Question

Renaud Excavation needs a piece of equipment that costs $20,000. The company can either lease the equipment or borrow $20,000 from a local bank and

Renaud Excavation needs a piece of equipment that costs $20,000. The company can either lease the equipment or borrow $20,000 from a local bank and buy the equipment on a 3-year loan. If the company buys the equipment it will be depreciated using MACRS with a 3-year class. The company will also buy a maintenance contract at a cost of $500 per year (paid at the beginning of each year). If the company leases the equipment on a 3-year lease, the payment would be $8,000 at the beginning of each year. The equipment will have a residual value of $1,000 at the end of three years. Assume that the tax rate is 40 percent and that the company can borrow at 10 percent before taxes.

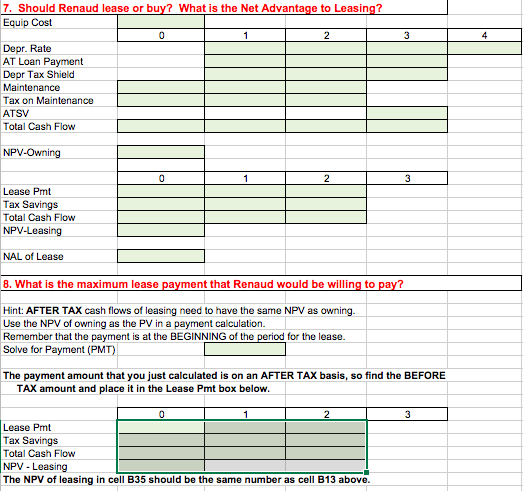

(EXCEL TEMPLATE) Should Renaud lease or buy? What is the Net Advantage to Leasing?

(EXCEL TEMPLATE) What is the maximum lease payment that Renaud would be willing to pay?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started