Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reporting Discontinued Operations expenses) of $2,160,000 and $1,980,000 , respectively. Leigh Corp, reported income from continuing operations of $540,000 before tax for the year. a.

Reporting Discontinued Operations expenses) of

$2,160,000and

$1,980,000, respectively. Leigh Corp, reported income from continuing operations of

$540,000before tax for the year.\ a. Assuming an income tax rate of

25%, prepare an income statement beginning with Income from Continuing Operations. Ignore earnings per share disclosures.\ Use a negative sign to indicate a loss.\ \\\\table[[\\\\table[[Leigh Corp.],[Income Statement],[Year Ended December 31]]],[Income from continuing operations,

$405,000vv

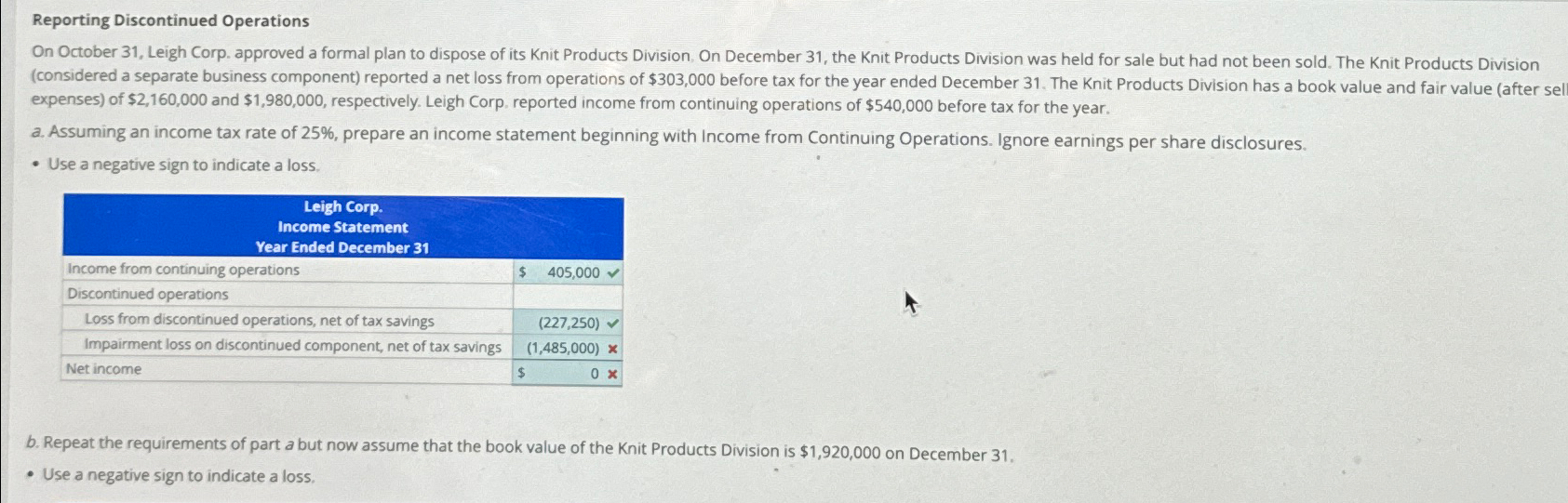

Reporting Discontinued Operations On October 31, Leigh Corp. approved a formal plan to dispose of its Knit Products Division. On December 31, the Knit Products Division was held for sale but had not been sold. The Knit Products Division (considered a separate business component) reported a net loss from operations of $303,000 before tax for the year ended December 31. The Knit Products Division has a book value and fair value (after sell expenses) of $2,160,000 and $1,980,000, respectively. Leigh Corp. reported income from continuing operations of $540,000 before tax for the year. a. Assuming an income tax rate of 25%, prepare an income statement beginning with Income from Continuing Operations. Ignore earnings per share disclosures. Use a negative sign to indicate a loss. Leigh Corp. Income Statement Year Ended December 31 Income from continuing operations $ 405,000 Discontinued operations Loss from discontinued operations, net of tax savings Impairment loss on discontinued component, net of tax savings Net income (227,250) (1,485,000) x $ 0 x b. Repeat the requirements of part a but now assume that the book value of the Knit Products Division is $1,920,000 on December 31. Use a negative sign to indicate a loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started