Question: a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected

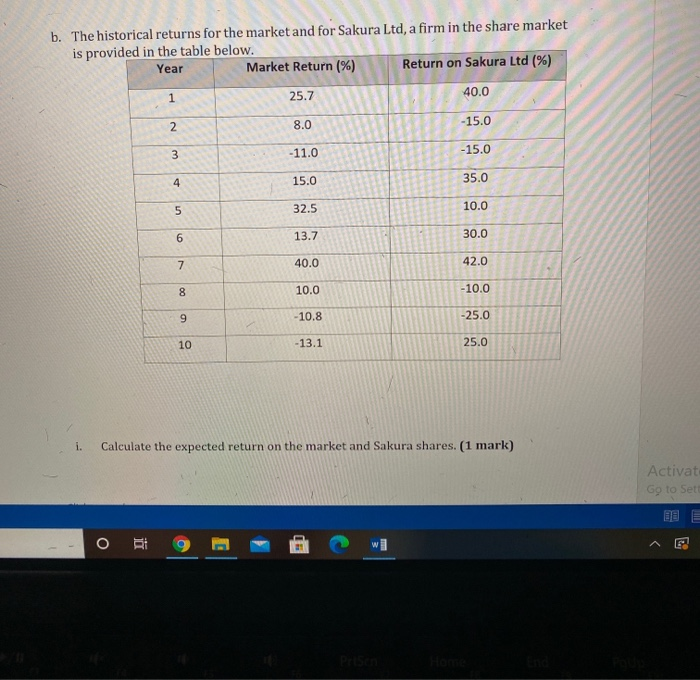

a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected by increasing the number of securities in the portfolio. (2 marks) b. The historical returns for the market and for Sakura Ltd, a firm in the share market is provided in the table below. Market Return (%) Return on Sakura Ltd (%) Year 25.7 40.0 8.0 -15.0 -11.0 -15.0 4 15.0 35.0 32.5 10.0 6. 13.7 30.0 7. 40.0 42.0 8. 10.0 -10.0 9. -10.8 -25.0 10 -13.1 25.0 i. Calculate the expected return on the market and Sakura shares. (1 mark) Activate Go to Sett PriSen Home End 2. 00 i. Calculate the expected return on the market and Sakura shares. (1 mark) Click or tap here to enter text. ii. Calculate the standard deviation of the market returns and the standard deviation of the returns on Sakura Ltd. (1 mark) Click or tap here to enter text. iii. Determine the correlation coefficient between the market return and the return on Sakura shares and hence calculate the Beta coefficient for Sakura Ltd. (2 marks) Click or tap here to enter text. iv. What is the compensation for bearing systematic risk? (2 mark) Click or tap here to enter text. If the risk free rate is 5 percent would you consider the shares of Sakura Ltd as a good buy? v. (2 marks) Click or tap here to enter text. a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected by increasing the number of securities in the portfolio. (2 marks) b. The historical returns for the market and for Sakura Ltd, a firm in the share market is provided in the table below. Market Return (%) Return on Sakura Ltd (%) Year 25.7 40.0 8.0 -15.0 -11.0 -15.0 4 15.0 35.0 32.5 10.0 6. 13.7 30.0 7. 40.0 42.0 8. 10.0 -10.0 9. -10.8 -25.0 10 -13.1 25.0 i. Calculate the expected return on the market and Sakura shares. (1 mark) Activate Go to Sett PriSen Home End 2. 00 i. Calculate the expected return on the market and Sakura shares. (1 mark) Click or tap here to enter text. ii. Calculate the standard deviation of the market returns and the standard deviation of the returns on Sakura Ltd. (1 mark) Click or tap here to enter text. iii. Determine the correlation coefficient between the market return and the return on Sakura shares and hence calculate the Beta coefficient for Sakura Ltd. (2 marks) Click or tap here to enter text. iv. What is the compensation for bearing systematic risk? (2 mark) Click or tap here to enter text. If the risk free rate is 5 percent would you consider the shares of Sakura Ltd as a good buy? v. (2 marks) Click or tap here to enter text. a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected by increasing the number of securities in the portfolio. (2 marks) b. The historical returns for the market and for Sakura Ltd, a firm in the share market is provided in the table below. Market Return (%) Return on Sakura Ltd (%) Year 25.7 40.0 8.0 -15.0 -11.0 -15.0 4 15.0 35.0 32.5 10.0 6. 13.7 30.0 7. 40.0 42.0 8. 10.0 -10.0 9. -10.8 -25.0 10 -13.1 25.0 i. Calculate the expected return on the market and Sakura shares. (1 mark) Activate Go to Sett PriSen Home End 2. 00 i. Calculate the expected return on the market and Sakura shares. (1 mark) Click or tap here to enter text. ii. Calculate the standard deviation of the market returns and the standard deviation of the returns on Sakura Ltd. (1 mark) Click or tap here to enter text. iii. Determine the correlation coefficient between the market return and the return on Sakura shares and hence calculate the Beta coefficient for Sakura Ltd. (2 marks) Click or tap here to enter text. iv. What is the compensation for bearing systematic risk? (2 mark) Click or tap here to enter text. If the risk free rate is 5 percent would you consider the shares of Sakura Ltd as a good buy? v. (2 marks) Click or tap here to enter text. a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected by increasing the number of securities in the portfolio. (2 marks) b. The historical returns for the market and for Sakura Ltd, a firm in the share market is provided in the table below. Market Return (%) Return on Sakura Ltd (%) Year 25.7 40.0 8.0 -15.0 -11.0 -15.0 4 15.0 35.0 32.5 10.0 6. 13.7 30.0 7. 40.0 42.0 8. 10.0 -10.0 9. -10.8 -25.0 10 -13.1 25.0 i. Calculate the expected return on the market and Sakura shares. (1 mark) Activate Go to Sett PriSen Home End 2. 00 i. Calculate the expected return on the market and Sakura shares. (1 mark) Click or tap here to enter text. ii. Calculate the standard deviation of the market returns and the standard deviation of the returns on Sakura Ltd. (1 mark) Click or tap here to enter text. iii. Determine the correlation coefficient between the market return and the return on Sakura shares and hence calculate the Beta coefficient for Sakura Ltd. (2 marks) Click or tap here to enter text. iv. What is the compensation for bearing systematic risk? (2 mark) Click or tap here to enter text. If the risk free rate is 5 percent would you consider the shares of Sakura Ltd as a good buy? v. (2 marks) Click or tap here to enter text.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

ANSWER A COMPONENTS OF TOTAL RISK ARE AS FOLLOW SYSTEMATIC RISK It refers to the risk that is inhere... View full answer

Get step-by-step solutions from verified subject matter experts