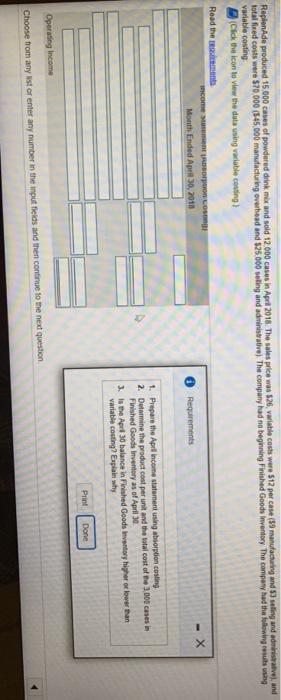

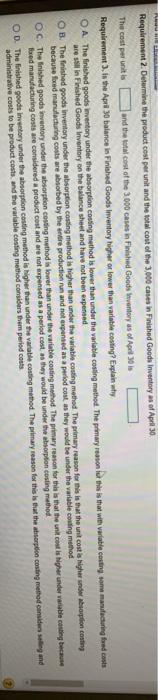

Replen Ade produced 15.000 cases of powdered drink mix and sold 12.000 cases in April 2018. The sales price was $26, variable costs were $12 per case (59 manufacturing and selling and adve), and totalfred costs were $70,000 (545.000 manufacturing overhead and 525.000 soling and administrative). The company had no beginning Finished Goods Inventory The company had the following results using variable costing (Click the icon to view the data ning valable conting) Read the recent mome orpoorng Month Ended April 30, 2018 Requirements 1. Prepare the April income statement using absorption costing 2. Deformine the product cost per unit and the total cost of the 3000 cases in Finished Goods Inventory as of April 30 3. is the April 30 balance in Finished Goods Inventory higher or lower than variable conting? Explain why Print Done Operating Income Choose from any est or enter any number in the input fields and then continue to the next question Requirement 2. Determine the product cost per unit and the total cost of the 3,000 cases in Finished Goods Inventory as of April 30. The cost per unit is and the total cost of the 3000 cases in Fished Goods Inventory as of Apr 30 is Requirement is the Apri 30 balance in Finished Goods Inventory higher or lower than variabile conting? Explain why OA The finished goods Inventory under the absorption costing method is lower than under the variable costing method. The primary reason is this is that with variable casting, some manufacturing fed costs are si in Finished Goods Inventory on the balance sheet and have not been expensed OB. The finished goods inventory under the absorption costing method is higher than under the variable casting method. The primary reason for this is that the unit cost a Higher under option conting because fred manufacturing costs are absorbed by the entire production run and not expensed as a period cost as they would be under the variable conting method OC. The finished goods Inventory under the absorption costing method is lower than under the variable costing method. The primary reason for this is that the unit cost is higherunder able casting beca feed manufacturing costs are considered a product cost and are not expensed as a period cost as they would be under the absorption costing method OD. The finished goods Invertory under the absorption costing method is higher than under the variable conting method. The primary reason for this is that the topion costing methododend administrative costs to be product costs and the variable costing method consider the period.co