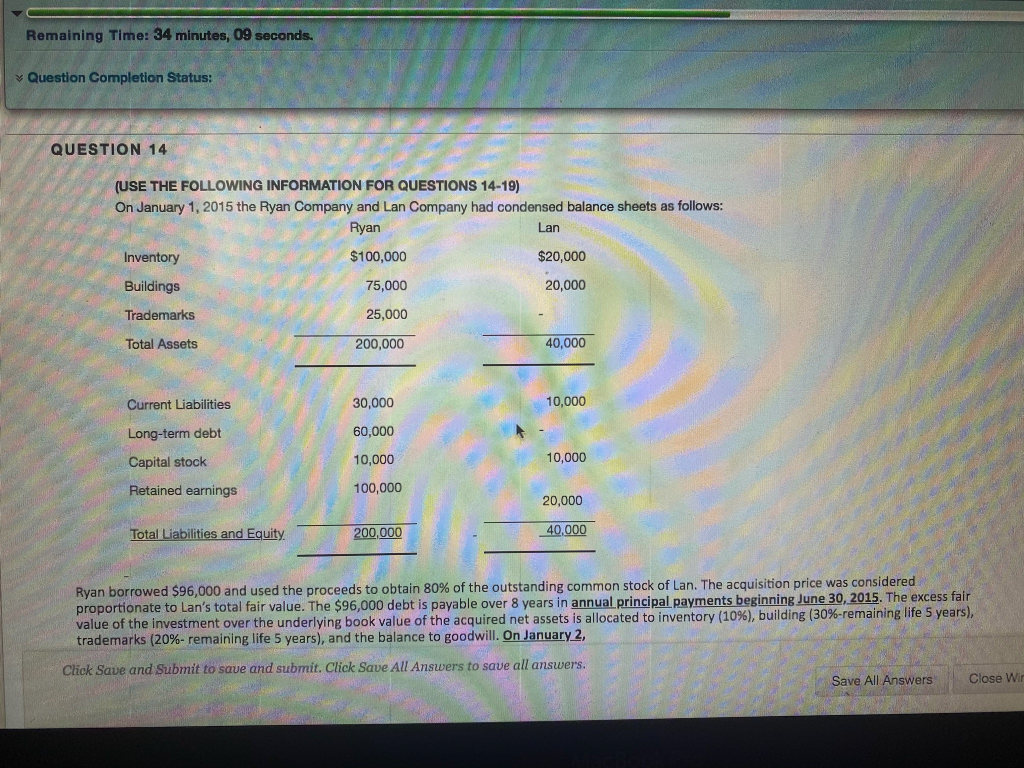

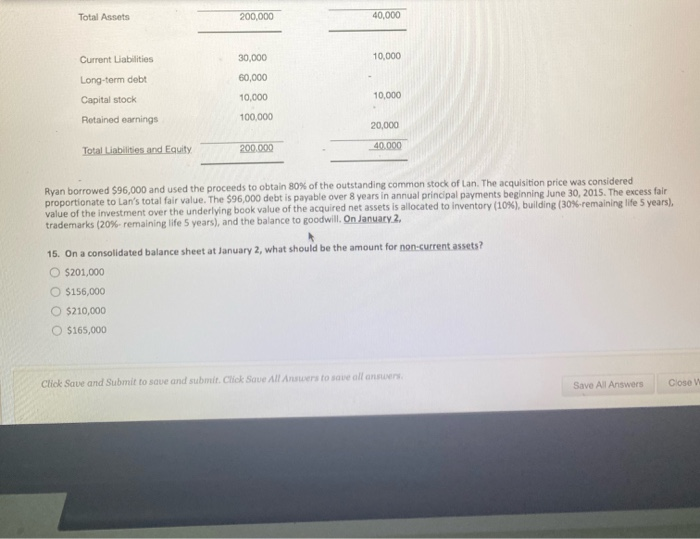

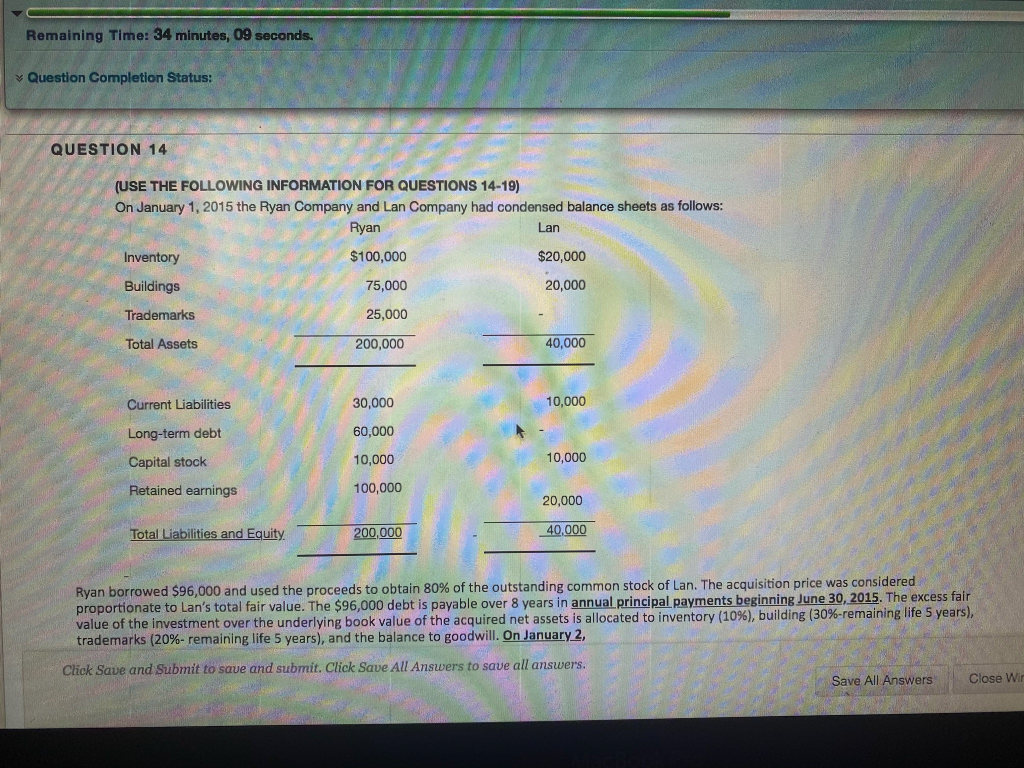

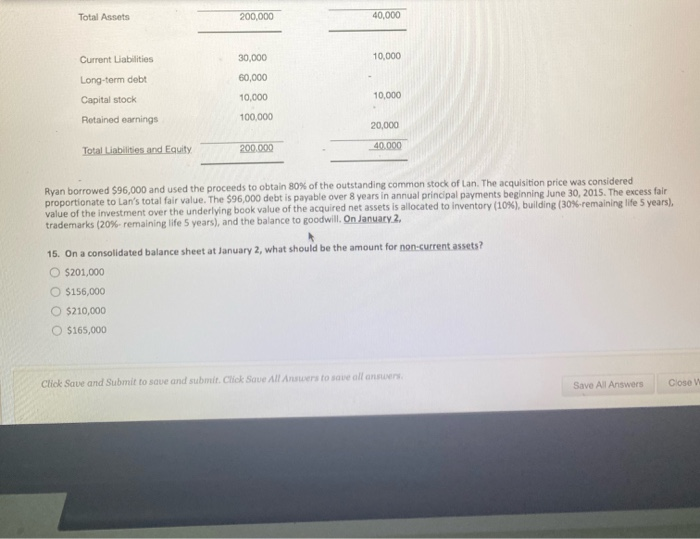

Remaining Time: 34 minutes, 09 seconds Question Completion Status: QUESTION 14 (USE THE FOLLOWING INFORMATION FOR QUESTIONS 14-19) On January 1, 2015 the Ryan Company and Lan Company had condensed balance sheets as follows: Ryan Lan $100,000 $20,000 20,000 Trademarks Total Assets 200,000 40,000 Inventory Buildings 75,000 25,000 10,000 Current Liabilities Long-term debt Capital stock Retained earnings 30,000 60,000 10,000 100,000 10,000 20,000 Total Liabilities and Equity 200,000 40,000 Ryan borrowed $96,000 and used the proceeds to obtain 80% of the outstanding common stock of Lan. The acquisition price was considered proportionate to Lan's total fair value. The $96,000 debt is payable over 8 years in annual principal payments beginning June 30, 2015. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (10%), building (30%-remaining life 5 years), trademarks (20%-remaining life 5 years), and the balance to goodwill. On January 2, Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close W Total Assets 200,000 40,000 10,000 Current Liabilities Long-term debt Capital stock 30,000 60,000 10,000 100.000 10,000 Retained earnings 20,000 Total abilities and Equity 200.000 40.000 Ryan borrowed 596,000 and used the proceeds to obtain 80% of the outstanding common stock of Lan. The acquisition price was considered proportionate to Lan's total fair value. The 596,000 debt is payable over 8 years in annual principal payments beginning June 30, 2015. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (10%), building (30%-remaining life 5 years). trademarks (20%-remaining life 5 years), and the balance to goodwill. On January 2. 