Question

Reporting Operating LeaseLessee On January 1 of Year 1, Lessee Inc. leased equipment at an annual payment of $85,099, payable each January 1 for four

Reporting Operating LeaseLessee

On January 1 of Year 1, Lessee Inc. leased equipment at an annual payment of $85,099, payable each January 1 for four years, with the first payment due immediately. The equipment had a fair value of $400,000 and a book value of $375,000, and was commonly purchased or leased by customers. The lessor estimates that the equipment has an estimated useful life of eight years and an estimated residual value of $125,000, not guaranteed by the lessee. Lessors implicit rate is 7.5%, which is unknown to the lessee. The lessees incremental borrowing rate is 8%. The lease does not contain a purchase option or a renewal option. The lessee had no other costs associated with this lease. The lease liability on January 1 Year 1 is $304407. Please solve the question below.

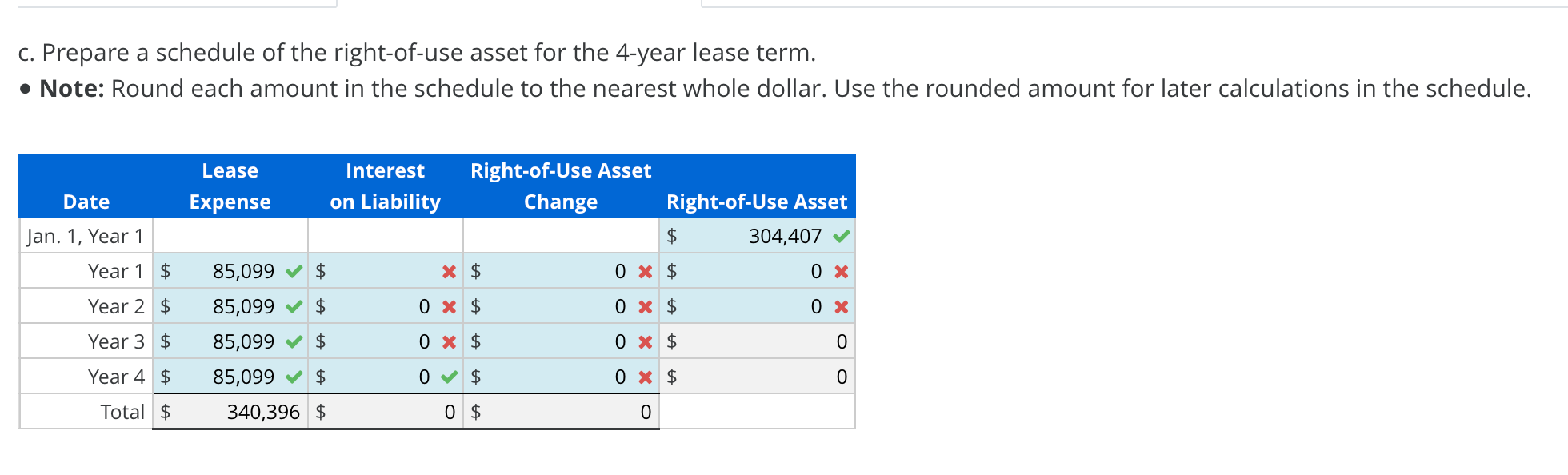

c. Prepare a schedule of the right-of-use asset for the 4-year lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. c. Prepare a schedule of the right-of-use asset for the 4-year lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started