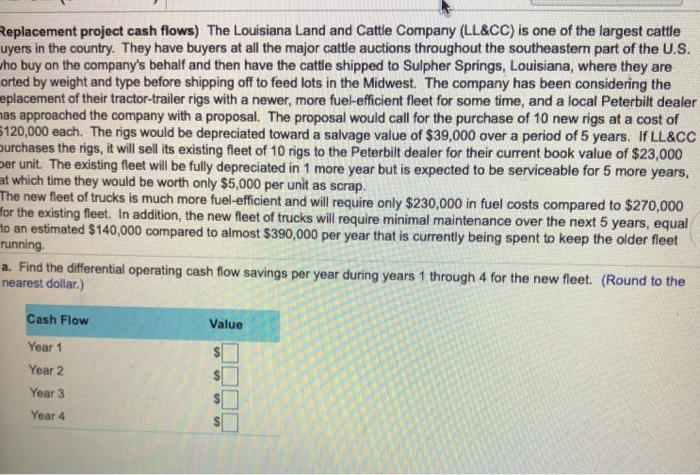

Replacement project cash flows) The Louisiana Land and Cattle Company (LL&CC) is one of the largest cattle uyers in the country. They have buyers at all the major cattle auctions throughout the southeastern part of the U.S. ho buy on the company's behalf and then have the cattle shipped to Sulpher Springs, Louisiana, where they are orted by weight and type before shipping off to feed lots in the Midwest. The company has been considering the replacement of their tractor-trailer rigs with a newer, more fuel-efficient fleet for some time, and a local Peterbilt dealer has approached the company with a proposal. The proposal would call for the purchase of 10 new rigs at a cost of 5120,000 each. The rigs would be depreciated toward a salvage value of $39,000 over a period of 5 years. If LL&CC Durchases the rigs, it will sell its existing fleet of 10 rigs to the Peterbilt dealer for their current book value of $23,000 Der unit. The existing fleet will be fully depreciated in 1 more year but is expected to be serviceable for 5 more years, at which time they would be worth only $5,000 per unit as scrap. The new fleet of trucks is much more fuel-efficient and will require only $230,000 in fuel costs compared to $270,000 for the existing fleet. In addition, the new fleet of trucks will require minimal maintenance over the next 5 years, equal to an estimated $140,000 compared to almost $390,000 per year that is currently being spent to keep the older fleet running a. Find the differential operating cash flow savings per year during years 1 through 4 for the new fleet. (Round to the nearest dollar.) Cash Flow Value Year 1 Year 2 Year 3 Year 4 S $ $ Replacement project cash flows) The Louisiana Land and Cattle Company (LL&CC) is one of the largest cattle uyers in the country. They have buyers at all the major cattle auctions throughout the southeastern part of the U.S. ho buy on the company's behalf and then have the cattle shipped to Sulpher Springs, Louisiana, where they are orted by weight and type before shipping off to feed lots in the Midwest. The company has been considering the replacement of their tractor-trailer rigs with a newer, more fuel-efficient fleet for some time, and a local Peterbilt dealer has approached the company with a proposal. The proposal would call for the purchase of 10 new rigs at a cost of 5120,000 each. The rigs would be depreciated toward a salvage value of $39,000 over a period of 5 years. If LL&CC Durchases the rigs, it will sell its existing fleet of 10 rigs to the Peterbilt dealer for their current book value of $23,000 Der unit. The existing fleet will be fully depreciated in 1 more year but is expected to be serviceable for 5 more years, at which time they would be worth only $5,000 per unit as scrap. The new fleet of trucks is much more fuel-efficient and will require only $230,000 in fuel costs compared to $270,000 for the existing fleet. In addition, the new fleet of trucks will require minimal maintenance over the next 5 years, equal to an estimated $140,000 compared to almost $390,000 per year that is currently being spent to keep the older fleet running a. Find the differential operating cash flow savings per year during years 1 through 4 for the new fleet. (Round to the nearest dollar.) Cash Flow Value Year 1 Year 2 Year 3 Year 4 S $ $