Question

Replcement Project: KFUPM is planning to replace it heavy duty printing machine with a newer model that is faster and better quality. The existing machine

Replcement Project:

KFUPM is planning to replace it heavy duty printing machine with a newer model that is faster and better quality. The existing machine has a life of 5 years and 2 years of them has passed. Now KFUPM is evaluating replacing this machine with the newer model which has a life of 3 years. KFUPM hired you to analyze the proposed replacement and you collected the below information.

New Machine:

Life of machine: 3 years

The cost of the new machine is SAR 1,081

The machine will increase the gross profit every year by SAR 336

The market value of the machine when sold at the end of its life is SAR 195

If replaced, then the net working capital (NOWC) will increase every year by SAR 22

KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years).

Old Machine:

Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years.

Orginal cost of the existing machine is SAR 852

Total depreciation of the past 2 years is SAR340.8

If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 186

The market value of the machine when sold at the end of its life is zero (3 years from today)

WACC is

8.56%

Tax rate is 40%

Both machines use straight-line Depreciation.

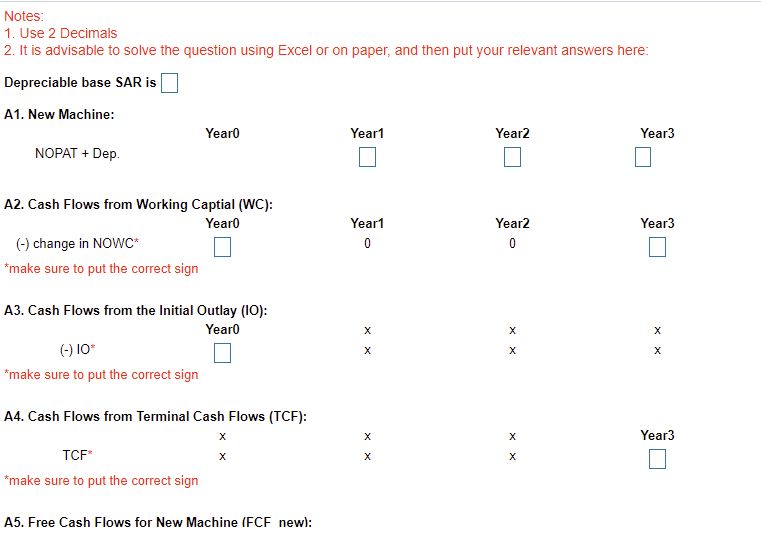

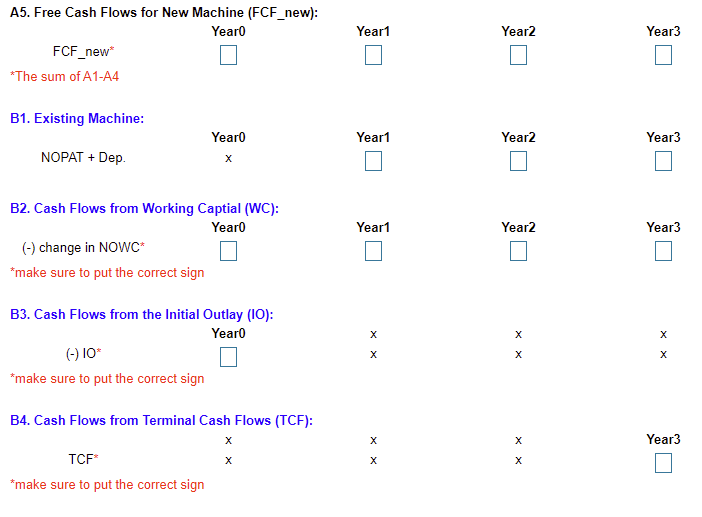

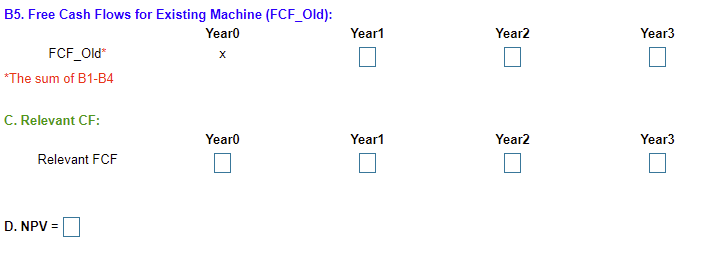

Calculate the follwoing:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started