Question

Rental Option: Rent is4000 per month for the first year. The monthly rental expense will increase by200 for each subsequent year of renting. There is

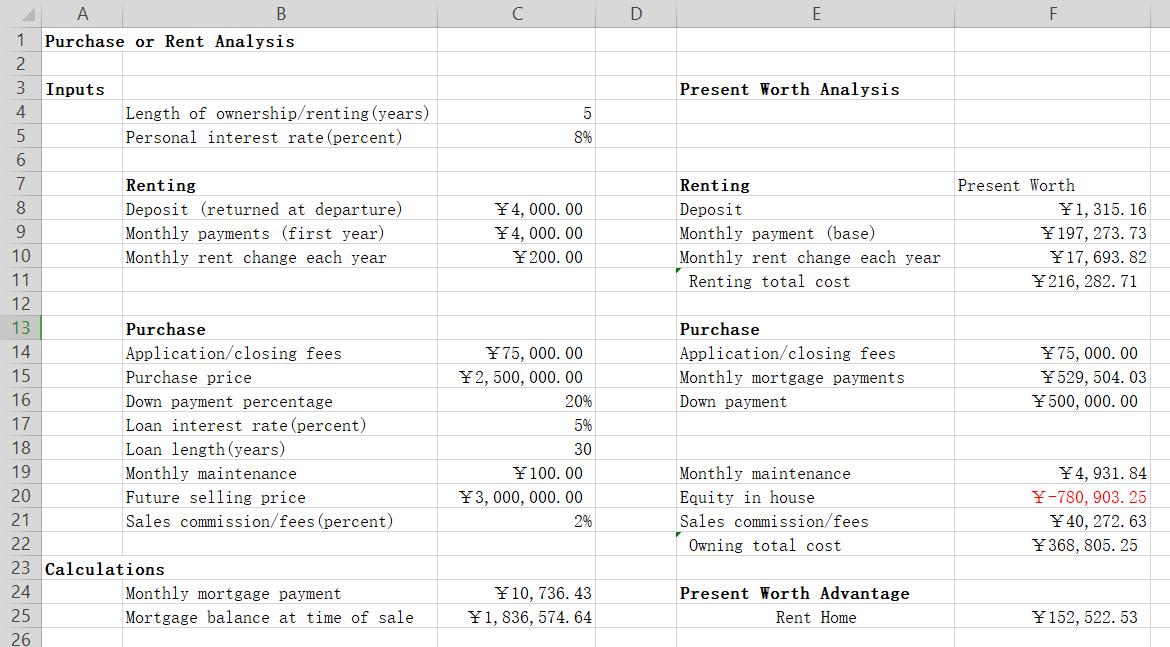

Rental Option: Rent is¥4000 per month for the first year. The monthly rental expense will increase by¥200 for each subsequent year of renting. There is also a¥4000 deposit payable when the lease is signed and refundable when the house is left in good condition.

Purchase Option: The house price is¥2500,000. A¥500,000 down payment is made, so¥2000,000 will be financed with a 30-year mortgage having a 5% annual interest rate. Additional contract tax of 3% of the house price are paid at the time of purchase. Property fee is expected to average¥100 per month. The resale value of the home after five years is anticipated to be¥3000,000. The commission paid to the realtor at the time of the sale is expected to be 2% of the selling price. The personal interest rate is 8% per year (compounded monthly).

1. You must describe the cash inflow and outflow of the projects, the time they occur, the interest rate and the draw the cash flow diagrams.

2. You must use PW and AW to compare the projects and identify the formulas of the functions of the calculations.

3. Market Fluctuation Analysis about the Alternatives

4. Breakeven Analysis, including "The Common Factor" and "The Breakeven Point"

5. Sensitive Analysis, including "The Variation of the Factors" and "The Single Factor Sensitive Analysis"

(You must make the sensitive analysis table and draw the spiderplot.)

6. Sensitive Analysis For Probability

7. You must come to a conclusion and its preconditions and describe the accompanying risks.

Cash Flow Table:

1 2 3 4 5 6 7 8 9 10 11 A B Purchase or Rent Analysis Inputs Length of ownership/renting (years) Personal interest rate (percent) Renting Deposit (returned at departure) Monthly payments (first year) Monthly rent change each year 12 13 14 15 16 17 18 19 20 21 22 23 Calculations. 24 25 26 Purchase Application/closing fees Purchase price. Down payment percentage Loan interest rate (percent) Loan length (years) Monthly maintenance Future selling price. Sales commission/fees (percent) Monthly mortgage payment Mortgage balance at time of sale C 5 8% 4,000.00 4,000.00 200.00 75, 000.00 2, 500, 000. 00 20% 5% 30 100.00 3, 000, 000.00 2% 10, 736. 43 1, 836, 574.64 D E Present Worth Analysis Renting Deposit Monthly payment (base) Monthly rent change each year Renting total cost Purchase Application/closing fees Monthly mortgage payments Down payment Monthly maintenance Equity in house Sales commission/fees Owning total cost Present Worth Advantage Rent Home F Present Worth 1, 315. 16. 197, 273. 73 17, 693.82 216, 282. 71 75,000.00 529, 504. 03 500, 000. 00 4, 931. 84 Y-780, 903. 25 40, 272. 63 368, 805. 25 152, 522. 53

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question G9 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 A B X N Rate Np...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started