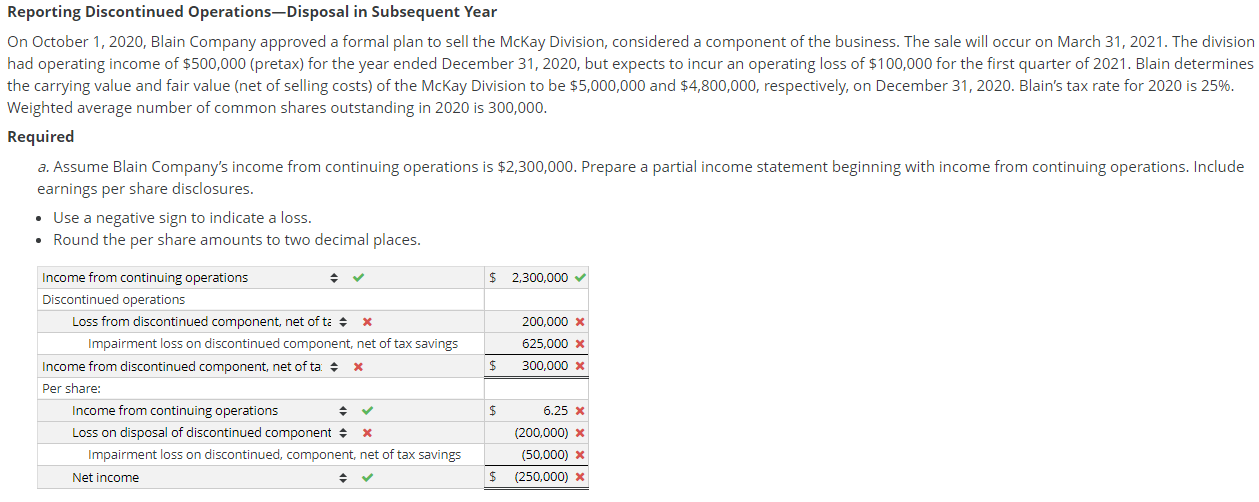

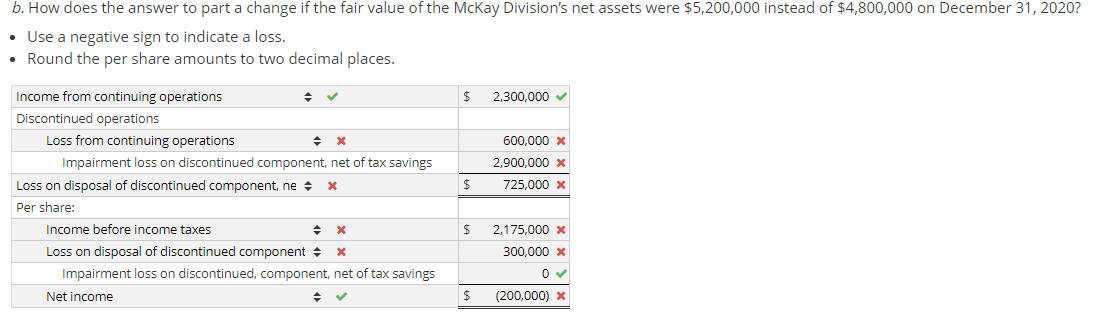

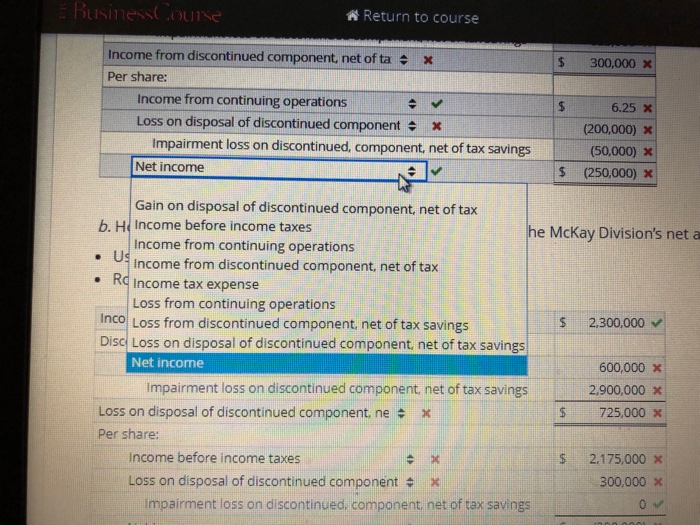

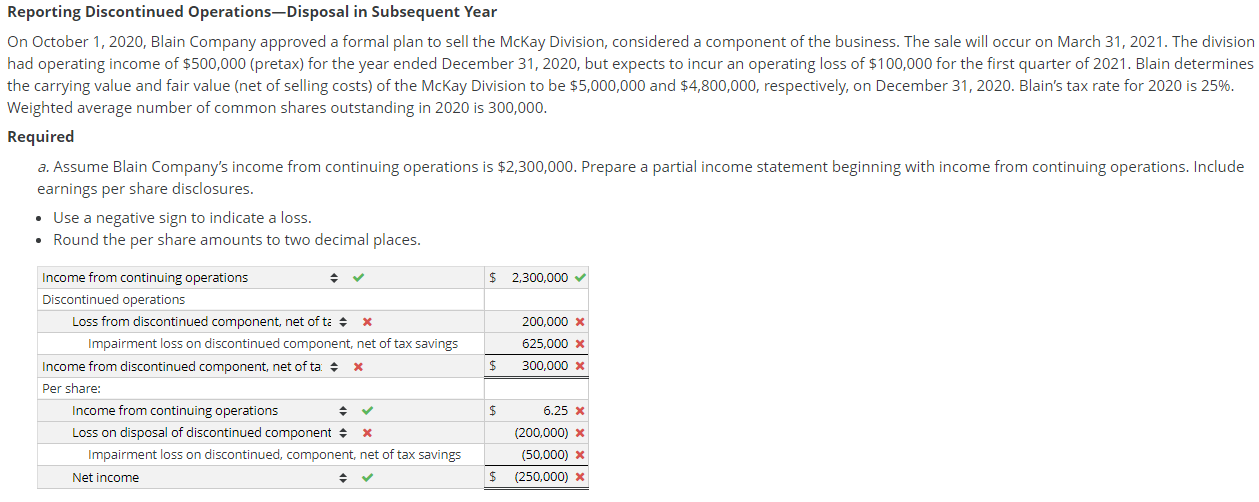

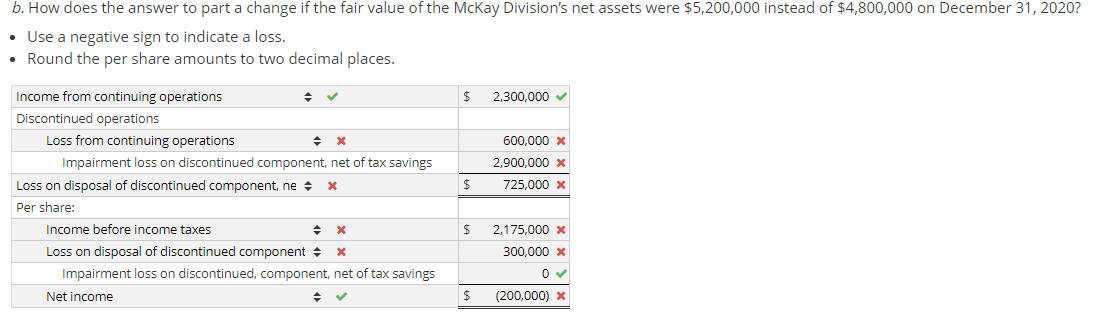

Reporting Discontinued Operations-Disposal in Subsequent Year On October 1, 2020, Blain Company approved a formal plan to sell the Mckay Division, considered a component of the business. The sale will occur on March 31, 2021. The division had operating income of $500,000 (pretax) for the year ended December 31, 2020, but expects to incur an operating loss of $100,000 for the first quarter of 2021. Blain determines the carrying value and fair value (net of selling costs) of the McKay Division to be $5,000,000 and $4,800,000, respectively, on December 31, 2020. Blain's tax rate for 2020 is 25%. Weighted average number of common shares outstanding in 2020 is 300,000. Required a. Assume Blain Company's income from continuing operations is $2,300,000. Prepare a partial income statement beginning with income from continuing operations. Include earnings per share disclosures. Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. $ 2,300,000 200,000 x 625,000 X 300,000 x $ Income from continuing operations Discontinued operations Loss from discontinued component, net of tax Impairment loss on discontinued component, net of tax savings Income from discontinued component, net of tax Per share: Income from continuing operations Loss on disposal of discontinued component X Impairment loss on discontinued, component, net of tax savings Net income $ 6.25 X (200,000) X (50,000) X (250,000) X $ Business Course Return to course $ 300,000 X Income from