Answered step by step

Verified Expert Solution

Question

1 Approved Answer

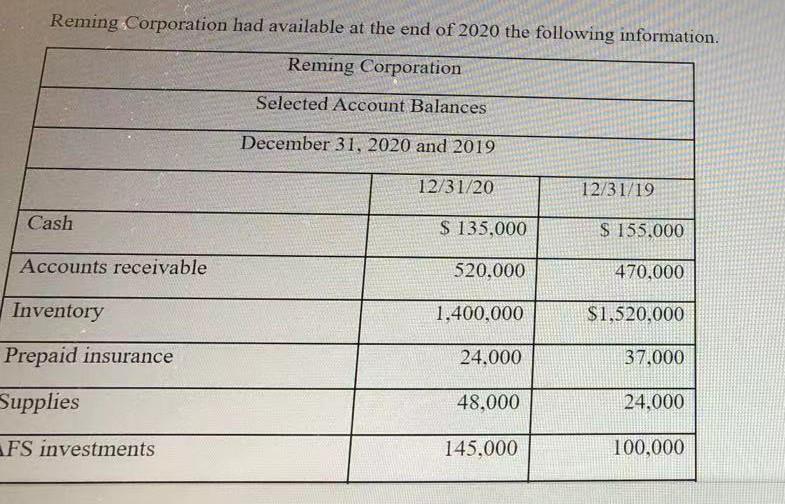

Reming Corporation had available at the end of 2020 the following information. Reming Corporation Selected Account Balances December 31, 2020 and 2019 12/31/20 12/31/19 Cash

