Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your company owns a subsidiary operating in Canada. The subsidiary has adopted the Canadian Dollar (CAD) as its functional currency. Your parent

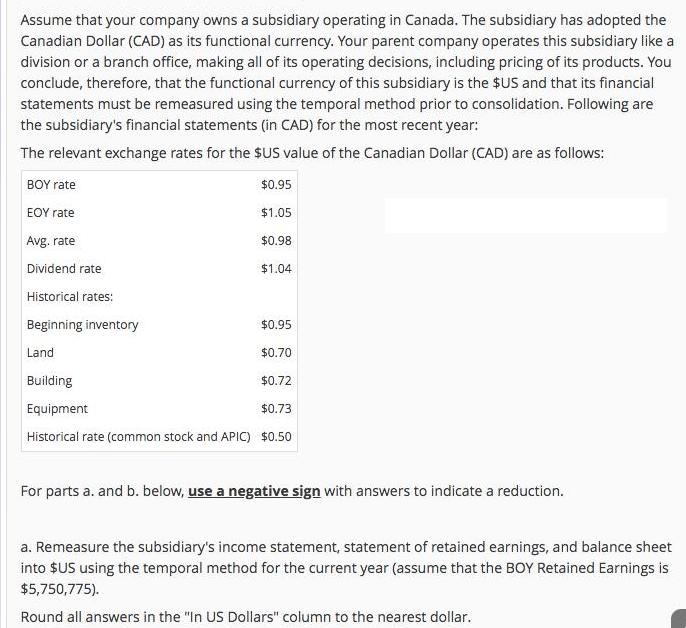

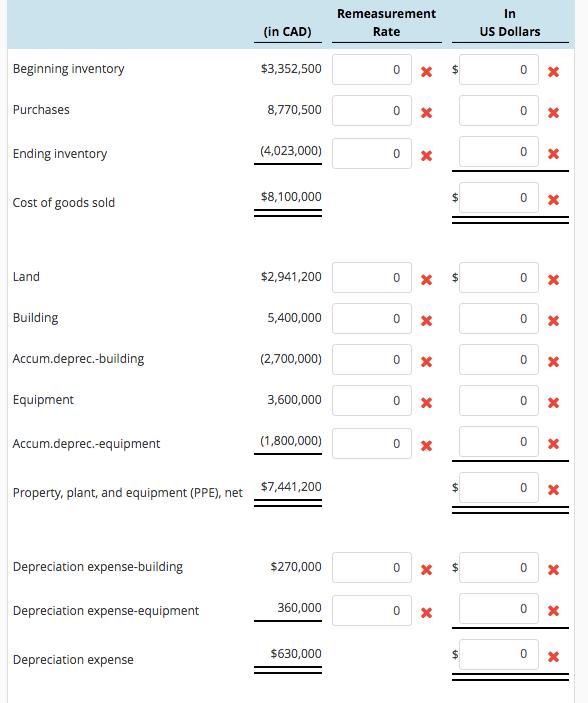

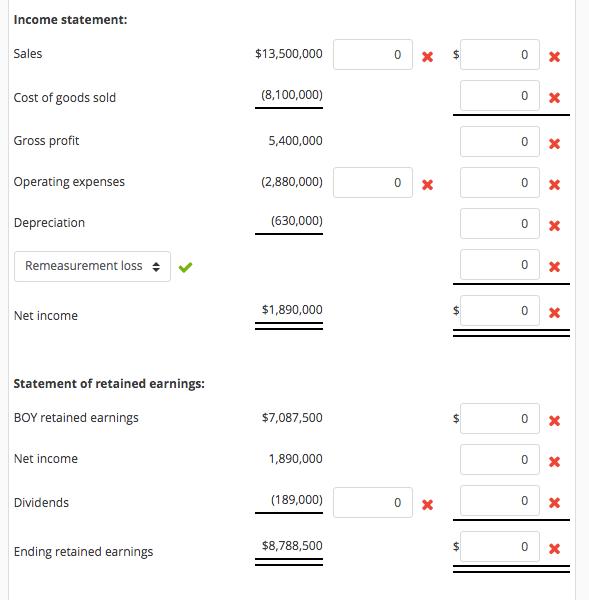

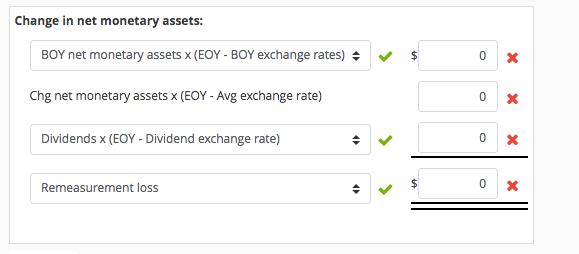

Assume that your company owns a subsidiary operating in Canada. The subsidiary has adopted the Canadian Dollar (CAD) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the $US and that its financial statements must be remeasured using the temporal method prior to consolidation. Following are the subsidiary's financial statements (in CAD) for the most recent year: The relevant exchange rates for the $US value of the Canadian Dollar (CAD) are as follows: Y rate $0.95 rate $1.05 Avg. rate $0.98 Dividend rate $1.04 Historical rates: Beginning inventory $0.95 Land $0.70 Building $0.72 Equipment $0.73 Historical rate (common stock and APIC $0.50 For parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Remeasure the subsidiary's income statement, statement of retained earnings, and balance sheet into $US using the temporal method for the current year (assume that the BOY Retained Earnings is $5,750,775). Round all answers in the "In US Dollars" column to the nearest dollar. Remeasurement In (in CAD) Rate US Dollars Beginning inventory $3,352,500 Purchases 8,770,500 Ending inventory (4,023,000) $8,100,000 Cost of goods sold Land $2,941,200 Building 5,400,000 Accum.deprec.-building (2,700,000) Equipment 3,600,000 Accum.deprec.-equipment (1,800,000) $7,441,200 Property, plant, and equipment (PPE), net Depreciation expense-building $270,000 Depreciation expense-equipment 360,000 Depreciation expense $630,000 $4 Income statement: Sales $13,500,000 0 x $ Cost of goods sold (8,100,000) Gross profit 5,400,000 Operating expenses (2,880,000) Depreciation (630,000) Remeasurement loss $1,890,000 Net income Statement of retained earnings: BOY retained earnings $7,087,500 Net income 1,890,000 Dividends (189,000) $8,788,500 Ending retained earnings Balance sheet: Assets Cash $3,842,100 Accounts receivable 3,132,000 Inventory 4,023,000 Property, plant, and equipment (PPE), net 7,441,200 $18,438,300 Total assets Liabilities and stockholders' equity Current liabilities $2,289,600 Long-term liabilities 5,335,200 Common stock 900,000 APIC 1,125,000 Retained earnings 8,788,500 $18,438,300 Total liabilities and equity b. A Compute the remeasurement gain or loss directly assuming BOY net monetary assets of (2,311,200), a net monetary liability. Round all answers to the nearest dollar. %24 Change in net monetary assets: BOY net monetary assets x (EOY - BOY exchange rates) +v Chg net monetary assets x (EOY - Avg exchange rate) Dividends x (EOY - Dividend exchange rate) Remeasurement loss %24 >

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Amount in Exchange CAD Description Amount in S Rate Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started