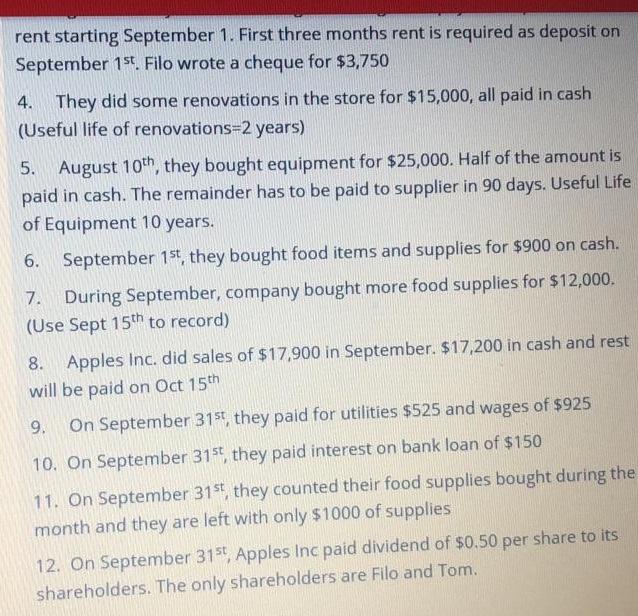

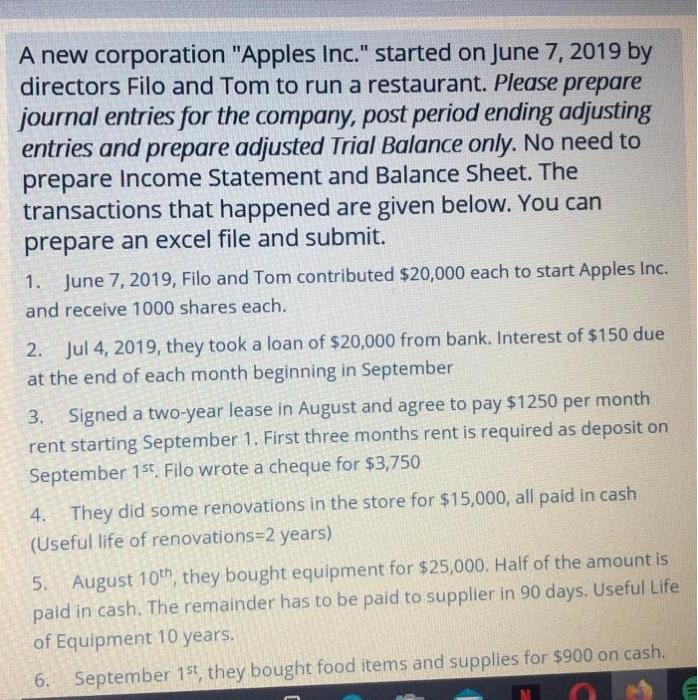

rent starting September 1. First three months rent is required as deposit on September 1st. Filo wrote a cheque for $3,750 4. They did some renovations in the store for $15,000, all paid in cash (Useful life of renovations=2 years) 5. August 10th, they bought equipment for $25,000. Half of the amount is paid in cash. The remainder has to be paid to supplier in 90 days. Useful Life of Equipment 10 years. 6. September 1st, they bought food items and supplies for $900 on cash. 7. During September, company bought more food supplies for $12,000. (Use Sept 15th to record) 8. Apples Inc. did sales of $17,900 in September. $17,200 in cash and rest will be paid on Oct 15th 9. On September 31st, they paid for utilities $525 and wages of $925 10. On September 31st, they paid interest on bank loan of $150 11. On September 31st, they counted their food supplies bought during the month and they are left with only $1000 of supplies 12. On September 31st, Apples Inc paid dividend of $0.50 per share to its shareholders. The only shareholders are Filo and Tom. A new corporation "Apples Inc." started on June 7, 2019 by directors Filo and Tom to run a restaurant. Please prepare journal entries for the company, post period ending adjusting entries and prepare adjusted Trial Balance only. No need to prepare Income Statement and Balance Sheet. The transactions that happened are given below. You can prepare an excel file and submit. 1. June 7, 2019, Filo and Tom contributed $20,000 each to start Apples Inc. and receive 1000 shares each. 2. Jul 4, 2019, they took a loan of $20,000 from bank. Interest of $150 due at the end of each month beginning in September 3. Signed a two-year lease in August and agree to pay $1250 per month rent starting September 1. First three months rent is required as deposit on September 15t. Filo wrote a cheque for $3,750 4. They did some renovations in the store for $15,000, all paid in cash (Useful life of renovations=2 years) 5. August 10th, they bought equipment for $25,000. Half of the amount is paid in cash. The remainder has to be paid to supplier in 90 days. Useful Life of Equipment 10 years. 6. September 1st, they bought food items and supplies for $900 on cash