Question

Renew Energy Ltd. (REL) manufactures and sells directly to customers a special long-lasting rechargeable battery for use in digital electronic equipment. Each battery sold comes

Renew Energy Ltd. (REL) manufactures and sells directly to customers a special long-lasting rechargeable battery for use in digital electronic equipment. Each battery sold comes with a guarantee that the company will replace free of charge any battery that is found to be defective within six months from the end of the month in which the battery was sold. On June 30, 2020, the Warranty Liability account had a balance of $45,000, but by December 31, 2020, this amount had been reduced to $5,000 by charges for batteries returned.

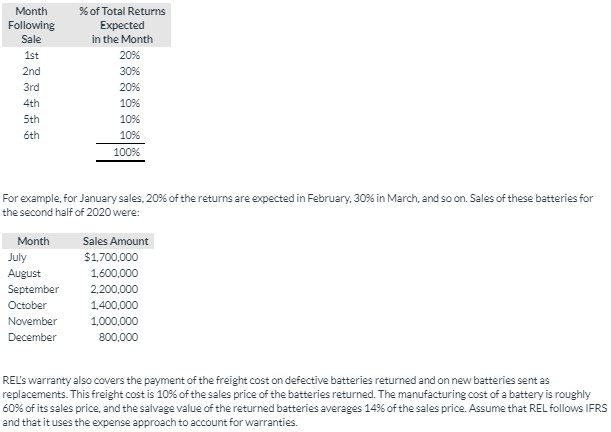

REL has been in business for many years and has consistently experienced an 10% return rate. However, effective October 1, 2020, because of a change in the manufacturing process, the rate increased to a total of 12%. Each battery is stamped with a date at the time of sale so that REL has developed information on the likely pattern of returns during the six-month period, starting with the month following the sale. (Assume no batteries are returned in the month of sale.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started