discontinued component, net of tax Per share: Income from continuing operations Loss on disposal of discontinued component Impairment loss on discontinued, component, net of tax savings Net income 6.25 x (200,000) * (50,000) X (250,000) * $ Gain on disposal of discontinued component, net of tax b. HIncome before income taxes he McKay Division's net a Income from continuing operations * Income from discontinued component, net of tax Rd Income tax expense Loss from continuing operations Inco Loss from discontinued component net of tax savings 2.300,000 Disc Loss on disposal of discontinued component, net of tax savings Net income 600,000 x Impairment loss on discontinued component. net of tax savings 2,900,000 x Loss on disposal of discontinued component ne X $ 725,000 x Per share: Income before income taxes 2,175,000 x Loss on disposal of discontinued componente 300,000 Impairment loss on discontinued, component, net of tax savings Reporting Discontinued Operations-Disposal in Subsequent Year On October 1, 2020, Blain Company approved a formal plan to sell the Mckay Division, considered a component of the business. The sale will occur on March 31, 2021. The division had operating income of $500,000 (pretax) for the year ended December 31, 2020, but expects to incur an operating loss of $100,000 for the first quarter of 2021. Blain determines the carrying value and fair value (net of selling costs) of the McKay Division to be $5,000,000 and $4,800,000, respectively, on December 31, 2020. Blain's tax rate for 2020 is 25%. Weighted average number of common shares outstanding in 2020 is 300,000. Required a. Assume Blain Company's income from continuing operations is $2,300,000. Prepare a partial income statement beginning with income from continuing operations. Include earnings per share disclosures. Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. $ 2,300,000 200,000 x 625,000 X 300,000 x $ Income from continuing operations Discontinued operations Loss from discontinued component, net of tax Impairment loss on discontinued component, net of tax savings Income from discontinued component, net of tax Per share: Income from continuing operations Loss on disposal of discontinued component X Impairment loss on discontinued, component, net of tax savings Net income $ 6.25 X (200,000) X (50,000) X (250,000) X $ Business Course Return to course $ 300,000 X Income from discontinued component, net of tax Per share: Income from continuing operations Loss on disposal of discontinued component Impairment loss on discontinued, component, net of tax savings Net income 6.25 x (200,000) * (50,000) X (250,000) * $ Gain on disposal of discontinued component, net of tax b. HIncome before income taxes he McKay Division's net a Income from continuing operations * Income from discontinued component, net of tax Rd Income tax expense Loss from continuing operations Inco Loss from discontinued component net of tax savings 2.300,000 Disc Loss on disposal of discontinued component, net of tax savings Net income 600,000 x Impairment loss on discontinued component. net of tax savings 2,900,000 x Loss on disposal of discontinued component ne X $ 725,000 x Per share: Income before income taxes 2,175,000 x Loss on disposal of discontinued componente 300,000 Impairment loss on discontinued, component, net of tax savings