Question

Remote Education Technology, Incorporated started and finished job number B67 during June. The job required $47,200 of direct material and 400 hours of direct

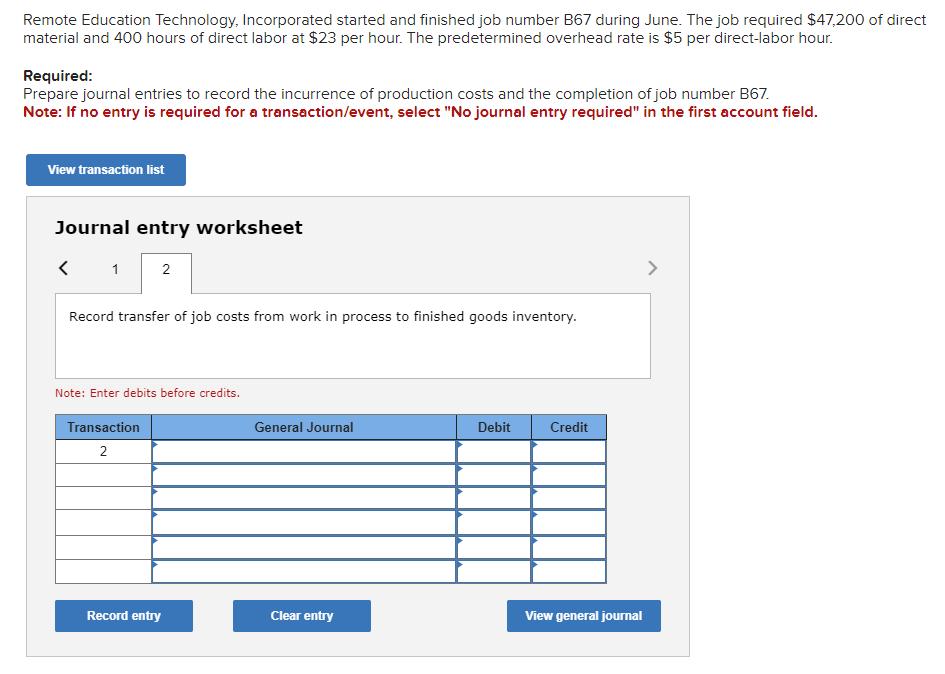

Remote Education Technology, Incorporated started and finished job number B67 during June. The job required $47,200 of direct material and 400 hours of direct labor at $23 per hour. The predetermined overhead rate is $5 per direct-labor hour. Required: Prepare journal entries to record the incurrence of production costs and the completion of job number B67. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Record transfer of job costs from work in process to finished goods inventory. Note: Enter debits before credits. Transaction 2 General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Creating Value In A Dynamic Business Environment

Authors: Ronald Hilton, David Platt

13th Edition

1264100698, 9781264100699

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App