Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Report Structure for Personal Financial Planning: 1 . Develop Financial Goals ( One goal in each category ) o Short term ( Less than two

Report Structure for Personal Financial Planning:

Develop Financial Goals One goal in each category

o Short term Less than two years

o Intermediate years

o Long term More than five years

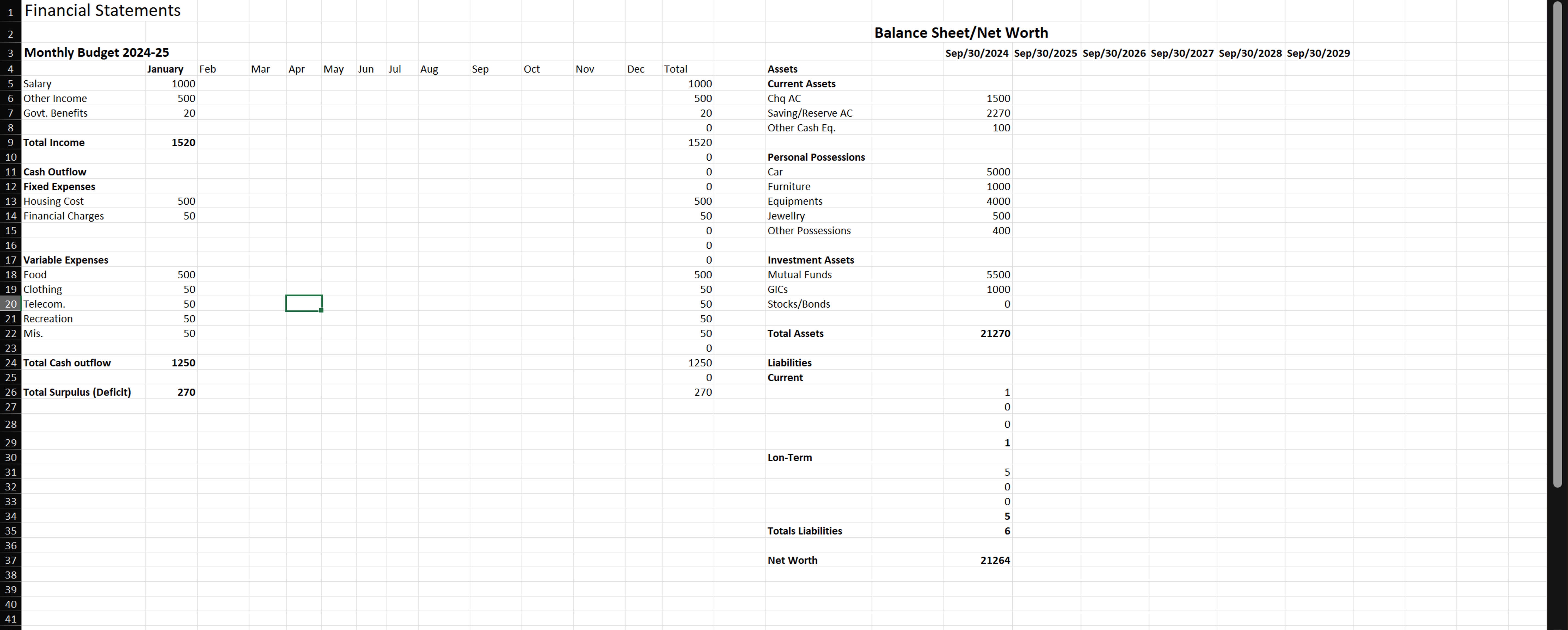

Review Your Current Financial Situation

o Annual Current and Projected Net worth Statement For next five years

o Current Monthly Budget and Projected for next months.

Note: Provide all assumptions taken for projected statements.

Identify Alternative Courses of Action

o Provide at least two alternatives to achieve each goal.

o Support each alternative with relevant financial data.

Evaluate Alternatives

o Take into consideration your life situation, personal values and current economic situation.

o Opportunity cost is what you give up by making a choice.

o The cost, referred to as the tradeoff of a decision, can be measured in money or time

o Consider lost opportunities that will result from your decisions.

o Evaluate the risks faced

o Choose one alternative for each goal which you may like to choose.

Action Plan

o Recommend a timeline and actions to implement each goal.

Review

o Recommend a review plan.

o Support your review plan with reasoning.

Instructions:

Report should start with title page followed by table of contents and ends with references.

May use provided financial statement sheet for guidance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started