Question

Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To

Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an assets expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence.

Consider the following case:

Joshua owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters of Joshuas portfolio value consists of HDSs shares, and the balance consists of BSBs shares.

Each stocks expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table:

| Market Condition | Probability of Occurrence | Happy Dog Soap | Black Sheep Broadcasting |

|---|---|---|---|

| Strong | 0.20 | 20% | 28% |

| Normal | 0.35 | 12% | 16% |

| Weak | 0.45 | -16% | -20% |

Calculate expected returns for the individual stocks in Joshuas portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year.

| The expected rate of return on Happy Dog Soaps stock over the next year is . | |

| The expected rate of return on Black Sheep Broadcastings stock over the next year is . | |

| The expected rate of return on Joshuas portfolio over the next year is . |

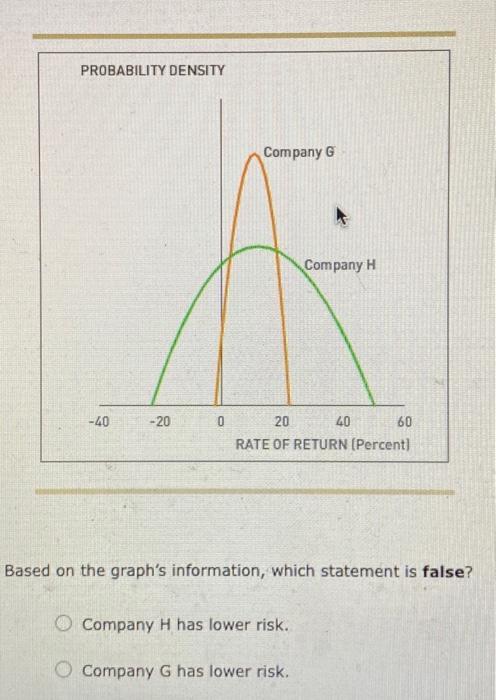

The expected returns for Joshuas portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph.

For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph:

Based on the graphs information, which statement is false?

Company H has lower risk.

Company G has lower risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started