Reporting a Note Payable Using air Value Option On January 1, 2020, Nakoma Inc. issued an 8% note payable of $100,000 to a financial

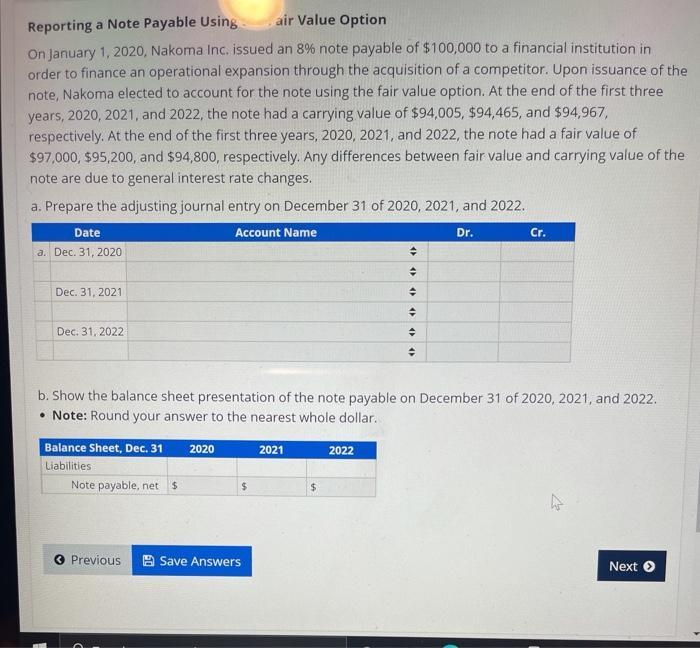

Reporting a Note Payable Using air Value Option On January 1, 2020, Nakoma Inc. issued an 8% note payable of $100,000 to a financial institution in order to finance an operational expansion through the acquisition of a competitor. Upon issuance of the note, Nakoma elected to account for the note using the fair value option. At the end of the first three years, 2020, 2021, and 2022, the note had a carrying value of $94,005, $94,465, and $94,967, respectively. At the end of the first three years, 2020, 2021, and 2022, the note had a fair value of $97,000, $95,200, and $94,800, respectively. Any differences between fair value and carrying value of the note are due to general interest rate changes. a. Prepare the adjusting journal entry on December 31 of 2020, 2021, and 2022. Dr. Date a. Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Balance Sheet, Dec. 31 Liabilities Note payable, net $ Previous Account Name 2020 $ Save Answers b. Show the balance sheet presentation of the note payable on December 31 of 2020, 2021, and 2022. Note: Round your answer to the nearest whole dollar. 2021 $ 2022 " 12 4 + Cr. Next

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started