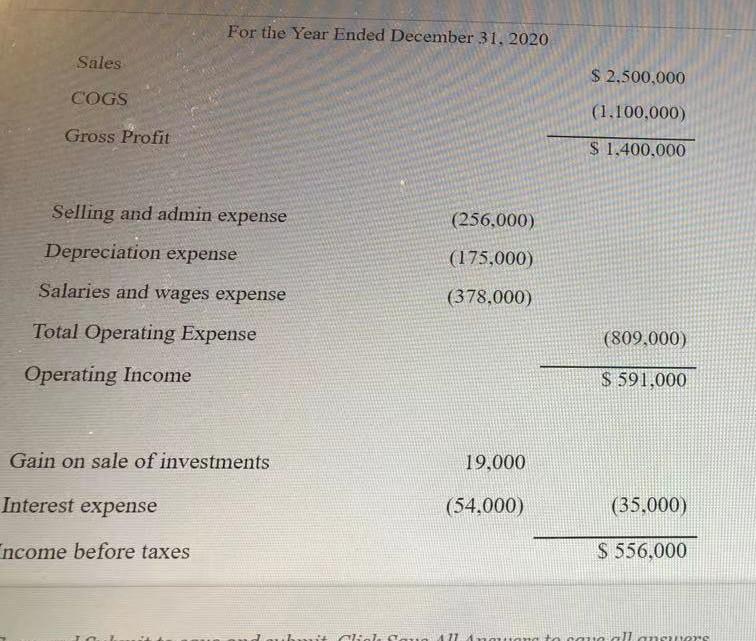

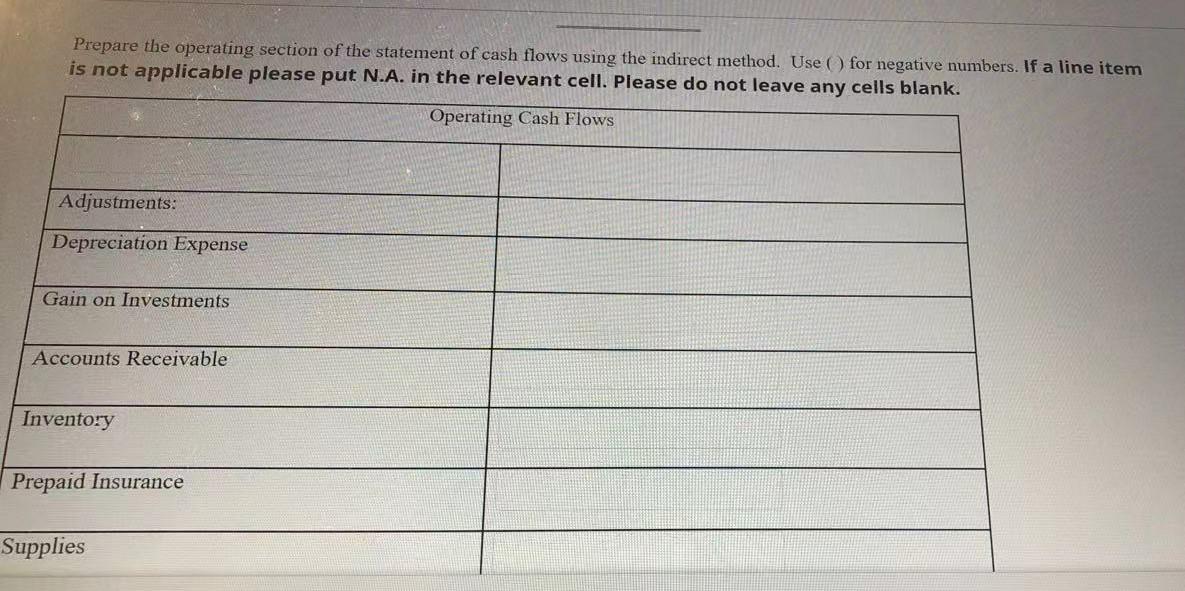

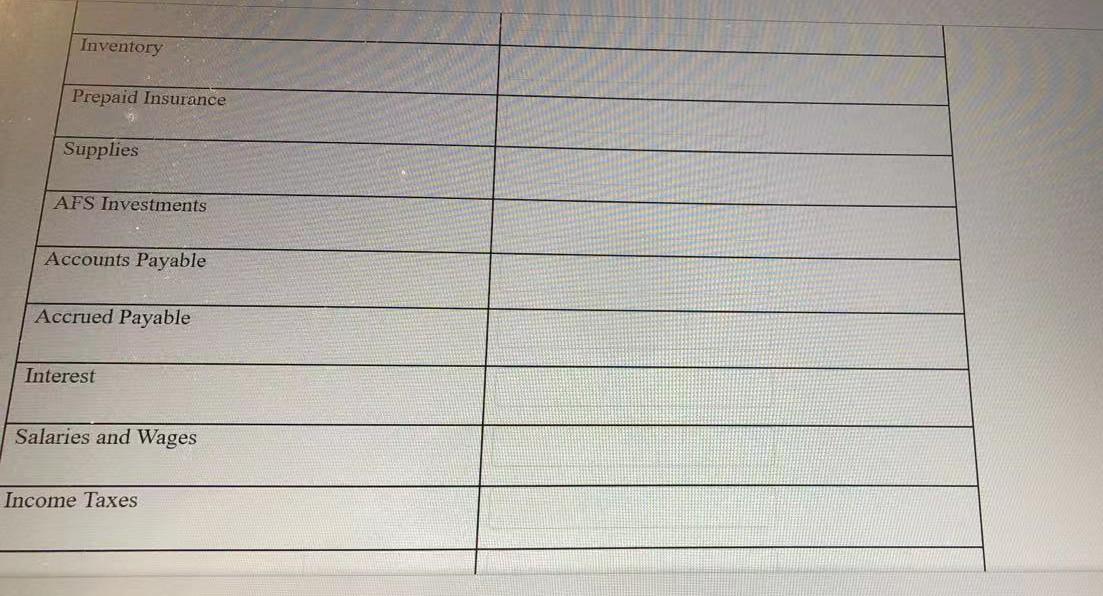

Reming Corporation had available at the end of 2020 the following information. Reming Corporation Selected Account Balances December 31, 2020 and 2019 12/31/20 12/31/19 Cash $ 135,000 $ 155,000 Accounts receivable 520.000 470,000 Inventory 1.400,000 $1,520,000 Prepaid insurance 24.000 37.000 Supplies 48,000 24,000 FS investments 145,000 100,000 For the Year Ended December 31, 2020 Sales $ 2.500,000 COGS (1.100,000) Gross Profit $ 1.400.000 (256,000) Selling and admin expense Depreciation expense (175,000) Salaries and wages expense (378,000) Total Operating Expense (809,000) Operating Income $ 591,000 Gain on sale of investments 19,000 Interest expense (54.000) (35.000) ncome before taxes $ 556.000 Huhuut Cho Thun 1 mmHana to chuc nangag Prepare the operating section of the statement of cash flows using the indirect method. Use for negative numbers. If a line item is not applicable please put N.A. in the relevant cell. Please do not leave any cells blank. Operating Cash Flows Adjustments: Depreciation Expense Gain on Investments Accounts Receivable Inventory Prepaid Insurance Supplies Inventory Prepaid Insurance Supplies AFS Investments Accounts Payable Accrued Payable Interest Salaries and Wages Income Taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started