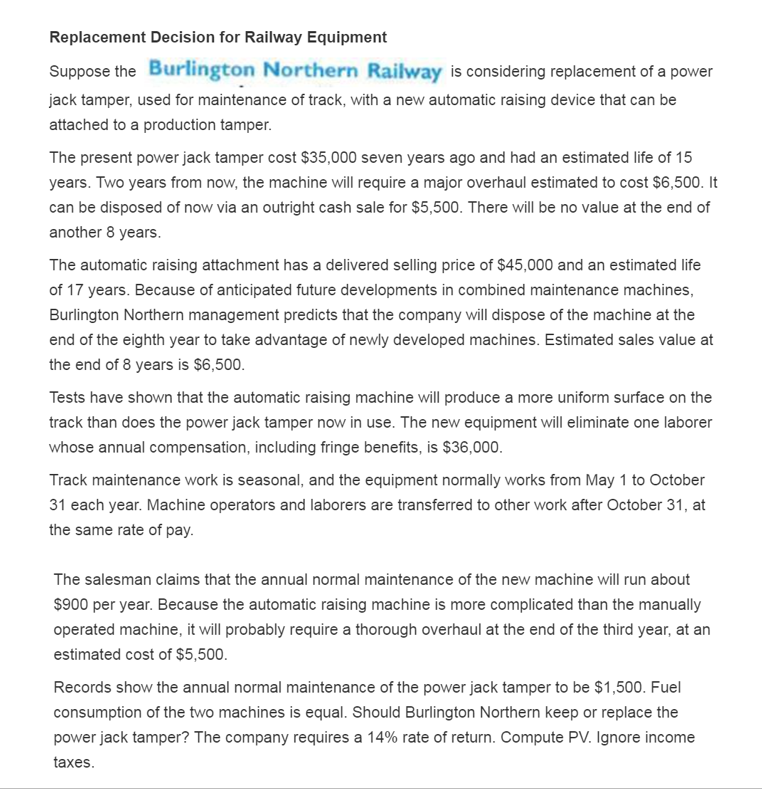

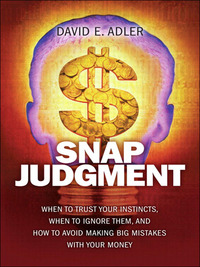

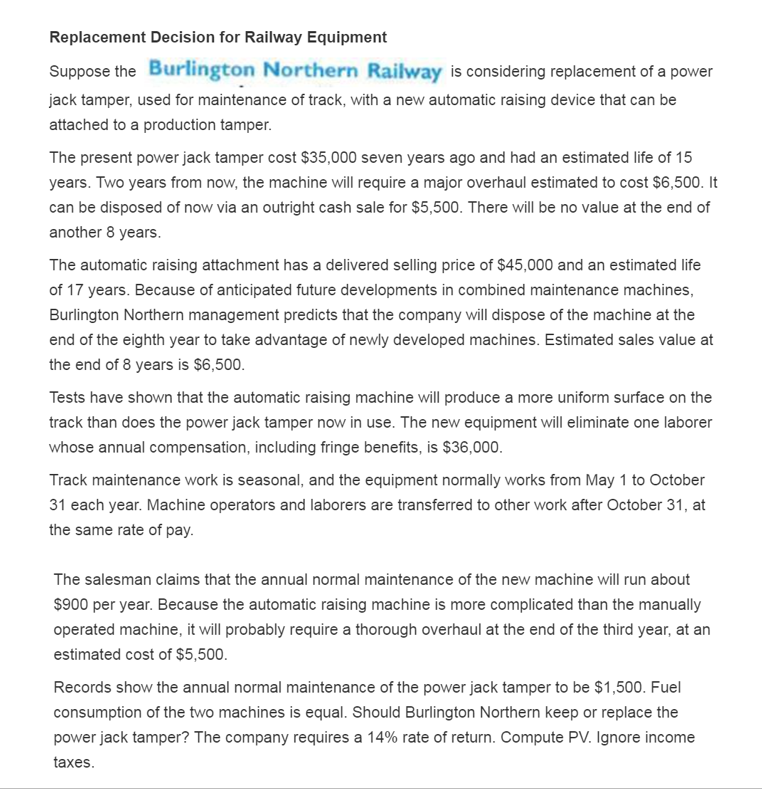

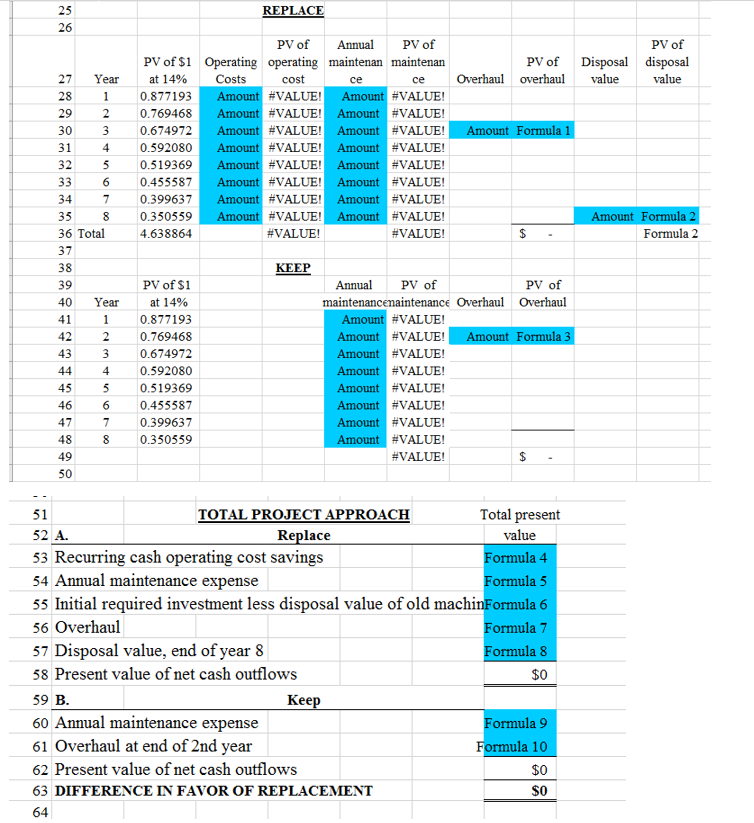

Replacement Decision for Railway Equipment Suppose the Burlington Northern Railway is considering replacement of a power jack tamper, used for maintenance of track, with a new automatic raising device that can be attached to a production tamper. The present power jack tamper cost $35,000 seven years ago and had an estimated life of 15 years. Two years from now, the machine will require a major overhaul estimated to cost $6,500. It can be disposed of now via an outright cash sale for $5,500. There will be no value at the end of another 8 years. The automatic raising attachment has a delivered selling price of $45,000 and an estimated life of 17 years. Because of anticipated future developments in combined maintenance machines, Burlington Northern management predicts that the company will dispose of the machine at the end of the eighth year to take advantage of newly developed machines. Estimated sales value at the end of 8 years is $6,500. Tests have shown that the automatic raising machine will produce a more uniform surface on the track than does the power jack tamper now in use. The new equipment will eliminate one laborer whose annual compensation, including fringe benefits, is $36,000. Track maintenance work is seasonal, and the equipment normally works from May 1 to October 31 each year. Machine operators and laborers are transferred to other work after October 31, at the same rate of pay The salesman claims that the annual normal maintenance of the new machine will run about $900 per year. Because the automatic raising machine is more complicated than the manually operated machine, it will probably require a thorough overhaul at the end of the third year, at an estimated cost of $5,500 Records show the annual normal maintenance of the power jack tamper to be $1,500. Fuel consumption of the two machines is equal. Should Burlington Northern keep or replace the power jack tamper? The company requires a 14% rate of return. Compute PV. Ignore income taxes 25 26 REPLACIE PV of Annual PV of PV of PV of S1 Opeating operating maintenan maintenan cost #VALUE! #VALUE! #VALUE #VALUE #VALUE #VALUE #VALUE/ #VALUE! #VALUE! PV of Disposal disposal ce Overhaul overhau value value 27 Year at14% Costs 28 29 ce 0.877193 0.769468 303 0.674972 0.592080 0.519369 6 0.455587 7 0.399637 0.350559 4.638864 #VALUE! Amount#VALUE! Amount #VALUE! Amount#VALUE! Amount #VALUE! Amount ;VALUE! Amount #VALUE! #VALUE! #VALUE! A VALUFA Formal 4 32 34 35 36 Total 37 38 39 40 Year Formula2 KEEP PV of $1 at14% 411 0.877193 42 2 0.769468 0.674972 44 4 0.592080 5 0.519369 6 0.455587 7 0.399637 0.350559 AnnualPV of maintenancenaintenance Overhaul Overhaul PV of #VALUE! Amount #VALUE! Amount #VALUE! Amount #VALUE! Amount VALUE! Amount VALUE! Amount VALUE! #VALUE! #VALUE! 433 45 46 48 49 50 TOTAL PROJECT APPROACH Total present value Formula 4 Formula 5 52 A. 53 Recurring cash operating cost saving:s 54 Annual maintenance expense 55 Initial required investment less disposal value of old machinFormula 6 56 Overhaul 57 Disposal value, end of year8 58 Present value of net cash outflows 59 B 60 Annual maintenance expense 61 Overhaul at end of 2nd year 62 Present value of net cash outflows 63 DIFFERENCE IN FAVOR OF REPLACEMENT 64 Replace ormula 7 Formula 8 $0 Kee Formula 9 Formula 10 $0 Replacement Decision for Railway Equipment Suppose the Burlington Northern Railway is considering replacement of a power jack tamper, used for maintenance of track, with a new automatic raising device that can be attached to a production tamper. The present power jack tamper cost $35,000 seven years ago and had an estimated life of 15 years. Two years from now, the machine will require a major overhaul estimated to cost $6,500. It can be disposed of now via an outright cash sale for $5,500. There will be no value at the end of another 8 years. The automatic raising attachment has a delivered selling price of $45,000 and an estimated life of 17 years. Because of anticipated future developments in combined maintenance machines, Burlington Northern management predicts that the company will dispose of the machine at the end of the eighth year to take advantage of newly developed machines. Estimated sales value at the end of 8 years is $6,500. Tests have shown that the automatic raising machine will produce a more uniform surface on