Answered step by step

Verified Expert Solution

Question

1 Approved Answer

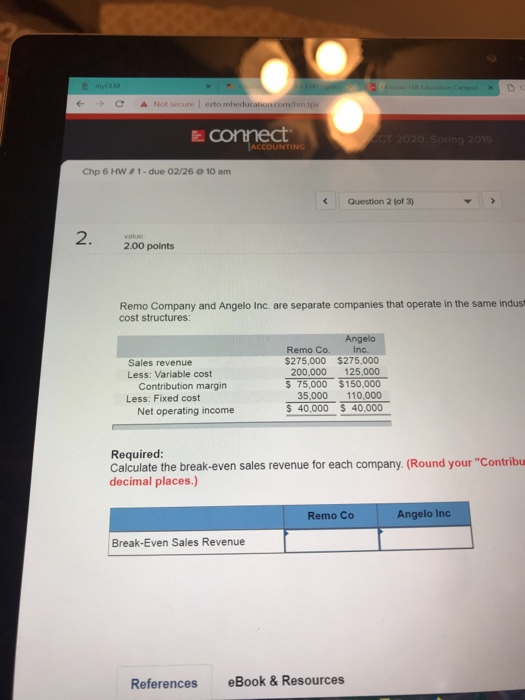

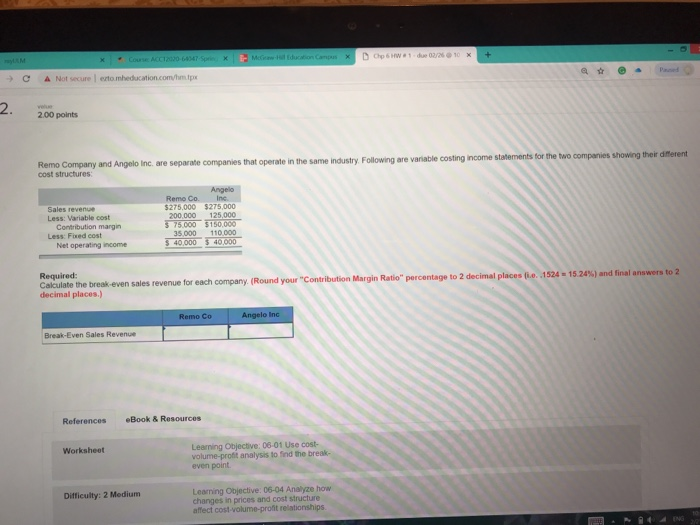

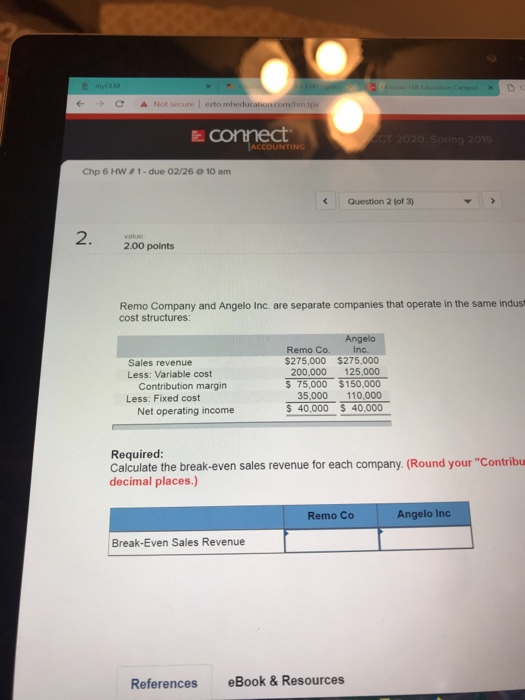

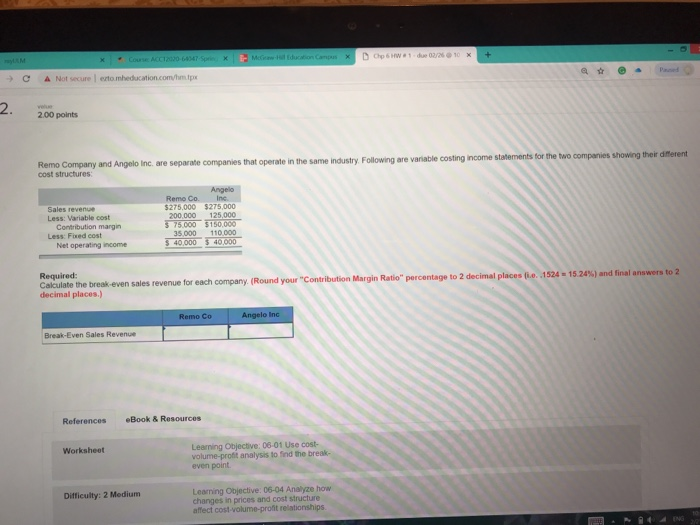

Reno Company and Angelo Inc. are separate companies that operate in the same industry. Following are variable costing income statements for the two companies showing

Reno Company and Angelo Inc. are separate companies that operate in the same industry. Following are variable costing income statements for the two companies showing their different cost structures: (pictures included)

(--) Not secure. I eztomheducat.u"com/hmtp. connect. ACCOUNTING Chp 6 HNw # 1 . due 02/26 @ 10 am Question 2 (of 3) 2. 200 points Remo Company and Angelo Inc. are separate companies that operate in the same indust cost structures: Angelo Remo Co. Inc. $275,000 $275,000 200,000 125,000 S 75,000 $150,000 35,000 110,000 s 40,000 40,000 Sales revenue Less: Variable cost Contribution margin Less: Fixed cost Net operating income Required Calculate the break-even sales revenue for each company. (Round your "Contribu decimal places.) Remo Co Angelo Inc Break-Even Sales Revenue References eBook & Resources 0 -) C Not secure leno! 2.00 points ncome statements for the two companies showing their different Remo Company and Angelo Inc. are separate companies that operate in the same industry Following are cost structures: Remo Co Inc. 275,000 $275,000 200000 125.000 575.000 $150,000 Sales revenue Less: Variable cost Contribution margin 35,000 110.000 40,000 $ 40.000 Less:Fixed cost 4 Net operating income Required: Calculate the break-even sales revenue for each decimal places.) "Contribution Margin Ratio" percentage to 2 decimal places (ie, .1524-1524%) and final answers to 2 Remo Co Angelo Inc Break-Even Sales Revenue References eBook & Resources Learning Objective: 06-01 Use cost- volume-profit analysis to ind the br even point Worksheet Learning Objective: 06-04 Analyze how changes in prices and cost structure affect cost-volume-pronit relationships Difficulty: 2 Medium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started