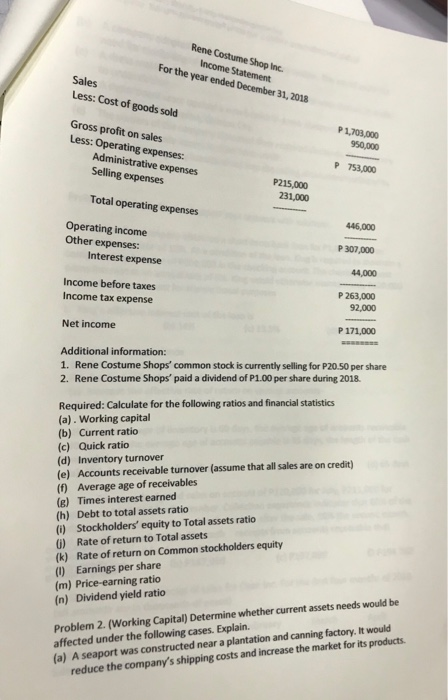

Rene Costume Shop Inc. Income Statement For the year ended December 31, 2018 Sales Less: Cost of goods sold P1,703,000 950,000 Gross profit on sales Less: Operating expenses: Administrative expenses P 753.000 Selling expenses P215,000 231,000 Total operating expenses 446,000 Operating income Other expenses: P 307,000 Interest expense 44,000 Income before taxes P 263.000 Income tax expense 92,000 P 171,000 Net income Additional information: 1. Rene Costume Shops' common stock is currently selling for P20.50 per share 2. Rene Costume Shops' paid a dividend of P1.00 per share during 2018. Required: Calculate for the following ratios and financial statistics (a). Working capital (b) Current ratio (c) Quick ratio (d) Inventory turnover (e) Accounts receivable turnover (assume that all sales are on credit) (f) Average age of receivables (g) Times interest earned (h) Debt to total assets ratio () Stockholders' equity to Total assets ratio (i) Rate of return to Total assets (k) Rate of return on Common stockholders equity () Earnings per share (m) Price-earning ratio (n) Dividend yield ratio Problem 2. (Working Capital) Determine whether current assets needs would be affected under the following cases. Explain. (a) A seaport was constructed near a plantation and canning factory. It would reduce the company's shipping costs and increase the market for its products Rene Costume Shop Inc. Income Statement For the year ended December 31, 2018 Sales Less: Cost of goods sold P1,703,000 950,000 Gross profit on sales Less: Operating expenses: Administrative expenses P 753.000 Selling expenses P215,000 231,000 Total operating expenses 446,000 Operating income Other expenses: P 307,000 Interest expense 44,000 Income before taxes P 263.000 Income tax expense 92,000 P 171,000 Net income Additional information: 1. Rene Costume Shops' common stock is currently selling for P20.50 per share 2. Rene Costume Shops' paid a dividend of P1.00 per share during 2018. Required: Calculate for the following ratios and financial statistics (a). Working capital (b) Current ratio (c) Quick ratio (d) Inventory turnover (e) Accounts receivable turnover (assume that all sales are on credit) (f) Average age of receivables (g) Times interest earned (h) Debt to total assets ratio () Stockholders' equity to Total assets ratio (i) Rate of return to Total assets (k) Rate of return on Common stockholders equity () Earnings per share (m) Price-earning ratio (n) Dividend yield ratio Problem 2. (Working Capital) Determine whether current assets needs would be affected under the following cases. Explain. (a) A seaport was constructed near a plantation and canning factory. It would reduce the company's shipping costs and increase the market for its products