the track than does the power jack tamper now in use. The new equipment will eliminate one laborer whose annual compensation, including fringe benefits, is $36,000. Track maintenance work is seasonal, and the equipment normally works from May 1 to October 31 each year. Machine operators and laborers are transferred to other work after October 31, at the same rate of pay The salesman claims that the annual normal maintenance of the new machine will run about $900 per year. Because the automatic raising machine is more complicated than the manually operated machine, it will probably require a thorough overhaul at the end of the third year, at an estimated cost of $5,500 Records show the annual normal maintenance of the power jack tamper to be $1,500. Fuel consumption of the two machines is equal. Should Burlington Northern keep or replace the power jack tamper? The company requires a 14% rate of return. Compute PV. Ignore income taxes 25 26 REPLACIE PV of Annual PV of PV of PV of S1 Opeating operating maintenan maintenan cost #VALUE! #VALUE! #VALUE #VALUE #VALUE #VALUE #VALUE/ #VALUE! #VALUE! PV of Disposal disposal ce Overhaul overhau value value 27 Year at14% Costs 28 29 ce 0.877193 0.769468 303 0.674972 0.592080 0.519369 6 0.455587 7 0.399637 0.350559 4.638864 #VALUE! Amount#VALUE! Amount #VALUE! Amount#VALUE! Amount #VALUE! Amount ;VALUE! Amount #VALUE! #VALUE! #VALUE! A VALUFA Formal 4 32 34 35 36 Total 37 38 39 40 Year Formula2 KEEP PV of $1 at14% 411 0.877193 42 2 0.769468 0.674972 44 4 0.592080 5 0.519369 6 0.455587 7 0.399637 0.350559 AnnualPV of maintenancenaintenance Overhaul Overhaul PV of #VALUE! Amount #VALUE! Amount #VALUE! Amount #VALUE! Amount VALUE! Amount VALUE! Amount VALUE! #VALUE! #VALUE! 433 45 46 48 49 50 TOTAL PROJECT APPROACH Total present value Formula 4 Formula 5 52 A. 53 Recurring cash operating cost saving:s 54 Annual maintenance expense 55 Initial required investment less disposal value of old machinFormula 6 56 Overhaul 57 Disposal value, end of year8 58 Present value of net cash outflows 59 B 60 Annual maintenance expense 61 Overhaul at end of 2nd year 62 Present value of net cash outflows 63 DIFFERENCE IN FAVOR OF REPLACEMENT 64 Replace ormula 7 Formula 8 $0 Kee Formula 9 Formula 10 $0