Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reporting Intangible Costs Hanks Co. recorded the following amounts for the current year. o Research and development costs, $50,000. o Patent acquired on January 1

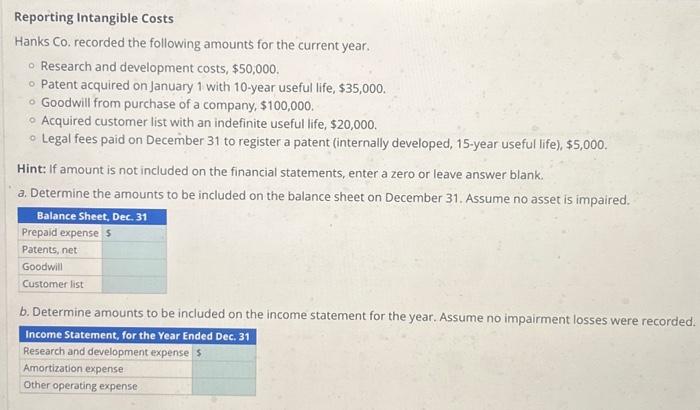

Reporting Intangible Costs Hanks Co. recorded the following amounts for the current year. o Research and development costs, $50,000. o Patent acquired on January 1 with 10-year useful life, $35,000. o Goodwill from purchase of a company, $100,000. o Acquired customer list with an indefinite useful life, $20,000. o Legal fees paid on December 31 to register a patent (internally developed, 15-year useful life), $5,000. Hint: If amount is not included on the financial statements, enter a zero or leave answer blank. a. Determine the amounts to be included on the balance sheet on December 31. Assume no asset is impaired. Balance Sheet, Dec. 31 Prepaid expense $ Patents, net Goodwill Customer list b. Determine amounts to be included on the income statement for the year. Assume no impairment losses were recorded. Income Statement, for the Year Ended Dec. 31 Research and development expense $ Amortization expense Other operating expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started