Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Renter Company acquired the use of a machine by agreeing to pay the manufacturer of the machine $7,500 per year for 10 years. At

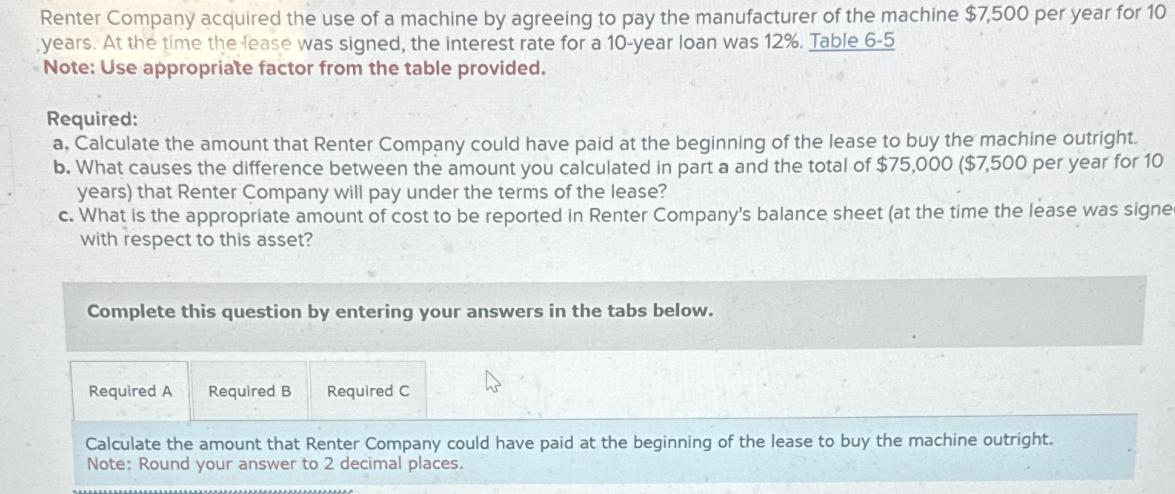

Renter Company acquired the use of a machine by agreeing to pay the manufacturer of the machine $7,500 per year for 10 years. At the time the lease was signed, the interest rate for a 10-year loan was 12%. Table 6-5 Note: Use appropriate factor from the table provided. Required: a. Calculate the amount that Renter Company could have paid at the beginning of the lease to buy the machine outright. b. What causes the difference between the amount you calculated in part a and the total of $75,000 ($7,500 per year for 10 years) that Renter Company will pay under the terms of the lease? c. What is the appropriate amount of cost to be reported in Renter Company's balance sheet (at the time the lease was signe with respect to this asset? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the amount that Renter Company could have paid at the beginning of the lease to buy the machine outright. Note: Round your answer to 2 decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question appears to be incomplete as it seems there was table referred to as Table 65 that is re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started