Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Report Journal Entries by using Sage 50 software 5. Issue a single payroll check dated Oct 15, 2024 (for Oct 1- Oct 15, 2024) using

Report Journal Entries by using Sage 50 software

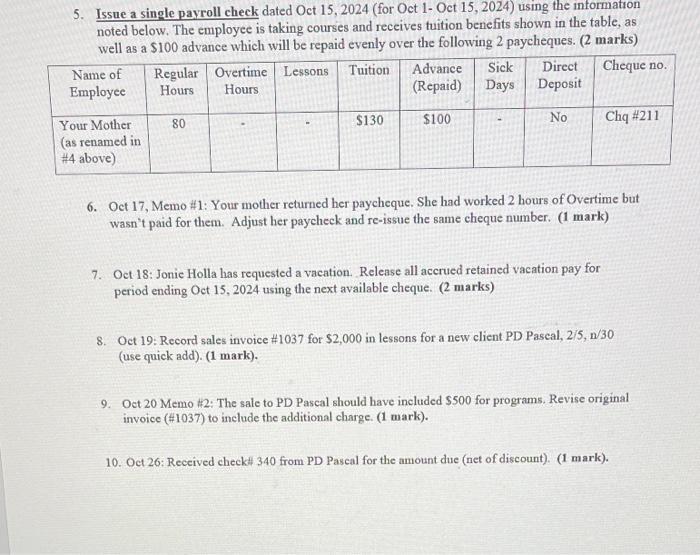

5. Issue a single payroll check dated Oct 15, 2024 (for Oct 1- Oct 15, 2024) using the information noted below. The employee is taking courses and receives tuition benefits shown in the table, as well as a $100 advance which will be repaid evenly over the following 2 paycheques. (2 marks) Advance Sick Direct Cheque no. (Repaid) Days Deposit $100 No Name of Employee Your Mother (as renamed in #4 above) Regular Overtime Lessons Tuition Hours Hours 80 $130 Chq #211 6. Oct 17, Memo #1: Your mother returned her paycheque. She had worked 2 hours of Overtime but wasn't paid for them. Adjust her paycheck and re-issue the same cheque number. (1 mark) 7. Oct 18: Jonic Holla has requested a vacation. Release all accrued retained vacation pay for period ending Oct 15, 2024 using the next available cheque. (2 marks) 8. Oct 19: Record sales invoice # 1037 for $2,000 in lessons for a new client PD Pascal, 2/5, n/30 (use quick add). (1 mark). 9. Oct 20 Memo #2: The sale to PD Pascal should have included $500 for programs. Revise original invoice (#1037) to include the additional charge. (1 mark). 10. Oct 26: Received check# 340 from PD Pascal for the amount due (net of discount). (1 mark).

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the payroll and accounting tasks in the instructions Oct 15 2024 Payroll Journal Entry Dr Wages Expense 475 Dr Tuitio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started