15. On a consolidated balance sheet at January 2, what should be the amount for non-current assets? O $201,000 O $156,000 O $210,000 $165,000 Click Save and Submit to save and submit Chok Saue All Ar t o e alla Save All Answers Close Remaining Time: 34 minutes, 09 seconds Question Completion Status: QUESTION 14 (USE THE FOLLOWING INFORMATION FOR QUESTIONS 14-19) On January 1, 2015 the Ryan Company and Lan Company had condensed balance sheets as follows: Ryan Lan $100,000 $20,000 20,000 Trademarks Total Assets 200,000 40,000 Inventory Buildings 75,000 25,000 10,000 Current Liabilities Long-term debt Capital stock Retained earnings 30,000 60,000 10,000 100,000 10,000 20,000 Total Liabilities and Equity 200,000 40,000 Ryan borrowed $96,000 and used the proceeds to obtain 80% of the outstanding common stock of Lan. The acquisition price was considered proportionate to Lan's total fair value. The $96,000 debt is payable over 8 years in annual principal payments beginning June 30, 2015. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (10%), building (30%-remaining life 5 years), trademarks (20%-remaining life 5 years), and the balance to goodwill. On January 2, Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close W Total Assets 200,000 40,000 10,000 Current Liabilities Long-term debt Capital stock 30,000 60,000 10,000 100.000 10,000 Retained earnings 20,000 Total abilities and Equity 200.000 40.000 Ryan borrowed 596,000 and used the proceeds to obtain 80% of the outstanding common stock of Lan. The acquisition price was considered proportionate to Lan's total fair value. The 596,000 debt is payable over 8 years in annual principal payments beginning June 30, 2015. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (10%), building (30%-remaining life 5 years). trademarks (20%-remaining life 5 years), and the balance to goodwill. On January 2. 15. On a consolidated balance sheet at January 2, what should be the amount for non-current assets? O $201,000 O $156,000 O $210,000 $165,000 Click Save and Submit to save and submit Chok Saue All Ar t o e alla Save All Answers Close